The trucking apocalypse is upon us, and it has taken its latest victim. This time, it’s a 40-year-old carrier out of California. Timmerman Starlite Trucking Inc. of Ceres, California, announced it would be shutting down, placing 30 employees in the unemployment line effective immediately. Ceres is a suburb of Modesto, California, a mid-sized city 100 miles east of San Francisco. Starlite had a fleet of 30 trucks, 150 trailers and 28 drivers, according to Federal Motor Carrier Safety Administration data.

Owner Colby Bell cited a tough freight market and environmental regulations as the primary factors in the company’s failure, according to the Ceres Courier, which broke the story. Starlite also announced its closure on its Facebook page.

“We tried to provide a healthy work environment for our employees and give them the best wages and benefits we could,” Bell said. “But in the end, the rates that were available did not support the cost structure needed to compensate our employees appropriately.”

The company served clients through an 11-state region stretching from the Rocky Mountains to the Pacific Coast.

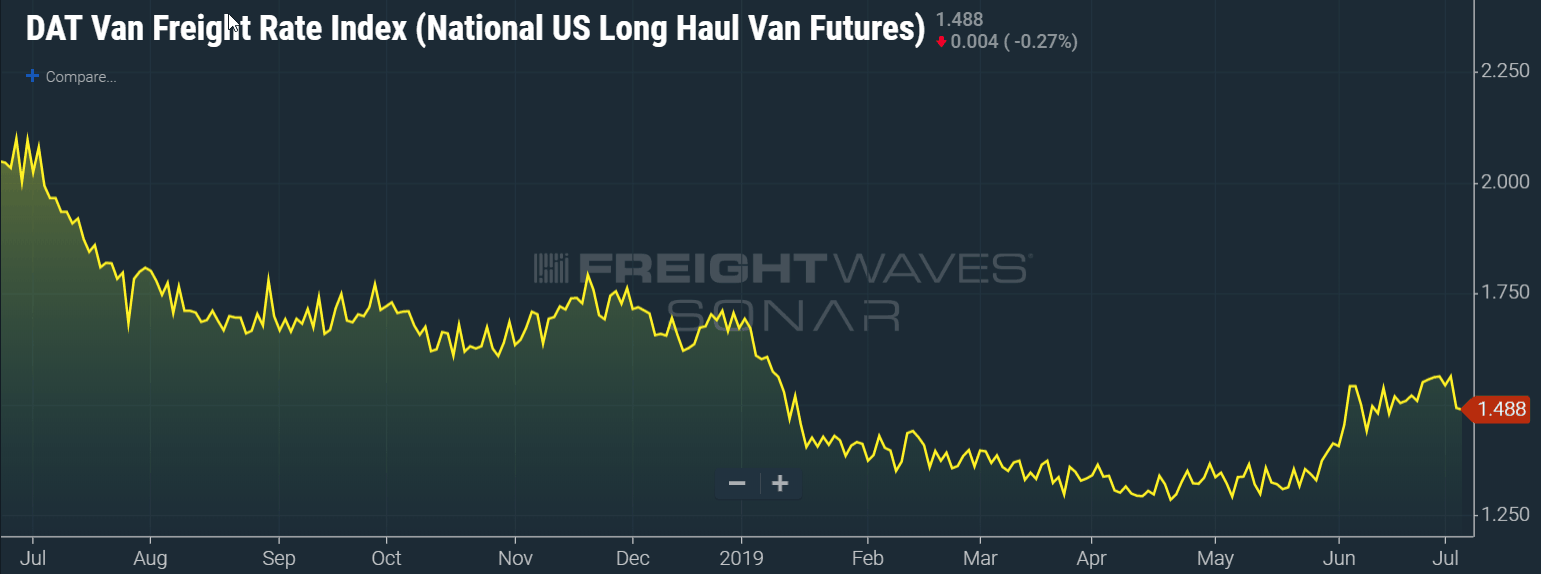

Long-haul trucking spot rates are at their lowest levels in the past few years, off by over 30 percent since last year’s peak.

