If you believe decarbonization will ultimately happen and the world will transition away from oil in the coming decades, how will that play out for crude tankers?

In one scenario, tankers are left with too few cargoes before they fully depreciate. Owners are stuck with big losses. As a tanker company CEO once told American Shipper, not for attribution, “Think about it. If everybody wants to decarbonize, what do I move? I move carbon.”

In another scenario, at the other end of the spectrum, new tankers aren’t ordered due to lack of financing for assets that move carbon and because tanker owners are concerned over future demand.

But the transition away from oil takes much longer than expected. There are eventually too few tankers left to carry the oil that’s still needed. Tanker rates go into supercycle mode, and the remaining tanker owners make a fortune off their aging ships.

If there is an energy transition, the endgame for tankers is likely many years away. But there is growing evidence that at least some version of the second scenario could emerge in the medium term.

Collapse in crude tanker orders

Orders for very large crude carriers (VLCCs, tankers that carry 2 million barrels) have collapsed. On Thursday, Japan’s Mitsui OSK Lines (MOL) announced orders for two VLCCs from China’s Dalian COSCO shipyard for deliveries in 2025-26. These are the first orders for VLCCs since June 2021.

“The orderbook continues to dwindle, particularly on the crude side,” said Lars Barstad, CEO of Frontline (NYSE: FRO), during a conference call on Thursday.

There are 21 VLCCs under construction for delivery in the second half of this year, plus another 20 in 2023, plus the two MOL newbuilds in 2025-26. There are currently 861 VLCCs in service, meaning the orderbook-to-fleet ratio is down to 5%. Barstad noted that by the end of this year, 81 VLCCs will be over 20 years old. By the end of 2023, there will be 114.

The situation with Suezmaxes (tankers that carry 1 million barrels) “is even more pronounced,” said Barstad. There has not been a new order for a Suezmax since July 2021. There are only 16 Suezmaxes on order, eight to be delivered this year, six next year and two in 2024. By the end of this year, 65 Suezmaxes will be over 20 years old. By 2024, there will be 111, he said.

Barstad noted that the absolute size of the tanker orderbook, measured in deadweight tons, is down to 2000-01 levels. “And we all know that the oil market now is much larger than it was in 2000.” The orderbook-to-fleet ratio hasn’t been this low since the 1980s or 1990s.

“This is an alarming development,” said Barstad. (Presumably he is referring to those who need tankers to transport oil, not companies like his own that earn money from renting out tankers.)

“I would say we’re starting to see the early signs that tankers could become a bottleneck in the logistical chain. Not every country is blessed with oil. And there’s often an asymmetrical relationship between [countries with] population growth and oil resources. So, this transportation need is real.”

Why tankers aren’t being ordered

Erik Broekhuizen, head of marine research at Poten & Partner, highlighted the dearth of new crude tanker orders in a research note this month. The “almost complete lack of ordering” is “remarkable,” he said.

Why have orders collapsed? One reason, he noted, was the jump in newbuild prices due to higher labor and material costs. Yard prices are also being driven up by heavy ordering of container ships and liquefied natural gas carriers.

The most common answer cited in industry forums is uncertainty over future regulations on ship propulsion. If owners order too soon, they’ll pay for ships that are quickly outdated. “With tightening environment regulations, tanker owners are uncertain what type of propulsion to choose for their newbuilding: fuel oil, LNG, ammonia, etc.,” said Broekhuizen.

The problem with this theory, he pointed out, is that “this uncertainty does not seem to faze the owners in other shipping segments. LNG carriers, container vessels and, to a lesser extent, bulk carriers are being ordered in large quantities.”

According to Broekhuizen, the biggest reason for the lack of tanker ordering is uncertainty over the future of oil itself.

“In previous cycles, owners could always feel comfortable that, as long as they could ride out the lean years, the market would eventually recover. Over the long term, oil and ton-mile demand growth could be taken for granted. The market would always grow itself out of trouble.

“That is no longer the case,” he maintained. Not only could ship-emissions regulations hit profitability but “there is a general expectation that global oil demand — and its transportation — will likely peak within the next 10-20 years.

“For a shipowner, that is not a strong incentive to invest in an asset that has a 25-year life, especially if, as in the case of a VLCC, it is 28% more expensive than last year and you won’t get it delivered for at least another two years.”

Thus, owners who are bullish on the short and medium term are focused instead on buying existing secondhand tanker tonnage. “A secondhand tanker is cheaper and can be employed in the rising market immediately,” said Broekhuizen.

Frontline results

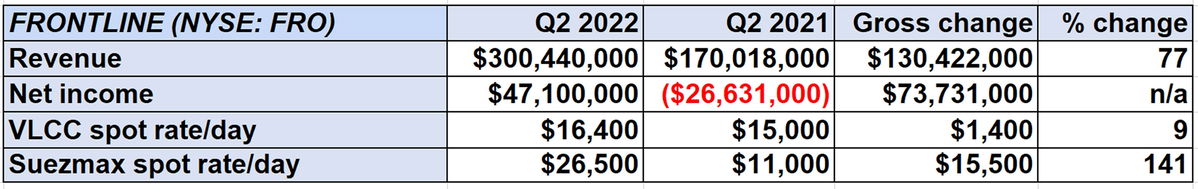

That rising market — after over a year in a rate depression — was apparent in Frontline’s latest results. “VLCCs got a pulse as the second quarter came to an end,” said Barstad.

The company’s VLCCs averaged just $16,400 per day in the second quarter. In the third quarter, 73% of its VLCC days have been booked at an average rate of $28,100 per day. Frontline’s Suezmaxes averaged $26,500 per day in the second quarter. In the third quarter, 73% of available Suezmax days have been booked at $45,000 per day.

Frontline reported net income of $47.1 million in Q2 2022 compared to a net loss of $26.6 million in Q1 2022. Adjusted earnings per share came in at 24 cents, below the consensus estimate of 30 cents.

Click for more articles by Greg Miller

Related articles:

- Tanker shipping stocks pull away from the pack, hitting fresh highs

- War effect on crude trade: Long-lasting and just beginning

- US exports of crude oil and diesel are climbing even higher

- In topsy-turvy commodity trades, small ships outperform big ships

- $4.2B shipping ‘mega-merger’ would create ‘supersized tanker behemoth’