With the first half in the rearview mirror, it’s time to take stock of shipping shares. How did they fare, particularly the tanker equities that stole the spotlight?

FreightWaves ran the numbers on the larger U.S.-listed ship owners — and not to rub salt in the wound, but the numbers are ugly.

Among the larger companies, the best-performing stock by far is Nordic American Tankers (NYSE: NAT), an owner of Suezmax tankers (tankers that carry 1 million barrels of crude).

The worst performer by far is Scorpio Bulkers (NYSE: SALT), which hit a fresh 52-week low on both Monday and Tuesday.

Scorpio’s executive team of Emanuele Lauro and Robert Bugbee is not having a good year on Wall Street — their product-tanker company, Scorpio Tankers (NYSE: STNG), also hit a 52-week low on Tuesday.

Jon Chappell, transportation analyst at Evercore ISI, issued a dire new assessment on tanker stocks in general. “The promise of a golden age for the tanker market has once again faded into oblivion,” he wrote on Tuesday.

“Tanker stocks have already sold off 33%-85% from 52-week highs and most trade at mere fractions of NAV [net asset value]. Broader institutional support of this sector will not emerge as long as there are brief super spikes directly followed by long downturns, which is where the industry stands today,” said Chappell.

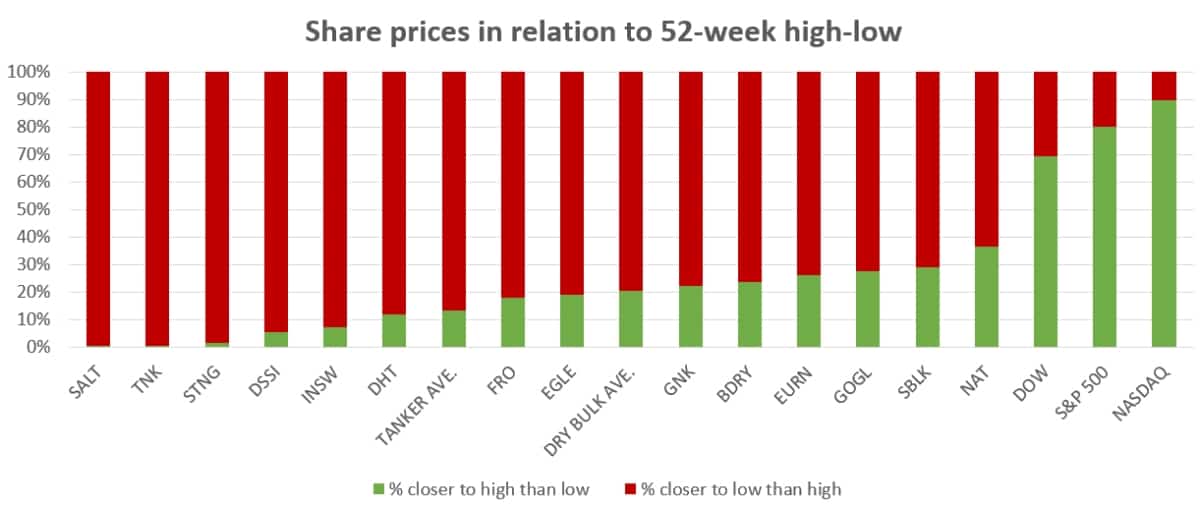

The high-low spectrum

Tanker and dry bulk stocks are much closer to annual lows than highs in comparison to the broader market indices. As of Monday’s closing bell, most of the larger U.S.-listed ocean shipping stocks were within 30% of their lows, whereas the Dow, S&P 500 and NASDAQ were within 30% of their 52-week highs.

Tanker stocks were closer to lows than dry bulk stocks. The outlier among shipping stocks was NAT, which was 37% above its annual low.