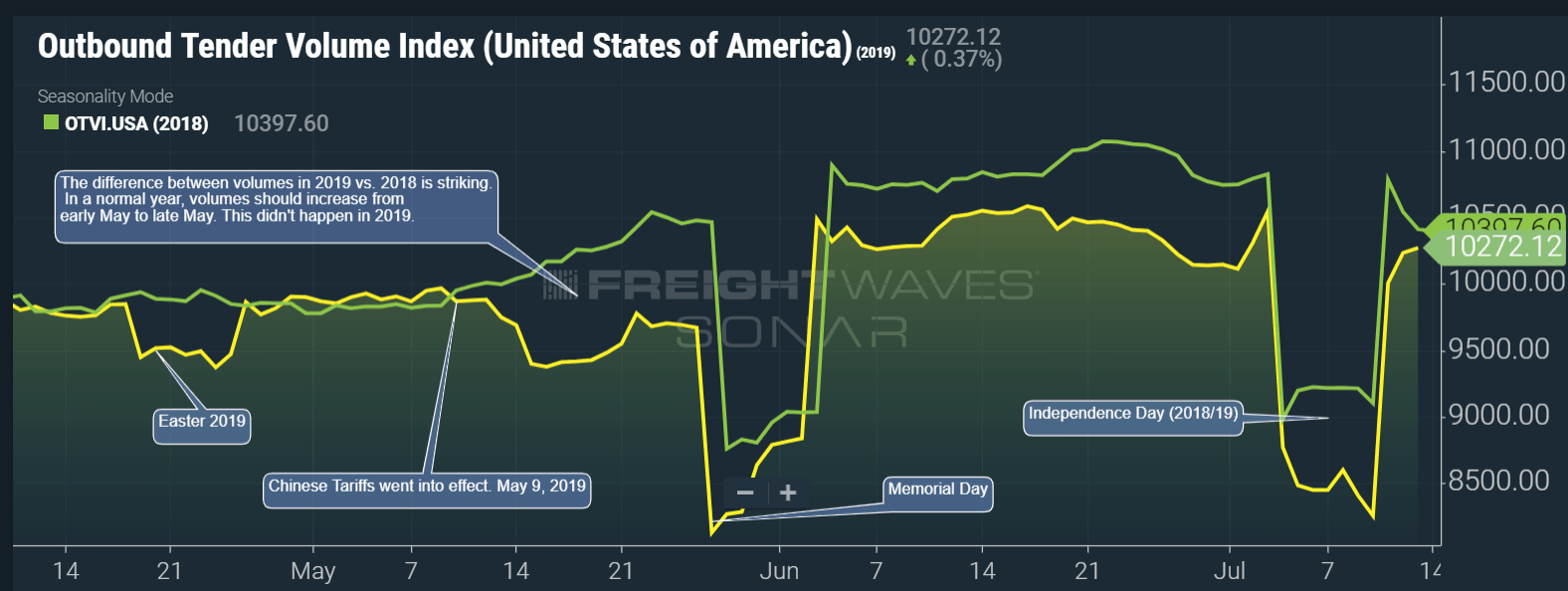

Even more challenging, trucking volumes have been running between 2 percent and 7 percent in equivalent days in 2018, starting with a large drop in mid-May.

While rates and load volumes reflect the demand side of the freight market and paint a picture of the revenue conditions for carriers, the profit story is much worse. In the past two years, carriers have seen significant cost inflation and operational pressure in almost every aspect of their businesses.

Wage increases for drivers have increased by double digits, insurance renewal rates have gone up and equipment is more expensive to maintain. Carriers have been forced to buy electronic logging devices, running their trucks with an inflexible clock.

