Growth in the U.S. economy slowed further in the fourth quarter of 2018, but came in well above expectations to round out an impressive year of growth.

The Bureau of Economic Analysis (BEA) released long-delayed results for fourth quarter gross domestic product (GDP) this morning, showing that overall growth in the economy slowed to a 2.6 percent annualized pace. This is down from 3.4 percent in the previous quarter but beat out consensus estimates of 2.2 percent growth. Year-over-year growth for the fourth quarter climbed to 3.1 percent, marking the fastest pace of yearly growth in the economy since the middle of 2015. For the year, U.S. GDP grew 2.9 percent in 2018, matching 2015 for the strongest year of growth in this current expansion.

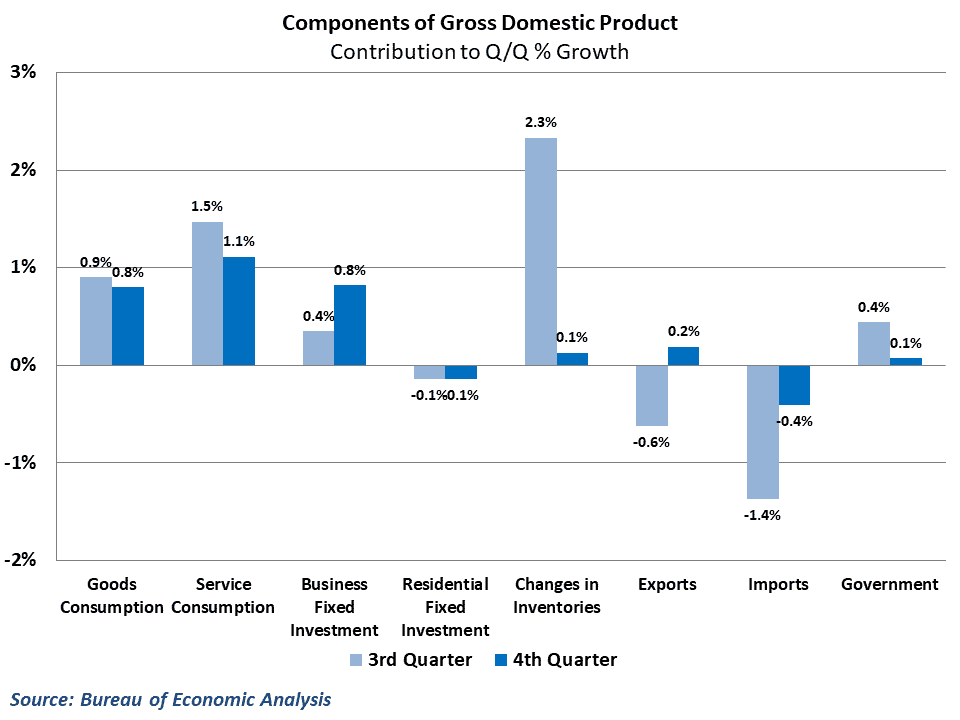

While the third quarter of the year was highlighted by wild swings in the often-volatile inventory and international trade components of GDP, movements in the fourth quarter were more modest in these areas of the economy. Tariff concerns caused many businesses to import goods earlier than they otherwise might, storing these goods inventories in case tariffs increase. As a result, imports weighed heavily on growth in the third quarter while inventory building contributed over 2 percent to growth during the quarter. This pattern likely continued in the fourth quarter, but at a slower pace.

Consumer spending, which makes up approximately 70 percent of all expenditures in the economy, slowed down at the end of 2018 but still managed to contribute an impressive 1.9 percent toward quarterly growth in the fourth quarter. After a brief slowdown at the beginning of 2018, consumers spent generously through the remainder of the year, boosted by tax cuts and solid income gains. Business investment performed well, contributing 0.8 percent to growth, led by a jump in intellectual property spending. Residential investment, which has been a consistent area of weakness throughout the year, declined for the fourth consecutive quarter at the end of 2018.

GDP and freight markets

In a broad sense, gross domestic product is the most often referenced measure of the state of an economy. GDP measures the value of all goods and services produced within an economy during a given period, and provides the broadest measure of overall economic activity.

Most of the activity in the U.S. economy revolves around the production of services, however, which has looser ties to freight movements. Spending on things like healthcare, recreation and financial services are a significant portion of economic production, but have less of an influence on freight demand and the movement of goods. As a result, headline GDP numbers may not accurately reflect the state of the freight market.

It is more useful, then, to focus on the areas of GDP that reference the goods side of the economy. Consumption of goods, business investment in equipment and structures, residential investment, and trade in goods all serve as key drivers for freight demand in the economy.

Taken through this lens, the GDP result also look solid, with a couple of notable caveats. The business investment numbers were stronger than most expected, but more than two-thirds of the growth during the quarter came from intellectual property products like software and research and development, which involve less freight movement. In addition, net exports subtracted far less from growth in the fourth quarter, but much of this was driven by a significantly slower pace of import growth. This has negative implications for freight movements even as it helps the overall GDP numbers.

Behind the numbers

At this point, fourth quarter numbers feel a bit like old news, but they still serve a useful purpose in that they help level set expectations going forward. It has been clear for some time now that the economy came down from the rapid pace of growth seen in mid-2018. The only question has been how severe the slowdown was going to be, and recent weak results from retail and factory orders had many (myself included) fearing growth of 2 percent or possibly worse.

As a result, the 2.6 percent showing gives a bit of temporary relief to an economy that has been beset with waves of bad news. Going forward, this moderation in growth is still likely to continue, however, and the combination of the government shutdown, tariff uncertainty and the polar vortex will likely drive growth below 2 percent in the first quarter. Still, this morning’s report serves as a reminder that there are still areas of the economy that are performing well. It is unlikely that the economy will recapture the momentum it had in the middle of last year, but growth fundamentals still look solid.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary bysubscribing.