Year-to-date performance

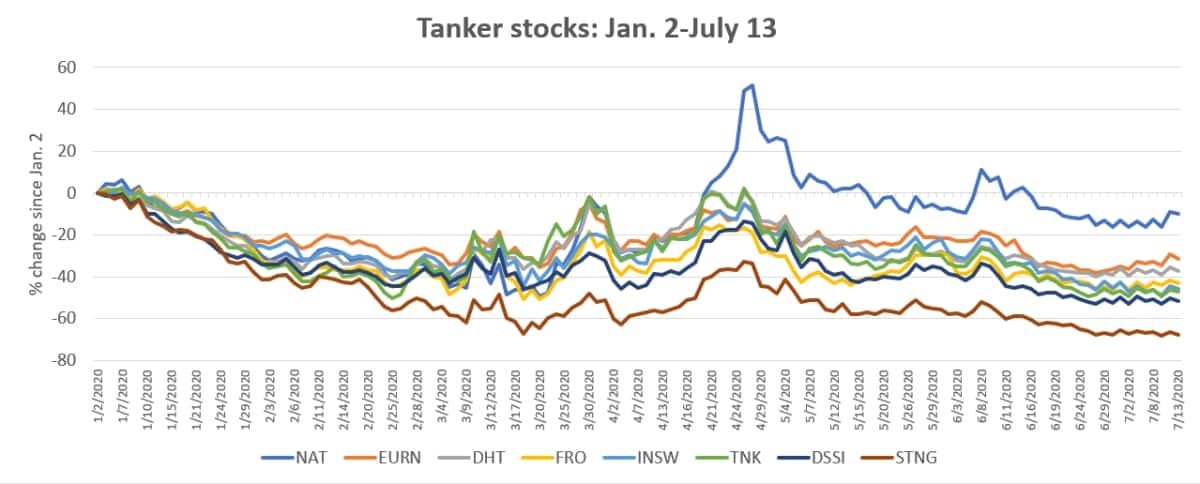

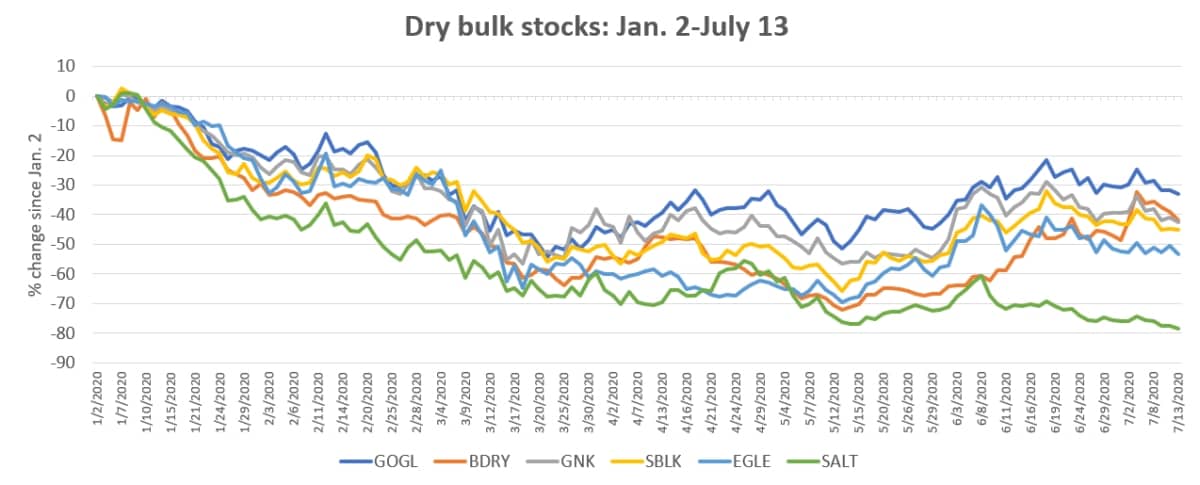

Looking at stock performance is inherently arbitrary, based on start and end dates. FreightWaves looked at two different periods: year to date (YTD) through Monday’s close, and from March 23 through Monday. March 23 was the low point for the overall stock market after the initial coronavirus crash.

The YTD numbers for tankers show NAT down only 10%. Euronav (NYSE: EURN), DHT (NYSE: DHT), Frontline (NYSE: FRO), International Seaways (NYSE: INSW), Teekay Tankers (NYSE: TNK) and Diamond S (NYSE: DSSI) were down in the 30%-50% range. The worst performer over this period, Scorpio Tankers, was down 68%.

On the dry bulk side, Golden Ocean (NASDAQ: GOGL), the BreakWave Dry Bulk ETF (NYSE: BDRY), Genco Shipping & Trading (NYSE: GNK), Star Bulk (NASDAQ: SBLK), and Eagle Bulk (NASDAQ: EGLE) wer down in the 30%-50% range. The worst performer, Scorpio Bulkers, was down 78% YTD.