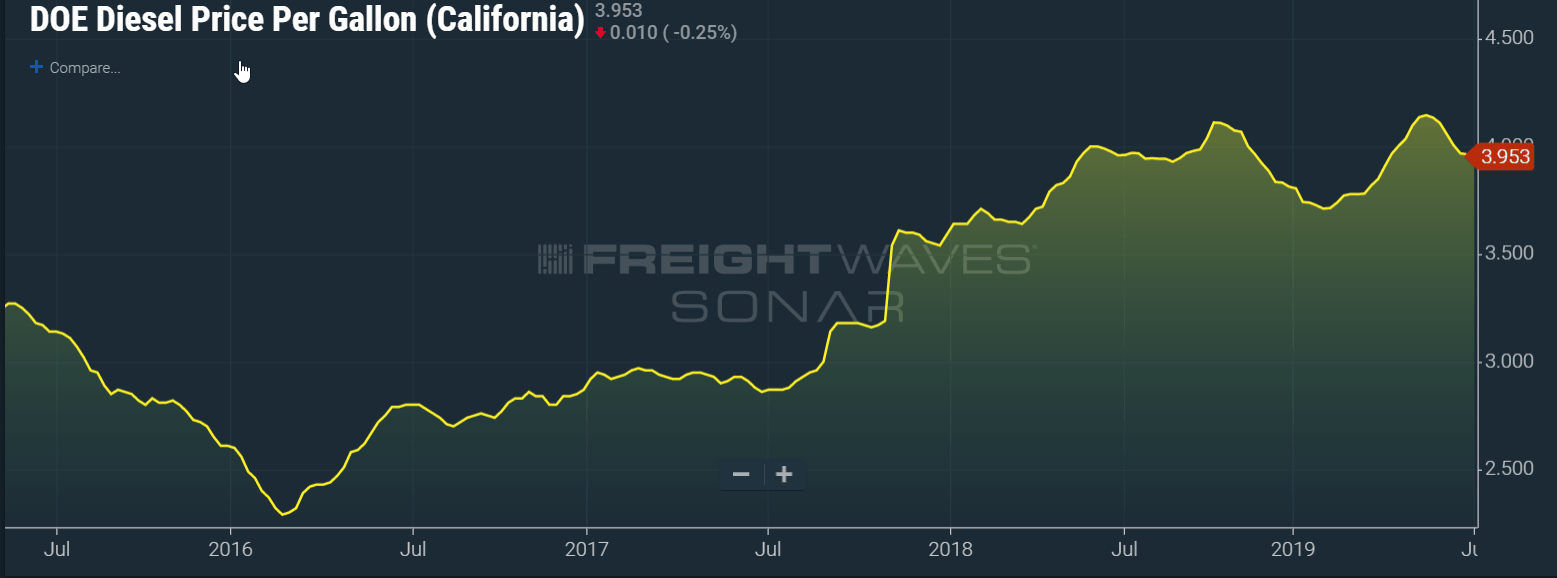

Fuel expenses, particularly in a tax- and regulation-heavy state like California, have also been way up in the past three years. Since February 2016, retail diesel prices in the state have increased from $2.29/gallon to $3.95/gallon, roughly equivalent to $.25 per mile. At $1.49 per mile, this will cost a carrier 17% of their operating profits if they aren’t on a fuel-surcharge program.

Larger carriers are able to recover most, if not all, of this in the form of a fuel surcharge. Unfortunately, Starlite was likely too small to have much leverage of their shipper relationships to do so.

