Author’s comment: This article is being published at a very challenging and unprecedented time for the trucking industry. Business sustainability, and perhaps survival are the main objectives for the short-term. However, the content provided below is based on empirical data of profitability versus seated tractor count percentage from carriers participating in the TCA Profitability Program.

A wise trucker once said that unseated tractors are like a leaky faucet for the industry. In fact, this same entrepreneur was famous for the quote, “If it ain’t seated, get it off my balance sheet.” Based on data collected by the TCA Profitability Program via monthly financial and operational surveys, plus exercises completed to quantify the financial impact of an unseated tractor, perhaps the better metaphor is a high pressure firehouse of profits going down the drain.

To start, for those that are new to trucking, an unseated tractor is a truck that the motor carrier has paid for license plates, insured and may or may not be making lease or other equipment financing payments on. The ‘unseated’ term refers to the fact that this tractor is lacking a professional truck driver to operate. When a tractor is unseated, it is parked, and as a result, is not generating any money for the company. To quantify this situation, based on our data, the average tractor age among TPP members is currently 2.1 years old, and the average financing term for equipment lending contracts is 48 months (four years). As such, almost every tractor that is not being utilized has some financing liability attached to it.

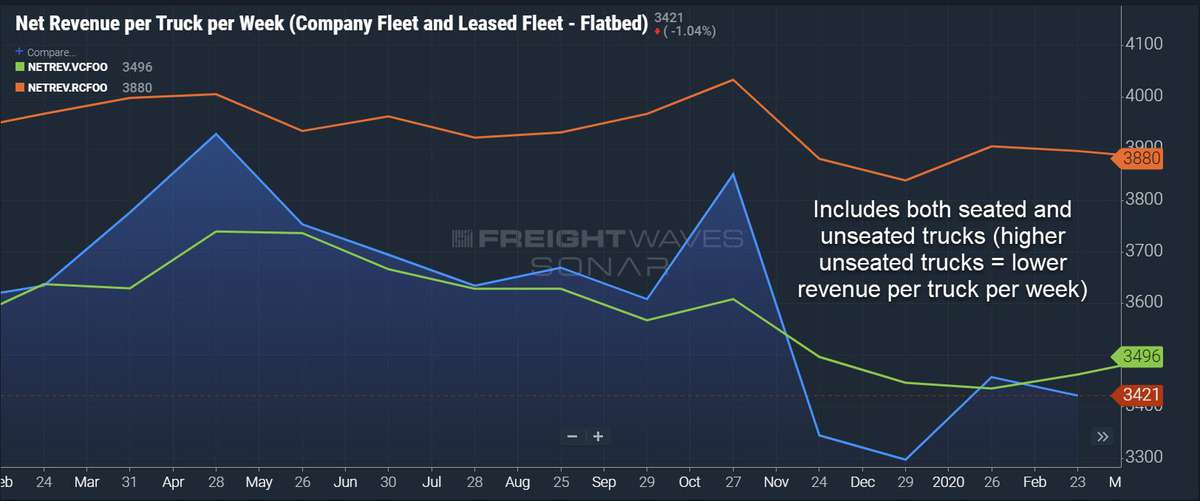

(Source: FreightWaves SONAR )

Since the idea is to ‘seat’ this tractor as soon as possible, a carrier would likely be insuring that tractor. The average cost of insurance, on a per tractor, per year basis is $7,100. Based on exercises we’ve done in the past with TPP members, the cost of that unseated tractor (without maintenance and any other friction cost) is $2,600 per month. To reinforce this to the reader, this is a net loss of $2,600 per month (conservatively) for the privilege of parking a Class 8 tractor.

Why would a motor carrier even consider having an unseated tractor? Well, the answer is really three-fold. Two are psychological problems, and one is a structural industry problem:

- Truck count – The de-facto yardstick for trucking success is ‘truck count.’ It is the first question a trucking company executive asks when introduced to a colleague at another company, and is the first answer in that same conversation. There is absolutely no correlation between truck count and marginal profitability. I can attest to this statement. However, there is no other (currently) useful alternative for a success milestone that you can share in trucking. Almost any other measure would be more appropriate to use (even ‘trailer count’ since a parked trailer could still be generating revenue). I would like to change the industry’s dialogue to focus on gross margin instead of truck count, and many of TPP’s benchmarking activities flow back to this key measure of success. The most successful trucking companies in the world (which also happen to be publicly traded), Knight-Swift and Heartland, spend almost no time boasting about truck count (in fact, Heartland has demonstrated the value of rationalizing the size of its fleet to gain profitability). The message = Margin Before Truck Count (say it loud, say it proud).

- FOMO (fear of missing out) – This is the number one response I hear when I question a carrier about the magnitude of its unseated tractor count – “If only I could seat these 50 tractors, we could be generating so much revenue based on the business we have available.” My response is that you must think like a manufacturer when combating FOMO. You have one finite resource – your drivers. If you don’t have drivers, you don’t have a method of producing the product that you sell. Your human assets are the primary method of production, the tractor is secondary. It doesn’t matter if you have the business if you don’t have the drivers. Further, carriers that have the business, but not the drivers should be working extremely hard on ramping up their brokerage operations to at least capture some value from that business instead of simply rejecting the load.

- Lack of quality professional truck drivers – this is a fact that every industry participant, from the C-suite to the driver’s seat can agree on. There is a major shortage of quality professional truck drivers in this industry. This shortage transcends all geographic boundaries, modes and operating models. Let’s be clear, there may not be a real (numeric) driver shortage, but definitely a lack of safe and productive drivers to help in the pursuit of a higher margin industry. This issue becomes a circular reference (analogy is a dog chasing its tail). Without these quality drivers, it’s almost impossible to achieve long-term increases in margins, and consistently higher pay for all drivers. Going back to the unseated tractor count, if many carriers do the math, they are actually better off parking a tractor then putting an unsafe driver behind the wheel. There may be short-term gain, but potentially long-term ruin.

Within the TCA Profitability Program, we’ve designed a template Profit and Loss statement to help reinforce the erosion in margin that unseated tractors produce. You can download a copy here. Once you plug in the necessary assumptions, and your data, it will provide the user with an ‘adjusted’ operating ratio, taking into account the underlying cost of that parked equipment. I would advise every motor carrier to adopt some or all of this function in your financial reporting, to educate your teams and partners on the dramatic cost of unutilized or underutilized equipment.

Pallet breakdown, piece count , shrink wrap, ask for the checker to check your pallets in so you can get your bills signed

Orientation said all the truck’s on their fleet is on a test drive status so the truck’s you’ll drive are Free we just have to get them back by so many miles

Eli

If they’re not moving they’re not making the company money :\