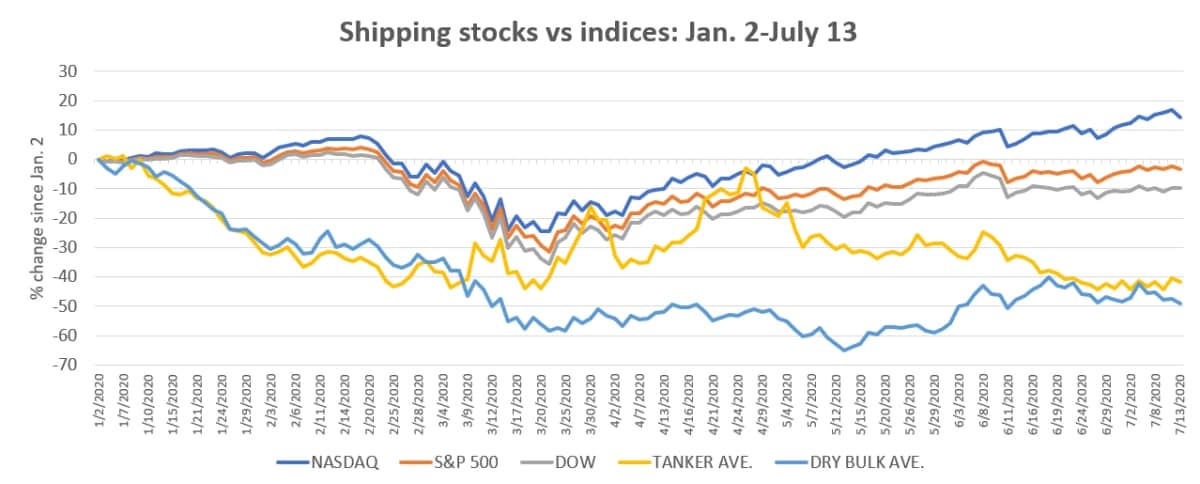

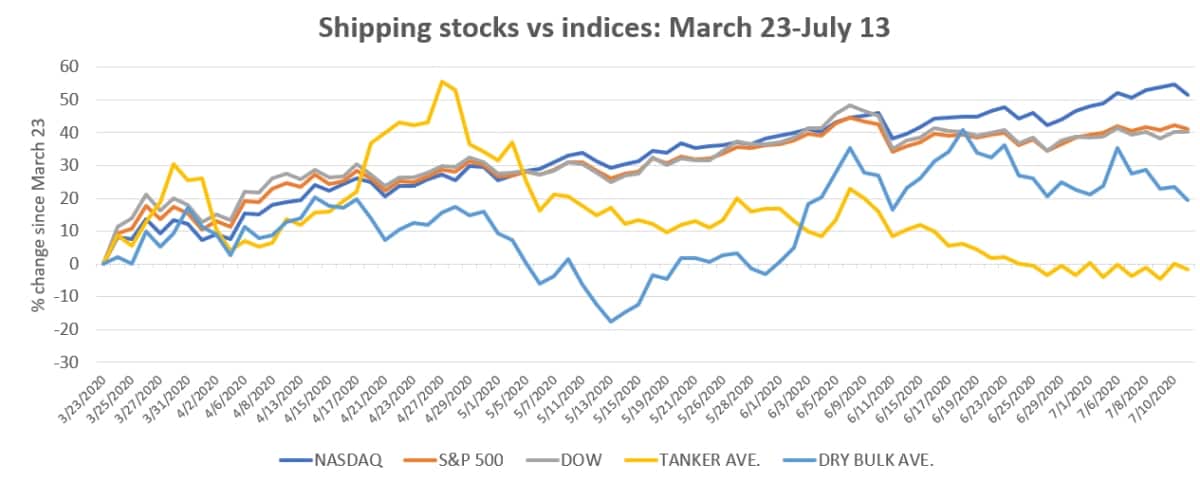

Looking at shipping stocks in relation to indices, the basket of top tanker stocks was down 49% YTD and dry bulk 42%. However, if Nordic American is removed from the tanker basket, the two sectors were essentially even.

The indices far outperformed the shipping stocks, with the Dow down 10% YTD, the S&P 500 down 3% and the NASDAQ up 14%.

COVID market collapse to present

March 23 was the market bottom after the initial COVID panic, a floor allowing investors to place recovery bets.