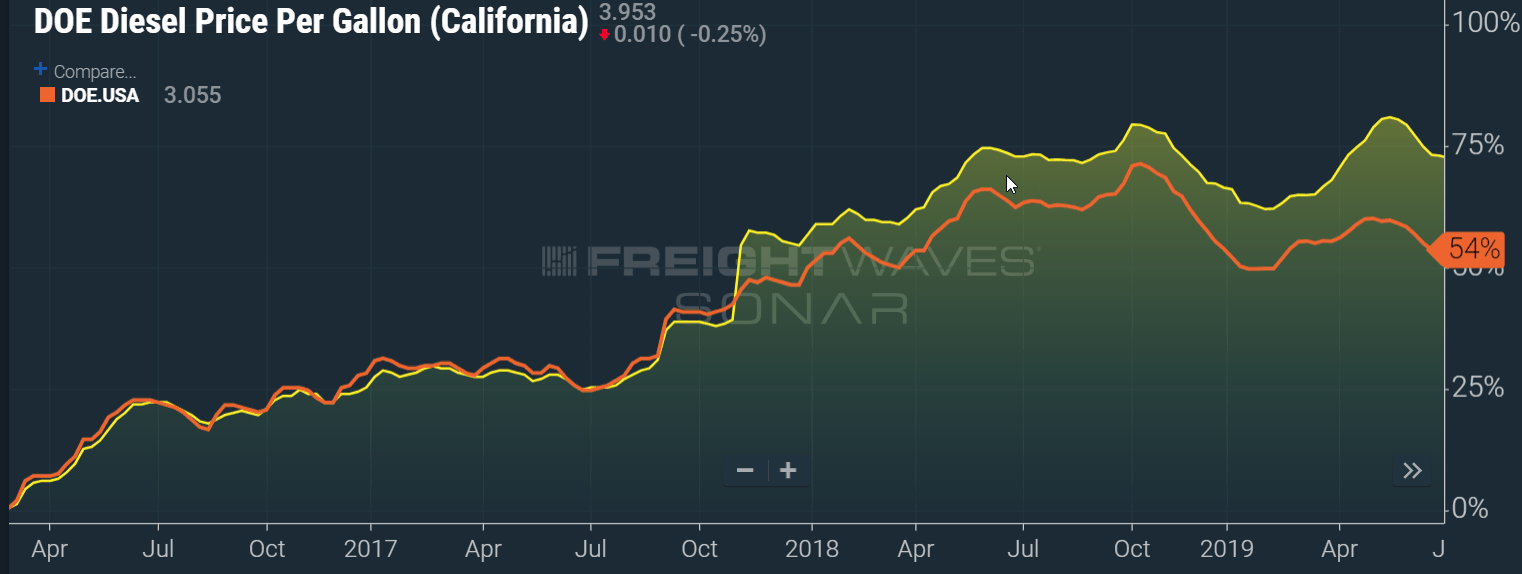

Retail average diesel fuel prices in California have shot up 75 percent since February 2016, while only jumping 58 percent on a national basis during the same period.

California has added two fuel and excise taxes during the period, first with a 20-cent-per-gallon increase in 2017 and another 20-cent increase initiated this July.

If taxes weren’t enough of a burden for California’s operators, the environment czar, the California’s Air Resources Board (CARB), creates its own set of challenges.

For the past decade, CARB has required carriers to buy and operate trucks that operate under a more stringent set of emissions regulations.

In describing the plight of environmental and business regulations on Starlite, Bell was quoted in the Turlock Journal:

“The air’s a lot cleaner today because of the work the industry has done — and we’re proud of that — but the rate structure is [holding arm flat] and the cost structure is like this [arm at an incline]. The family was just in a position where we could not continue to operate without risking financial devastation.

“If you’re an interstate carrier that operates in 50 states and you can make money in 49, you can lose a little in California while the pressure’s on, and over time you know that things are going to equalize. But, yeah, the smaller carriers are stressed. Most of them are family companies. They’re not capital rich and it’s a heavy capital industry to be in. They’re pulling $200,000 worth of equipment and that’s a lot of money when you think about almost a 40 percent increase in costs over the last 10 years but no change in the revenue.”

Few would deny that California has benefited from cleaner air, but tax increases, inflexible labor laws and a litigious court system have all made the operating environment for California-based trucking companies extremely difficult.

Last year, we wrote a commentary: “California’s Hostile Environment for the Trucking Industry.”

California, perhaps more than any other large state, is incredibly dependent on the trucking industry to keep the economy humming. It has a large agriculture industry, a sizable industrial sector and the biggest port in North America, and a third of all jobs in the state are in logistics-dependent industries. Trucking is still the largest logistics mode by far.

While it is too late for Starlite and Bell, chief executive officer of the California Trucking Association Shawn Yardon issued a statement about the closure: “I am saddened to learn of Starlite’s closure and this is further proof that California must take a very hard look at its business environment.”

If you are keeping score, this is the sixth major trucking company failure of 2019. LME, a Midwest LTL carrier, also shut its doors last week.

