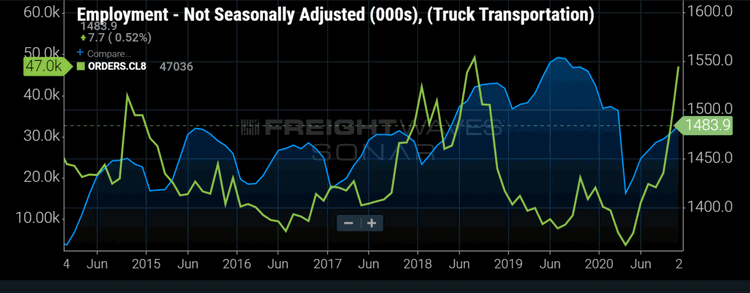

Chart of the Week: Employment Not Seasonally Adjusted – Truck Transportation, Equipment Orders – Class 8 Vehicles – USA SONAR: EMPN.TRUK, ORDERS.CL8

One of the biggest questions of 2021 for trucking is whether a wave of capacity will enter the market that stabilizes the current elevated spot rate environment. This is a question many transportation providers struggle with each year as they attempt to balance the need for growth versus cost control. Overextend your fleet beyond demand and you have to drop your prices just to keep rolling. Demand exceeds your capacity and you miss out on precious growth opportunities. The bottom line is spot rates have expanded too much and sustained for too long not to see growth in capacity this year. So the real question is not if, but when will it occur.

Trucking capacity is relatively opaque, with very few measures available to get a full picture of how much is available in the for-hire or non-private trucking space. The Bureau of Labor Statistics puts out a monthly figure measuring employees in the truck transportation space that is a good directional measure for the growth or decline of the industry. It covers all the employees of carriers, including drivers and back office workers.

Looking at the non-seasonally adjusted figure for truck transportation employment levels as of November, there is still a long way to go to get back to pre-pandemic levels. In November of 2019, there were over 15.3 million people employed in the trucking industry, whereas this past November that figure sat around 14.8 million — a difference of more than 500,000 jobs.

Like many industries, trucking companies have not fully recovered their employment levels to where they were when the pandemic began in earnest in March of 2020. In the meantime, freight volumes have expanded beyond where they were when this began. The result has been unprecedented growth in spot market rates in the second half of the 2020.

With so much uncertainty around what was occurring and how long the demand would last, carriers were hesitant to invest in growth, having been hit hard by low volumes in April and burned by an oversupplied 2019 market that resulted largely from overinvestment in 2018.

Once again, we saw a familiar pattern emerge in late 2020 as orders for new Class 8 trucks hit 47,034 units in November and preliminary reports for December have orders over 50,000, according to ACT Research. These numbers resemble those last seen in July and August of 2018 as spot rates hit multiyear highs.

These two situations are not completely congruent. Carriers were motivated to invest in depreciating assets thanks in large part to the tax incentive put in place by the Trump administration. One of the major reasons for the surge of freight in 2017-18, which led to their confidence in an extended period of demand.

Orders averaged 32,000 units for the 12-month period starting in October of 2017, compared to 14,600 for the previous 12-month period. Looking at the employment figures we can see this was a rapid expansionary period for trucking that bled into early 2019.

The recent surge of orders signals a wave of capacity coming online in the second half of 2021, but some of that capacity will be replacement orders for older equipment and replenishment from a slew of exits in 2019.

Ordering trucks will be easier than seating them this year as driver recruitment challenges remain in place. Driver schools have been operating well below capacity and the Drug and Alcohol Clearinghouse has removed thousands of drivers from the pool since its inception last year.

Most forecasts show demand staying elevated for the first half of 2021, which means these orders will not have an impact in the near-term. Many questions still remain around what demand looks like after the pandemic begins to wane. These orders suggest carriers are much more optimistic about the long-term than they were earlier in the year.

About the Chart of the Week

The FreightWaves Chart of the Week is a chart selection from SONAR that provides an interesting data point to describe the state of the freight markets. A chart is chosen from thousands of potential charts on SONAR to help participants visualize the freight market in real time. Each week a Market Expert will post a chart, along with commentary, live on the front page. After that, the Chart of the Week will be archived on FreightWaves.com for future reference.

SONAR aggregates data from hundreds of sources, presenting the data in charts and maps and providing commentary on what freight market experts want to know about the industry in real time.

The FreightWaves data science and product teams are releasing new data sets each week and enhancing the client experience.

To request a SONAR demo, click here.

Mike K

No point working if government continues handing out free money while carriers low ball driver pay.

When they offer $600 extra unemployment again, not many will be willing to work.

ThaGearJammer25/8

What happened to the free market? Pay to low and u lose business to the better paying business? But ahh those self insured carriers… who can build capacity based off experience vs having to attract talent. Insurance is a racket! Based off fear. (basically a thing providing protection against a possible eventuality.) so why can’t business risk no insurance? Or with all the data why not insure everyone differently based off data? A million mile owner opp vs a brand new cr England employee? I guarantee that CR guys fixed insurance cost is much lower than a million mile owner opp. Why?? Self insured! Safety is for the working class!! Not a fan of self insured (until we are) because it affords carriers huge advantages! Conflict of interest at least.

I’m not positive but the big dogs around me are adding new trucks. End of year purchase perhaps? Something else to kill competition idk. Fuel on its way up. But really the autonomous future is unfolding now under the disguise of driver shortage. High demand low supply should be good for everyone?

Frank J Altieri

Hopefully people that haul for a dollar per mile will continue to leave the business. Those days are gone for good.

Jayrold Pollock

A Dollar a mile is an antiquated price that won’t even cover fuel costs

Stephen Webster

In Ontario and other parts of Canada at least 4 major trucking companies that self insure are trying to get new truck drivers from Canada and from lower wage workers from other parts of the world. This will push rates back down again in my opinion in about 11 months from now causing many expensive experienced drivers and owner ops to leave trucking. The trucking companies need to work with the insurance companies and the Government to protect trucking workers.

Frank J Altieri

We need to make sure no immigration visas are issued for truck drivers.

Mike K

So true.

Mass immigration lowers wages and standard of living.

Democrats and republicans have played the working class with excessive work visa mass migration.

Citizens get squeezed with low wages due to migrant competition AND price inflation due to migrant competition for housing.

Housing costs and property taxes are out of control due to out of control mass immigration.

This is much more than a MEX border wall issue. Mass migration is flying into the country then overstaying visas.

This is not just a low wage worker problem.

H1B visas are taking jobs away from American doctors, engineers, programmers, analysts, etc.

K-Style Transportation.com

Very good information. This will help us make better decisions going forward.