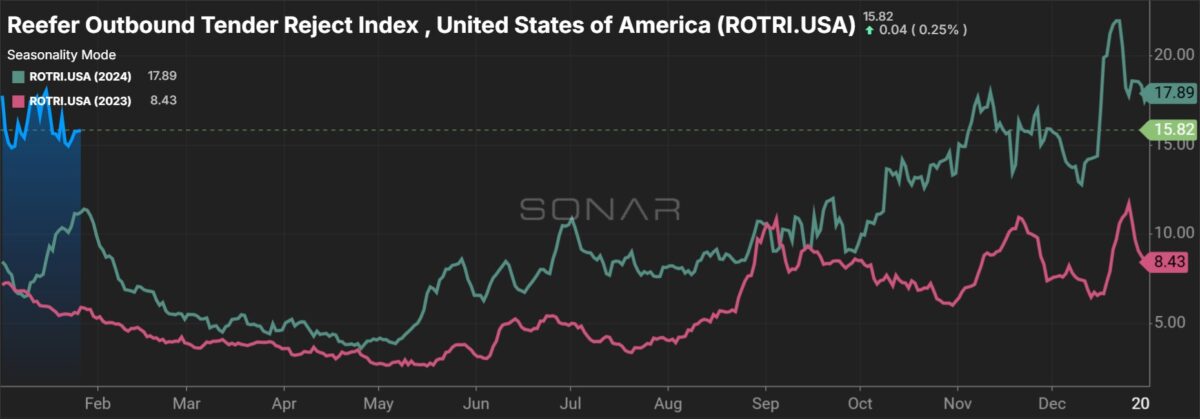

Refrigerated carrier Marten Transport reported sequential improvement in truckload trends during the 2024 fourth quarter, with earnings inflecting positively sequentially for the first time since the second quarter of 2022.

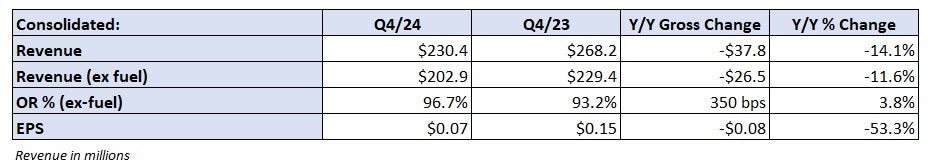

Marten (NASDAQ: MRTN) reported earnings per share of 7 cents Monday after the market closed, 1 cent better than the consensus estimate but 8 cents lower year over year. Gains on the sale of equipment were $1.4 million lower y/y, or approximately a 1-cent headwind.

The company recorded net earnings of 5 cents per share in the third quarter.

Consolidated revenue of $230.4 million was 14.1% lower y/y as all business segments saw declines. Fuel surcharge revenue was down 29% y/y.

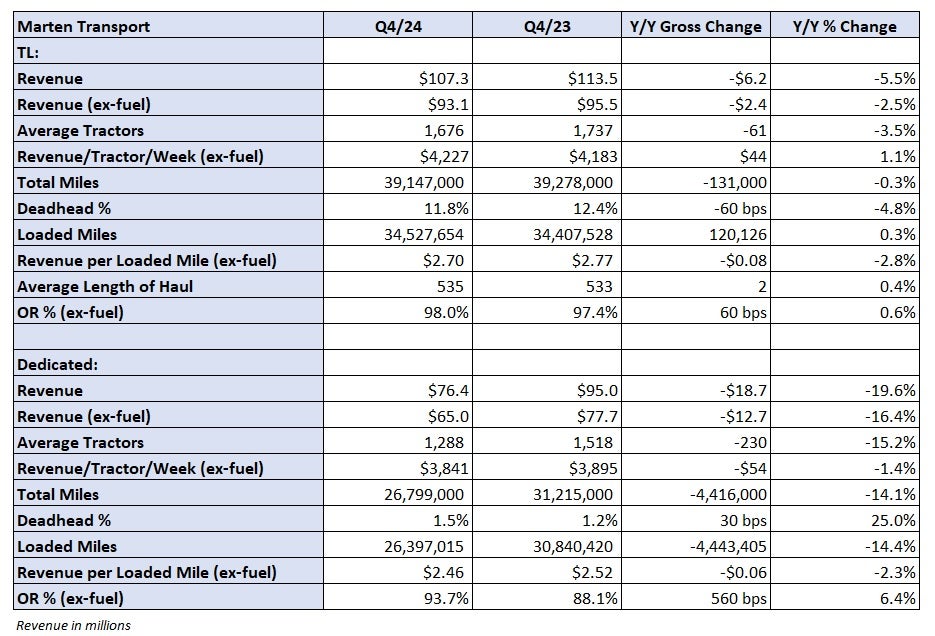

Marten’s TL unit reported a 2.5% y/y revenue decline (excluding fuel surcharges) as average tractors in service fell 3.5%, partially offset by a 1.1% increase in revenue per tractor per week. Revenue per loaded mile (excluding fuel) dipped 2.8% y/y but remained level with the third quarter at $2.70.

The segment returned to profitability in the quarter, posting a 98% operating ratio (inverse of operating margin) excluding the impact of fuel surcharges, which was 60 basis points (bps) worse y/y but 220 bps better than the third quarter.

On a consolidated basis, compensation expenses were 200 bps higher y/y (as a percentage of revenue) and depreciation expenses were up 120 bps.

The dedicated unit saw revenue fall 16.4% y/y (excluding fuel) as average tractors in use fell 15.2% and revenue per tractor per week was off 1.4% (but up 4% from the third quarter). The unit posted a 93.7% OR (excluding fuel), which was 560 bps worse y/y but 140 bps better sequentially.

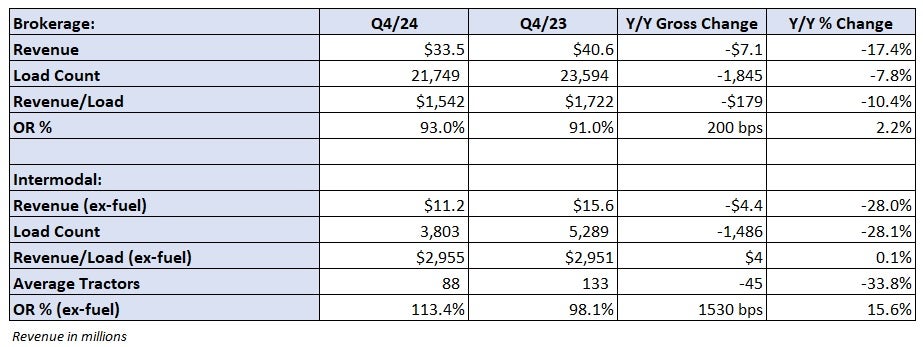

Brokerage revenue fell 17% y/y as loads were off 8% and revenue per load was off 10%.

The intermodal segment reported an operating loss of $1.5 million (a 113.4% OR ex-fuel), which was similar to the loss recorded in the prior quarter.

Marten does not hold a quarterly conference call to discuss results. The carrier didn’t provide any color on demand or rate expectations for the new year.

“We continue to focus on minimizing the freight market’s impact on our operations while investing in and positioning our operations to capitalize on profitable organic growth opportunities, with fair compensation for our premium services, across each of our business operations for what comes next in the freight cycle as the market moves toward equilibrium,” Marten Executive Chairman Randy Marten stated in a news release.

Shares of MRTN were down 0.3% in after-hours trading on Monday.