Fenix Marine Services aims to make faster dwell and truck turns the capstone of a nearly two-year project to upgrade the second largest marine terminal in Los Angeles.

Fenix is partnering with logistics technology provider Blume Global and artificial intelligence vendor SavantX to develop an expedited terminal service offering for customers retrieving containers. Fenix’s Pier 300 site handles 1.2 million container lifts per year.

The platform will use anonymized data from motor carriers, shippers and forwarders that ship through Fenix and whose assets are connected to Blume’s database to optimize terminal appointments and schedules for drayage drivers.

Pleasanton, California-based Blume said the platform aims to “increase terminal efficiency, expedite truck turn times and provide next generation differentiated services” for its users.

Mark Pluta, chief technology officer for Blume, likened the service offering to a TSA PreCheck, with some shippers deciding an extra fee is worth the faster turnaround time.

This is Blume’s first venture into optimizing container flow specifically at a marine terminal, but “we are definitely looking to expand this with Fenix and other marine terminals,” Pluta said.

Pluta said Blume’s ability to track trucks and chassis is critical to having a robust enough data to make the algorithms possible.

“We have the visibility into drayage, so we are able to find ways to accelerate the process,” he said. “We’ll get a good picture of what’s possible in reducing turn times.”

Once up and running, Pluta estimated the expedited service could reduce container dwell times by as much as 48 hours or more. Fenix’s average container dwell times are four to five days for truck pick-ups and three days for rail.

“There’s a lot of opportunity around optimization,” Pluta said. “For many shippers, containers being held up four days in ports is not acceptable. The work we are doing with Fenix is the opportunity to optimize those flows.”

Chief Executive Sean Pierce said the project with Blume and SavantX culminates a series of $90 million in upgrades Fenix has done over the last 18 months. Trials on the expedited service will take place from the fourth quarter of 2019 through the first quarter of 2020.

He said the genesis of the project was Fenix’s “ability to forecast container availability and forecast those into a push appointment system.”

Pierce said using machine learning on real-time asset tracking and event data “really drive[s] the next level of efficiency without equipment automation.”

The ability to offer expedited container moves is in response to shipper and trucker frustration over the long turn times for drivers at the nation’s busiest seaport.

Fenix saw average turn times rise to an all-time high of 140 minutes in March, according to Harbor Truck Association and GeoStamp Truck Mobility Data. That compares to an average turn time of 83 minutes across all Southern California marine terminals.

Fenix’s average turn time fell to just 87 minutes in June, compared to a regional average of 77 minutes.

Pierce did not address the specific turn time reports. But “we need to improve the quality of the service inside the fence.”

Fenix starting upgrading its terminal soon after the closing of private equity firm EQT’s acquisition of a 90 percent stake in Fenix from container line CMA CGM.

The project involved a densification of container stacks and new cargo handling equipment. Fenix also replaced its existing truck gates and installed new optical character readers at the gates.

Along with the physical infrastructure, Fenix upgraded its information technology systems. It implemented Voyage Control’s software platform for container availability and scheduling. Fenix also shifted away from its legacy operating system to the Navis N4 terminal operating system

“Once we got that in place, we set a strategy to take this conventional terminal and increase the velocity of containers moving through it,” Pierce said. “There is a tremendous amount of non-productive moves at a terminal when you are digging out containers.”

