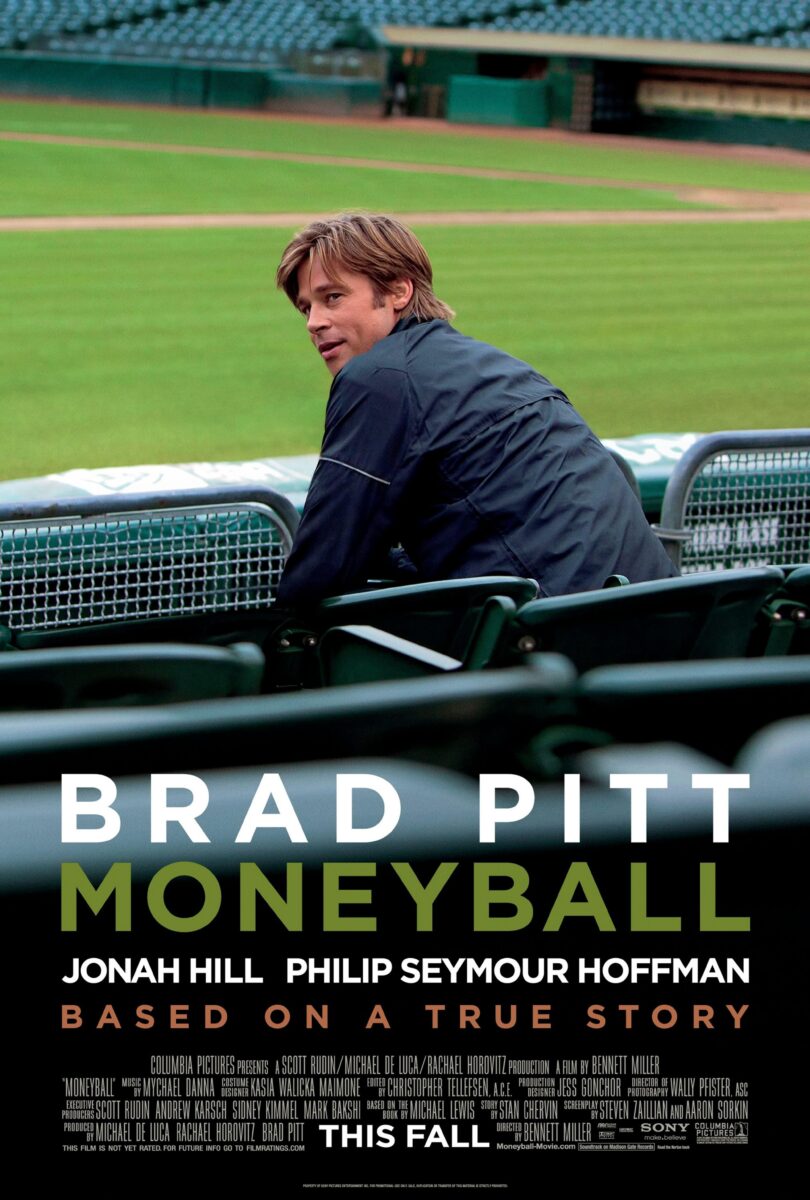

My favorite scene in the movie adaptation of Michael Lewis’ “Moneyball” occurred during 2003 in the darkened Oakland A’s locker room where Billy Beane, the team’s general manager, reluctantly slid a folded piece of paper across a table to his math genius assistant Peter Brand.

Unfolding the paper, Brand stared at the number written, telling Beane after a pause the offer from the Boston Red Sox would make Beane the highest-paid general manager in sports.

“So?” So what? Beane replies somewhat annoyed.

“You’re not doing it for the money,” Brand says. “You’re doing it for what the money says.”

Before the credits roll, we learn that Beane turned down an offer of $12.5 million a year to run a Red Sox team that would win a World Series a year later in 2004.

What, you may be rightfully wondering, does that have to do with electric infrastructure and the future of supply chains?

Maybe nothing. But stay with me here.

DOE doles out infrastructure dough

For just a couple hundred thousand dollars more than Red Sox owner John Henry offered Beane, the Department of Energy is granting two major auto suppliers and one university a total of $12.7 million to develop fast-charging infrastructure for electric vehicles.

If commercial electric vehicles — especially heavy-duty trucks — are going to be viable, they need to be able to charge quickly. Otherwise, they could become a future supply chain obstacle. Ready access to low-cost, fast-charging infrastructure is essential for fleet electrification and broader EV adoption. Scaling current charging technology is pricey.

I missed the specifics of these grants late last year. And I wondered why BorgWarner Inc. just got around to announcing its $4.09 million award on April 14. Eaton Corp, which picked up $4.9 million in the “Fiscal Year 2021 Low Greenhouse Gas (GHG) Vehicle Technologies Research, Development, Demonstration and Deployment” program, issued its release four months ago.

North Carolina State University received $3.9 million. In total, the DOE gave out more than $68 million across eight infrastructure-related areas, including $5 million to Achates Power, whose opposed-piston 2-stroke hybrid commercial vehicle system was featured in Truck Tech on Friday.

What the money says (and buys)

BorgWarner (NYSE: BWA) is leading a team on a36-month project to design and develop a cost-effective, advanced direct current fast charger (DCFC).

It is coordinating with U.S.-based suppliers and research partners, including Michigan State University, eTransEnergy, Cityfi, the State of Michigan, and the construction firm Barton Malow. Component supplier support is coming from Wolfspeed, Inc.

The goal is to develop the next-generation DCFC system for 20-30% lower cost than current systems. BorgWarner’s flexible and adaptable single-stage power conversion and power module architecture will allow up to five vehicles to share 150 to 350 kilowatts of juice in 25kW modules. Five other EVs can be plugged in and ready to be charged.

Initially, the charger won’t help trucks much since they need more power because of the size of their battery packs. But BorgWarner is confident it can get there.

Solid state transformer

Eaton (NYSE: ETN) is developing a compact and turnkey solution for DC fast-charging infrastructure. It is expected to reduce costs by 65% through improvements in power conversion, grid interconnection technology, charger integration and modularity and installation time.

A solid-state Eaton transformer design and modular chargers packaged on a compact skid will speed installation and reduce the amount of equipment and space needed, both of which should reduce cost. It will connect directly to a utility’s medium-voltage distribution system, eliminating the need for additional power conversion devices.

Eaton is leading the project. Partners include the National Renewable Energy Lab, N.C. State, the University of Pittsburgh, ITC Holdings, and Calstart, the national nonprofit focus on clean transportation.

Eaton, NCSU and Pitt are collaborating on the technical development of the solid-state transformer. NREL will validate the technology. ITC Holdings will provide a demonstration site for fleet charging, and CALSTART will independently validate costs and performance.

One more coincidence

Oh, and one more coincidence. Beane, who remains with the A’s as executive vice president nearly two decades after the Moneyball story was told in Lewis’ 2003 bestseller, will speak at the FreightWaves Future of Supply Chain event in Northwest Arkansas on May 9-10.

Related articles:

Electric truck charging: Can infrastructure keep pace with demand?

Daimler Truck, BlackRock and NextEra Energy bet $650M on electric infrastructure

Paccar puts charge into electric trucks with infrastructure plan