U.S. Xpress posted an operating income gain of more than 12.5 times, rising to an adjusted operating income of $15.1 million.

U.S. Xpress (NYSE: USX) saw its net income take a significant jump from the fourth quarter of last year while its operating ratio also improved.

However, adjusted earnings per share of 15 cents per share fell short of consensus by 4 cents. Revenue was short of consensus by $3.53 million, according to SeekingAlpha.

On a revenue gain net of fuel of 5.7% from the fourth quarter of 2019, U.S. Xpress posted an operating income gain of more than 12.5 times, rising to an adjusted operating income of $15.1 million from an adjusted operating income of $1.2 million in the fourth quarter of last year.

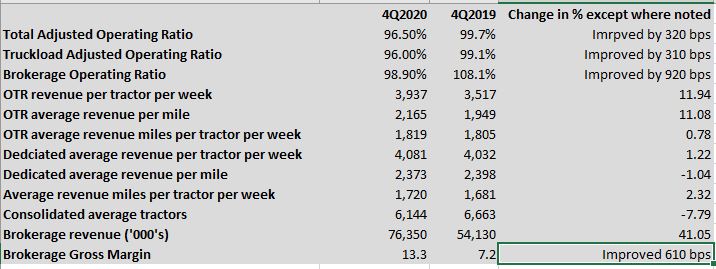

The company’s adjusted OR improved to 96.5% from 99.7% last year, an improvement of 320 basis points.

Adjusted net income moved from a loss last year of $2.82 million to adjusted net income this year of $7.5 million.

In prepared remarks with the release of the earnings, CEO Eric Fuller said the company’s new Variant initiative accounted for 9.4% of truckload revenues in the fourth quarter. Variant, with a different approach to operations and recruiting, did not exist in the fourth quarter of last year so there is no point of comparison.

“We believe Variant represents an entirely new paradigm for operating trucks in an over-the-road environment utilizing artificial intelligence and digital platforms to recruit, plan, dispatch and manage its fleet,” Fuller said in the statement.

Among some of the other specific numbers in the release:

— U.S. Xpress’ truckload division posted an adjusted OR of 96%, a 310 bps improvement from the fourth quarter of last year. The numbers in that segment were significantly higher. Average revenue per tractor per week jumped to $3,937 from $3,517; average revenue per mile rose to $2,165 from $1,949; and average revenue miles per tractor per week rose to 1,819 from 1,805. The average number of tractors was down significantly, to 3,355 from 3,835, but U.S. Xpress management has said the goal is to operate on more profitable routes rather than chasing business just for the sake of it.

— Dedicated’s numbers were little changed. Average revenue per tractor per week moved up slightly to $4,081 from $4,032, while average revenue per mile fell to $2,373 from $2,398. But average revenue miles per tractor per week was up to 1,720 from 1,681.

But in his statement, Fuller said the Dedicated division had experienced “earnings degradation … as driver and capacity costs accelerated faster than we were able to pass them through to our customers in the fourth quarter.” As other trucking executives have said this earnings season, Fuller said he expected higher rates to recapture some of that. “We are addressing customer pricing in certain Dedicated accounts,” he said in the statement.

— The brokerage division had a very strong quarter. Revenues rose to $76.35 million from $54.13 million and gross margin climbed to 13.3% from 7.2%. The load count declined slightly, to 42,155 from 42,208. What was notable in the earnings about the brokerage division is that the company said 62.1% of all loads were booked on its digital platform. Last year that number was 1.4%.

U.S. Xpress management is holding a conference call with analysts at 5 p.m. EST Thursday.

Disclosure: FreightWaves founder and CEO, Craig Fuller, retains ownership of US Xpress shares through his family trust.

More articles by John Kingston

Trucking demand flattens, but driver supply still tightens: U.S. Xpress CEO

U.S. Xpress CEO sees significant gains from Variant initiative as Q3 revenue posts modest increase