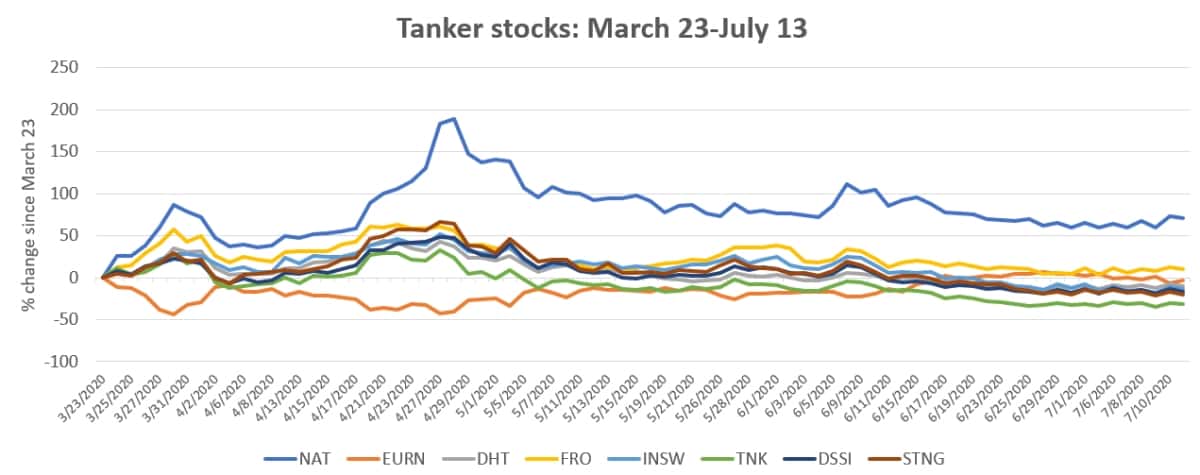

Rates for very large crude carriers (VLCCs; tankers that carry 2 million barrels of crude oil) hit all-time highs in late March. And yet, tanker stocks have performed poorly since then — much worse than dry bulk stocks and market indices.

The exception, again, has been NAT, even though Suezmax rates have been very low versus VLCC rates. NAT’s share price has been boosted by retail interest among traders on the Robinhood platform. NAT’s share price is up 71% from March 23.

The only other major tanker owner in positive territory is Frontline, up 10%. Euronav is roughly even. The worst performer is Suezmax owner Teekay Tankers, down 30%.

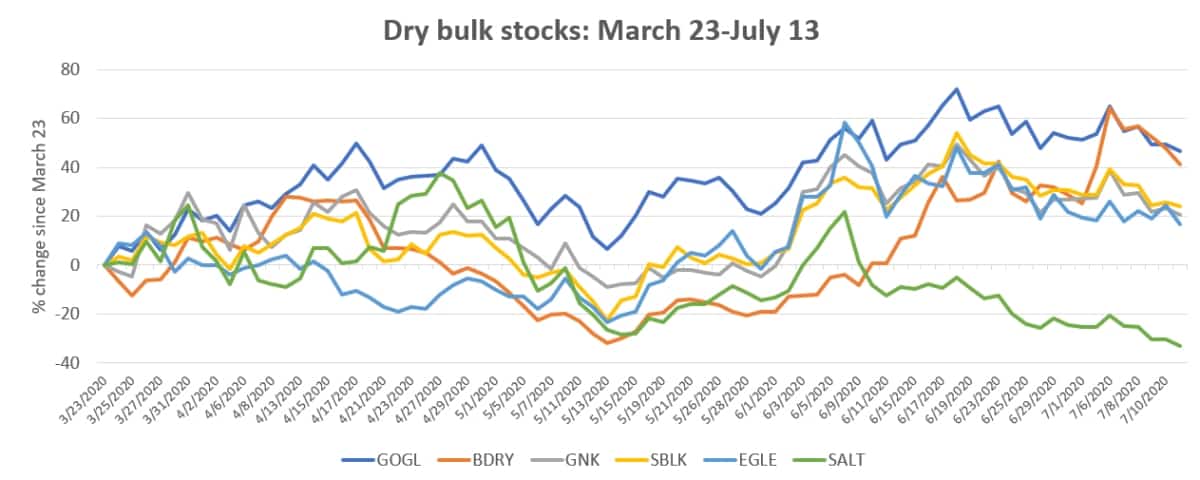

Dry bulk equities have performed much better than tanker equities during this period, with Golden Ocean and the BDRY exchange-traded fund up over 40%. In fact, all of the larger owners are in positive territory except Scorpio Bulkers, down 33%.

The nonshipping indices handily outperformed shipping in the period since late March. NASDAQ is up around 50%, the S&P 500 and the Dow 40%. The basket of dry bulk stocks is up 20%. The tanker basket is flat since VLCC rates hit an all-time record in late March, and would be negative if not for a boost from day-trader favorite NAT. Click for more FreightWaves/American Shipper articles by Greg Miller

MORE FROM SHIPPING STOCKS: See story here on the “lost decade” for shipping stocks since the financial crisis, The “Robinhood effect” on tanker stocks: see story here. And for the interview with Deutsche Bank transportation analyst Amit Mehrotra on intrinsic-value investing, see story here.

Stephen Leonard

“Tanker stocks are sinking toward the bottom”

Is there another way they could sink?