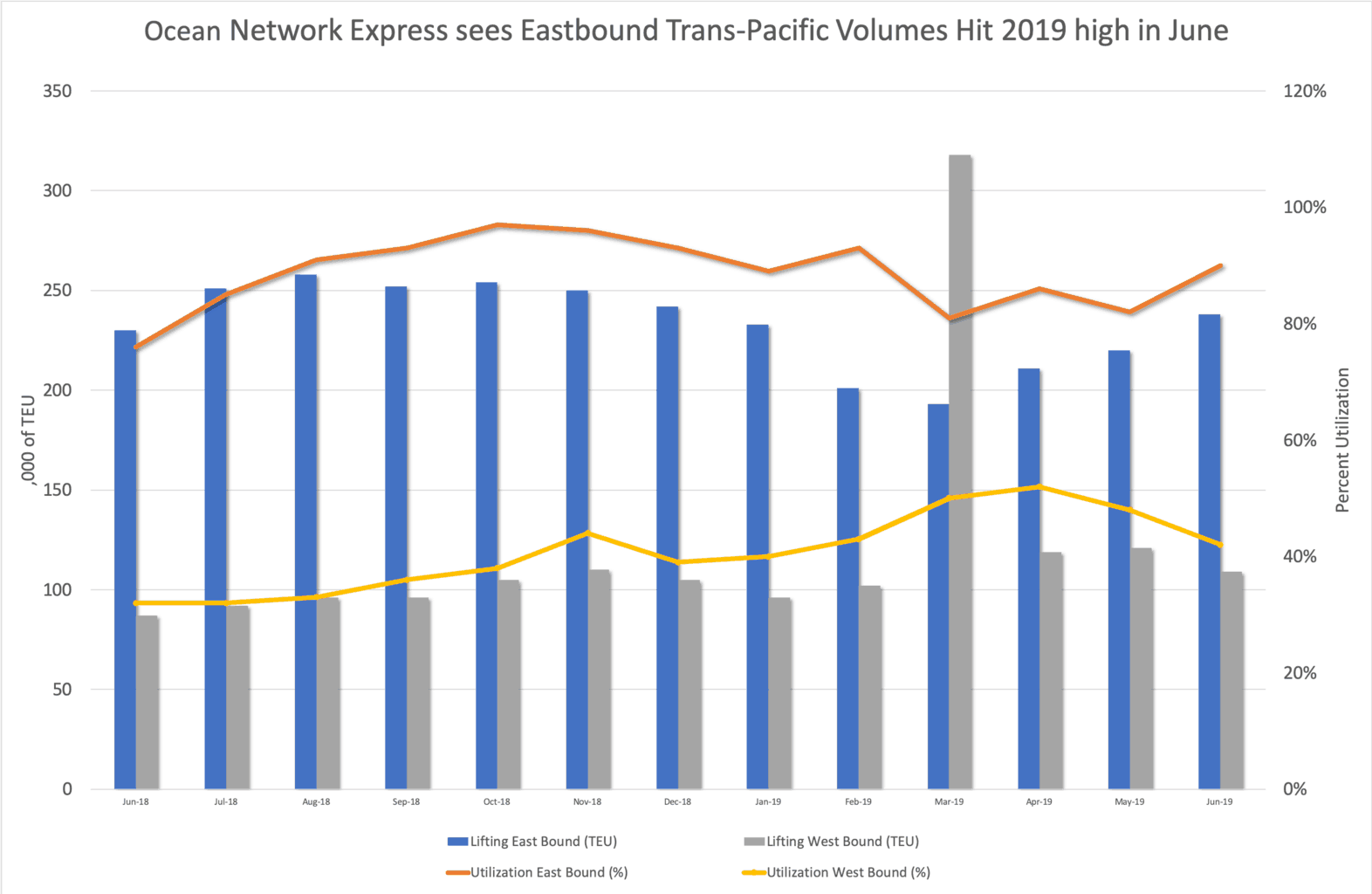

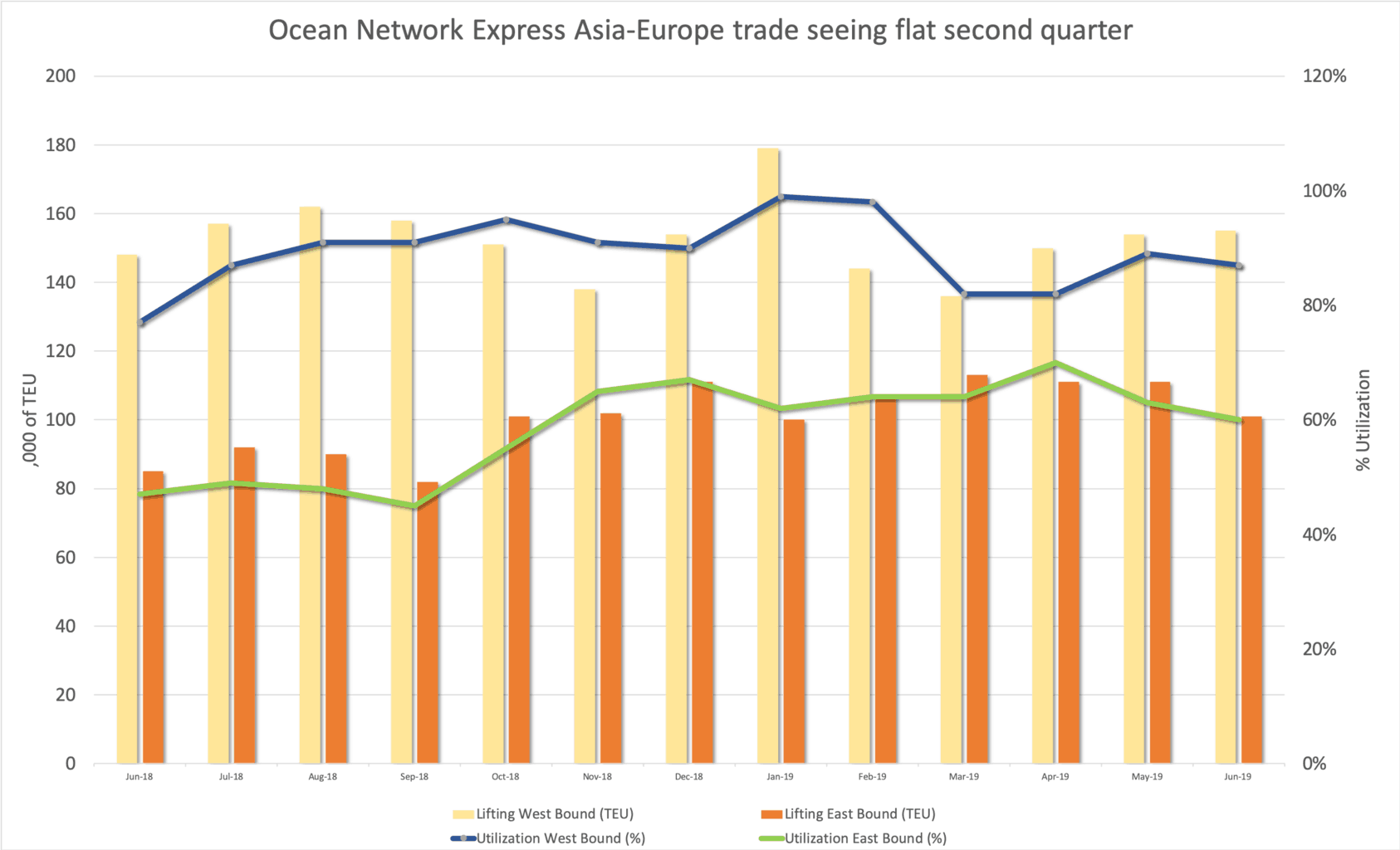

Ocean Network Express liftings show flat to moderate growth

Traders ditch U.K. flag ships over Iran fears

Use of ships flagged to U.K. or its territories seen as riskier now as Iran holds tanker. (Lloyd’s List)

China hoards Iranian oil

Tanker traffic said to be exceptionally strong as China stores more crude. (Bloomberg)

Six months to IMO 2020, it’s time to get worried

Dry bulk shipping group Intercargo warns of limited supply and testing of compliant fuels. (ShippingWatch)