Chris Henry, Program Manager, TCA Profitability Program

(PHOTO: MARTEN TRANSPORTATION)

Since 2014, we’ve been closely following the publicly-traded truckload companies, and in 2015 we started embedding the results from these companies into the inGauge database. In addition, we have created and maintained a workbook of individual and group results for these companies. This has proven to be a valuable tool for those who wish to consume the results in excel, as opposed to within the application. Having these years under my belt doesn’t make be a stock analyst, however, it does provide a great reference for which companies in the public markets consistently hit it out of the ballpark. The names that are consistently mentioned in the press are Werner, Knight-Swift, Landstar and Schneider. However, I’ve always been intrigued by one of the (relatively) smaller companies in this relatively tiny basket of trucking companies listed on the exchanges.

Quarter-over-quarter, year-over-year, Marten Transport (NASDAQ: MRTN) has delivered consistent, top quartile results. Key word is consistent. When compared to many of the others, you don’t see very many blips in operating expenses or legal exposures that may causes multi period hangovers for others. Everything I read about them through their earnings releases and SEC filings point to a very disciplined operating team. As you see below in the interactive chart, Marten has hung with, and bettered the performance of many of the big dogs (click on the labels on the legend to add/remove carriers from the comparison):

History

Roger Marten founded Marten Transport in 1946 at the age of 17, delivering milk and other dairy products. In the 1950’s he expanded his milk delivery routes, purchased and drove school buses, and hauled petroleum products with his first tractor-trailer. Roger’s son Randy joined the company in 1965, initially assisting with equipment maintenance and dispatch. Marten began trading on the NASDAQ at $13 per share in 1986. During the same year, Randy Marten became President, the company exceeded $50 million in revenue and built a major expansion to its Mondovi, WI headquarters. Roger Marten passed away in 1993. Upon the death of his father, Randy Marten also became the CEO in addition to being President. He remains in this role today.

Operating Attributes

Headquartered in Mondovi, WI., Marten Transport operates a total of 2,773 tractors, with an average age of 1.6 years, and a Tractor to Trailer Ratio of 2.6. They specialize in temperature-sensitive truckload, and have also expanded significantly into Dryvan with a total of 1580 dryvan trailers in the fleet as of September 30, 2018. Marten currently has 15 regional service centers spread across the United States.

4 Main Operating Sectors

Marten operates within 4 distinct segments:

- Truckload – Offering temperature controlled, haz-mat and dry van service to the U.S, Canada and Mexico. This segment utilizes both regional and over-the-road fleets.

- Dedicated – This segment involves taking over a company’s internal fleet and managing the details of their entire transportation budget – vehicle procurement, maintenance and cost management, peak season support, driver hiring and training, insurance provision, safety and compliance, securing backhauls through Marten’s truckload network and providing customized KPI’s to the customer.

- Brokerage – Marten Transport Logistics LLC offers capacity solutions beyond the daily commitments of the Marten’s company fleet. MTL monitors safety ratings, insurance and regulatory standards of hundreds of carriers to ensure that service expectations are met. Specialized equipment types not found in Marten’s fleet are available.

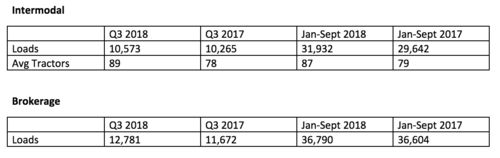

- Intermodal – Refrigerated intermodal has been offered since 2005. Service offers trailer on flatcar (TOFC), providing the economies and energy efficiencies of long-haul train transportation with extended door-to-door support from Marten’s truck network. Bi-Modal (utilizing both rail and traditional truck service) allows for service into all three countries Marten operates. Complete tracking is available. All Drayage is provided by Marten’s company fleet.

Performance

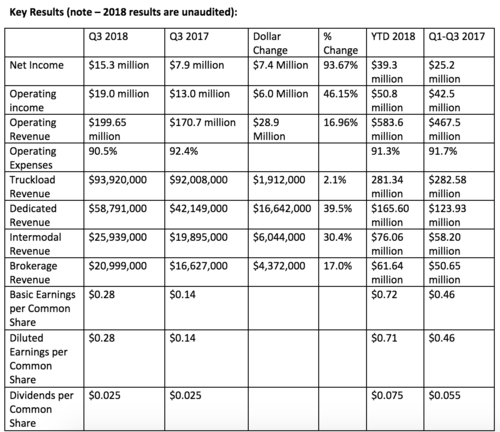

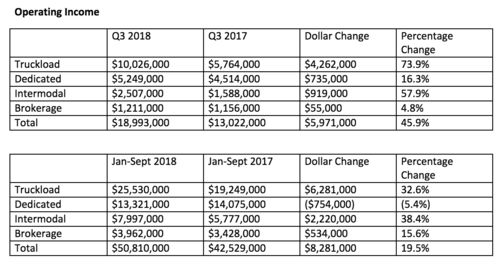

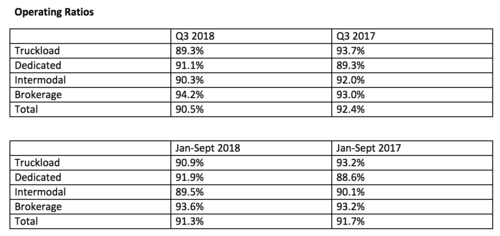

Marten released third quarter results on October 16, 2018. They reported the highest operating income and operating revenue for any quarter in their history. 3rd quarter net income was up 94.2% to $15.3 million versus $7.9 million in the 3rd quarter of 2017. The first nine months of 2018 saw net income improve by 55.9% to $39.3 million from $25.2 million in 2017.

Randy Marten gave this insight regarding the 3rd quarter results: “We are encouraged by our record operating income and operating revenue in this quarter, along with our best operating ratio, net of fuel surcharges, over the last 14 quarters. These top and bottom-line results are a direct result of the continued disciplined execution of our unique multifaceted business model by our dedicated and experienced Marten workforce while capitalizing on the strengthened freight environment. We also improved our balance sheet position with $35.7 million in cash at September 30, 2018 compared with $15.8 million at the beginning of the year. We expect to drive continued growth across all of our operating platforms with increasing compensation for our premium services, additional freight with existing and new customers, and our emphasis on operating efficiencies and cost controls. Our agreements with a number of customers included a shift beginning in this year’s first quarter from line haul to fuel surcharge revenue, which reduced our Dedicated and Truckload revenue, net of fuel surcharges, by $200 and $43 per tractor per week in the third quarter, and by $171 and $33 per tractor per week in the first nine months of this year. The change reduced out revenue excluding fuel surcharges by $3.8 million for the third quarter and by $9.3 million in this year’s first nine months, while increasing our fuel surcharge revenue by the same amounts.”