Tamale

Don’t drive a truck. Don’t live in California. Very easy.

DAVID ANDRUS

California probably will be one of the first states soon that truck drivers will avoid, I as a truck driver stay out of California due to the idiot’s that run the state , into the ground , so far iv notice more people moving out and living better lives elsewhere, also I have seen other trucking companies move out of California and start all over in other states and continue to avoid delivery to California and profit big in other states, I also know thru the trucking grapevine that the trucking industry will move slowly towards the east making it harder soon for California to get what it needs unless it lightens up how I know this is because we too have behind closed doors talks about when we should turn the key off of cali. Right now we are only humoring the government with our semi obedient way

Rotund Rider

Nonsense. You are not humoring anyone. You are making a profit. When you are not, you will abandon the market and others will enter it. This is what capitalism is all about.

Luke

Rotund Rider. Absolutely true. If I am not comfortable with existing HOS rules, I am welcome to leave. On my place will come 100 drivers who will feel comfortable with those HOS regulations.

Joffre Cueva

Do not believe all the bs they say. Most of these companies are trying to get out of paying workers out of benefits and pensions, they will reopen later under a new name just like eastern freightways and nemf.

Luke

Joffre Cueva. Maybe. But even if you are right, the low freight rates is a fact.

Jim

I’m hoping Ca. Keeps up the pressure, even making it worse, the more it heaps on, the more people and companies will leave ca. And leave that state with such devistation it will all come crashing down !

Frank Hammond

Jim – Drive on the 10 East to where it meets the 15 in Ontario. More new warehouses going up as fast as they can pour the concrete. As long as the ports of LA and Long Beach are open, California will have a lot of freight business.

Tom Hoffman

Everyone is comment on gas and regulation but that is only half the problem. The other half “Long haul trucking spot rates are at their lowest levels in the past few years” seems to be the bigger problem and the article doesn’t really say why. If the smaller companies can’t compete then isn’t this how the market is designed to work?

Jimmy Wells

The government also breaks up monopolies and anyone can see that’s exactly where we’re heading. The multinational conglomerates and megas are taking over the transportation industry slowly but surely. The writing is on the wall to anyone who’s been alive in this country for more than 30 years.

Luke

Jimmy Wells. It’s above my understanding. If US is a country of the law and it has an antimonpoly law then somebody have to go to prison for ruining small businesses families lives. Right?

Luke

Tom Hoffman. Eventually one reasonable voice.

The mega carriers did the right genius move – pushed small fleets out of the competition. And what is our answer? Where our niche in the market?

Do somebody need the small fleet service?

Our mane attribute – flexibility was taken from us by the mega carriers/government conglomerate. Abide.

Ernest Martin

I am a truck driver i will not go in to California fo no less then $5.00 a mile at 55 mph and the traffic it aint worth it. Yes they consume alot but the laws are to unreasonable for me many time stop at the borders and let a connection go eben when i had 9 hours left me for one will not drive in California. It is to big of a risk with all off the people who speed at 70+ .

A veteran

Well now you see what Democrats want to do to United States as a whole with a green deal which means to me green putting politicians pockets and their friends at the cost of the transportation industry and the United States as a whole and anyone that buys food or anything else must or because everything is hold on a truck there are other places to bring things in the United States then California

Luke

A veteran, you see it now? Not in before, when Democrats gave China the penetrate US missile technology? Improve Chinese and Russian military? Bowing to king Abdullah.

Rotund Rider

What do Republicans want to do to the United States? I’ll tell you: give large corporations all the power. Cut taxes for themselves, and kill Social Security and Medicare. Reagan said Medicare is socialism and would lead to a dictatorship.

Frank Rose

I lived in CA for 55 years… Now reside in NV..

.For me it was just all played out in CA so I left.

Slowly with all the Regs, taxes, crime, crazy housing prices…..,yes also the influx of people from other countries legal residents or not legal yes all these things….Have hurt all residents and small business. The State has completely changed in the last 30 years.

It got to the point for me to get the hell out of CA to find more piece of mind out in a much less regulated area…

Churchill County NV.

And more piece if mind I got…..