Holiday demand stresses an already tight market

In the past 27 years, since the passage of the Andean Trade Preference Act of 1991, the amount of cut flowers grown in the United States has fallen 95%. Today we import the vast majority of flowers for bouquets from two countries, Colombia and Ecuador. The flowers are flown into the Miami International Airport on 747s and loaded onto refrigerated trucks, which are often driven by teams to get the valuable, temperature-sensitive cargo into stores as quickly as possible.

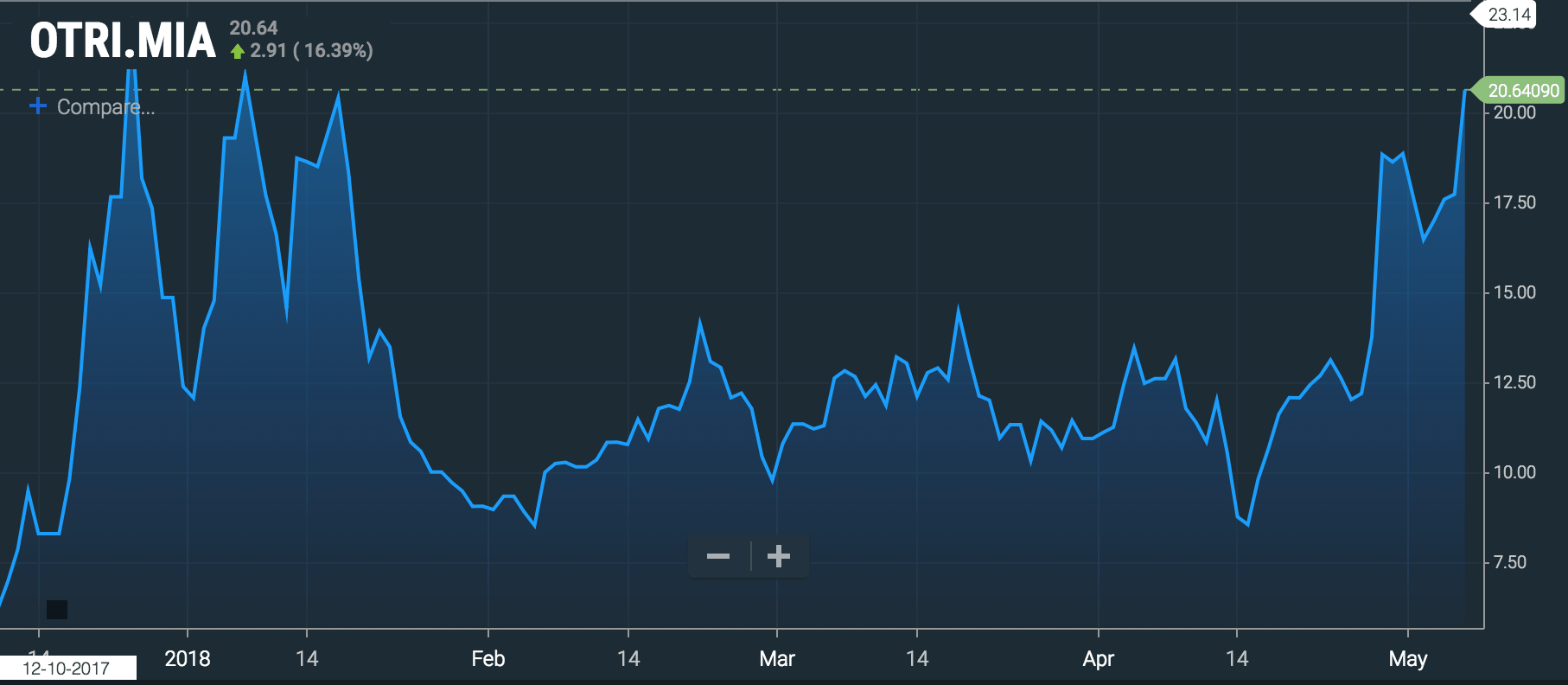

Now, in the week leading up to Mother’s Day, demand for reefer trucks out of Miami is spiking. DAT’s RateView tool shows that while reefer spot rates from Miami to Atlanta averaged $1.77 per mile in March and $2.04 in April, over the past seven days, reefers are taking in an average of $3.11 per mile. That’s a massive spike of 52%. The top quartile got in excess of $3.89 per mile in the past seven days on the Miami to Atlanta lane.

Dry van rates, on the other hand, are quiet. Dry vans leaving Miami for Atlanta averaged $1.05 per mile in March, $1.13 in April, and have increased modestly to $1.24 over the past seven days.

FreightWaves’ Tender Rejection Index (TRI) provides additional context for the high reefer spot rates. Outbound TRI from Miami has surged from about 8.5% of tendered loads being rejected in mid-April to more than 20% today. Right now Miami is an absolute feeding frenzy for reefer carriers, who get to pick and choose the best loads, driving spot rates even higher.

In March, the USDA released its “Agricultural Refrigerated Truck Quarterly”, and it shows that capacity in the national reefer market was already very tight. In the fourth quarter of 2017, refrigerated trucks moved 7.72M tons of fruit and vegetables, the third highest quarterly figure on record.

“After the December 18th ELD deadline,” the report says, “the majority of districts reported a switch from having adequate truck capacity to a slight shortage, and reported truck rates increased from many districts across California, Florida, and at U.S.-Mexico border crossings. In addition, the average rates during the 4th quarter of 2017, on many origin-destination routes, set either all-time quarterly records or 4th-quarter only records.”

Record agriculture-driven demand for reefers has created a very inelastic market, where relatively small changes in demand can cause wide swings in price. We think that’s what happening in Miami now. Mother’s Day in 2017 didn’t see nearly the size of the spot rate increase that this year brought, but capacity was much easier to find in the first half of 2017 than it has been since. The final push of agricultural exports from the South American fall harvest also flows through Miami and is also helping keep capacity tight in the region.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.