J.B. Hunt Transport Services continues to see demand for its services exceed capacity. Management from the company noted moderation in the spot truckload market on a call with analysts Monday night but said that pressure on rates is likely more of a hurdle for smaller carriers not operating under contractual arrangements.

“As we sit here today, demand for our services, and in particular the asset side of our business, is the strongest I’ve seen in my 27-year career at the company,” Chief Commercial Officer Shelley Simpson stated.

Simpson said loosening in the spot market along with declining rates is really more of an issue for small operators. She said J.B. Hunt is halfway through bid season and is seeing its best results from contractual negotiations in memory. She noted that potential supply chain disruptions tied to China’s latest rounds of COVID lockdowns and noise around West Coast labor negotiations could present incremental congestion and tightening by July.

“In this type of an environment, it just takes a little bit of disruption to really change the environment all over again, and so that’s what we’re watching out for,” Simpson said.

J.B. Hunt (NASDAQ: JBHT) reported first-quarter 2022 earnings per share of $2.29 after the market closed, 92 cents better than the 2021 first quarter and 35 cents ahead of consensus. Gains on equipment sales were $18 million higher year-over-year, which provided a 12-cent-per-share tailwind.

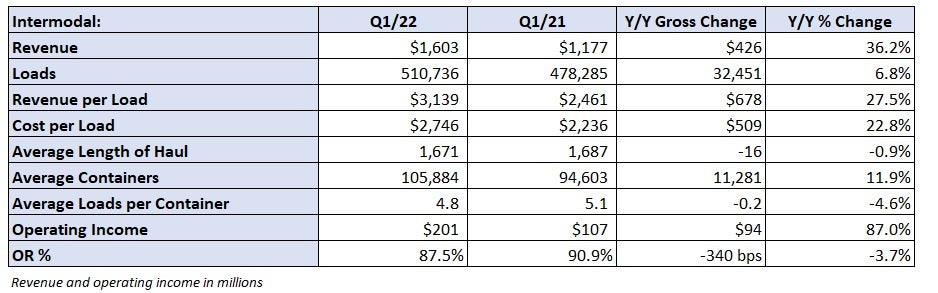

Intermodal segment logs growth while industry retreats

J.B. Hunt’s intermodal unit reported a 7% increase in loads during the quarter, while total intermodal traffic on the Class I railroads fell by a similar percentage. Loads were down 1% year-over-year in January but jumped 17% in February and 6% in March. The February comp was easy given severe winter-related outages across rail networks last year.

Revenue per load was up 27.5% year-over-year, outpacing cost increases on a per-load basis by 480 basis points. Labor headwinds at customer facilities weighed on January results but eased as the number of omicron cases declined. However, diminished velocity on the railroads constrained results throughout the period.

Dwell times increased by 11% and 12%, respectively, at primary rail partners BNSF (NYSE: BRK.B) and Norfolk Southern (NYSE: NSC) in the quarter. Train speeds were down 4% and 11%, respectively. J.B. Hunt’s container turns fell 5% to 4.8x, but recent investments in the fleet (average containers in service increased 12%) allowed for the volume growth.

J.B. Hunt’s intermodal head, Darren Field, said the company is “turning down thousands of loads per week.” He’s optimistic about the longer-term growth opportunities, which he said will accelerate as rail service improves.

“We’re encouraged by what we’re seeing from the rail network today, but it’s nowhere near getting back to where it was prior to the pandemic,” Field added. “We have a long way to go in that area, but there’s no lack of motivation from our rail providers to improve their velocity.”

The company added 4,350 containers in the quarter (109,300 units in total at quarter’s end) as part of a 12,000-unit order undertaken last year. It plans to grow its intermodal box fleet to 150,000 units within three to five years, a 40% increase from the 2021 close.

When fluidity in the ports and on the rails improves, Field sees modal conversion from more expensive truck to rail, transloading of international freight and organic growth among its existing customer base as favorable growth levers.

The company will also likely benefit from service improvements in the West as BNSF is adding railcars and facility capacity as well as providing access to property in major hubs to speed service. The rail line also lost Knight-Swift Transportation (NYSE: KNX) as a customer earlier this year, and Schneider (NYSE: SNDR) will be leaving at the end of the year, which should free up capacity for J.B. Hunt.

Field said declines in TL spot rates have not placed any pressure on intermodal pricing as the rate gap between the modes remains wide. Throughout the pandemic, it has been the lack of rail capacity and fluidity that helped drive spot TL rates higher.

“I mean you’re 200% higher to buy a spot-rated truckload solution off the West Coast versus an intermodal rate,” Field said. “There’s a very significant gap before truckload prices put any kind of pressure back on the intermodal market.”

Operating ratio in the segment improved to 87.5%, 340 bps better year-over-year.

Brokerage moving toward contractual, away from spot

Brokerage revenue increased 29% year-over-year to $675 million as loads increased 12% and revenue per load was 14% higher. Gross margin increased 60 bps to 13% with operating income up by more than three times at $25 million.

Brokerage TL volumes were up 15% year-over-year with management noting “a moderation of spot opportunities as of late.” It believes more customers have shifted freight out of the spot market and into contractual arrangements as there has been a “movement in the market toward more balance.”

J.B. Hunt’s brokerage segment saw contractual, or published, business increase more than 20% in the quarter, with its spot business up only low single digits.

Dedicated revenue increased 28% year-over-year to $741 million, but revenue per truck per week (+6%) was flat excluding fuel surcharges. The division reported 240 bps of OR deterioration at 89.6%. Increases in wages, benefits and recruiting costs, as well as labor disruptions at customer facilities and contract startup costs, were the culprits.

Read more

Click for more FreightWaves articles by Todd Maiden.

- Trucking: Cowen cuts estimates over ‘growing concerns for carriers’

- After XPO deal, STG CEO sees ‘perfect storm’ of opportunity

- Cass reports ‘freight slowdown’ in March