On a call with analysts Friday, management from Forward Air (NASDAQ: FWRD) laid out some margin targets after posting a first-quarter earnings beat and issuing guidance well ahead of expectations.

Thursday after the close, the Greeneville, Tennessee-based asset-light trucking and logistics company reported net income from continuing operations of 60 cents per share, which was 3 cents ahead of consensus and 19 cents better year-over-year.

Continuing operations exclude the high-frequency pool distribution segment, which was sold in February.

Outlook moves higher

The outlook for the second quarter came in notably higher than analysts’ expectations. Revenue is expected to increase between 35% and 40% year-over-year, implying $387 million at the midpoint compared to the consensus estimate of $349 million. Earnings per share were forecast to a range of 96 cents to $1 compared to consensus of 79 cents.

Behind the bullish outlook is the company’s “strongest March ever,” according to Tom Schmitt, chairman, president and CEO.

Schmitt said Forward saw March tonnage increase 32.6% year-over-year in its expedited freight segment with less-than-truckload recording a 15.6% operating margin. The tonnage comp was easy as it includes a freight falloff in the second half of March 2020 when COVID-related shutdowns widened.

However, tonnage was 10.8% higher than March 2018, a big year for the industry.

Further, April has not seen a letup from March as tonnage was up 56% compared to April 2020, albeit another easy comp. Schmitt said Forward has experienced several high-volume days recently that have “never been seen before” by the company, referring to the current market as “boom times right now.”

Schmitt summed up the month saying, “I love our April.”

Margins to move higher sooner than later

Schmitt believes the company has reached an inflection point in operations following several acquisitions over the last couple years, notably in the final-mile and intermodal markets, as well as the addition of LTL locations. LTL service is now run out of more than 100 locations currently with the expectation that at least 10 facilities will be added annually over the next three years.

Some investors have been concerned with expansion beyond the company’s traditional core airport-to-airport LTL offering but Schmitt believes management has a handle on the company’s past acquisitions and that operational improvement is on the horizon.

In LTL, the company inherited some ship-from-anywhere-to-anywhere business through acquisition that has been a drag on margins and the ire of investors. Schmitt said growing scale in the business resulted in taking on freight that wasn’t appropriately priced for its level of complexity. The current capacity tightness is allowing those yields to be brought up to acceptable levels.

The company’s recent general rate increase of 6% has been accepted by customers without any pushback. Adding in increases in accessorials and general yield improvement efforts, the company is seeing double-digit type rate renewals.

He said the company’s core LTL business can still generate margins of 18% to 19% and its newer LTL business can reach 12% to 13% margins. The all-in LTL operating margin is expected to be 15% to 16%. The other offerings in the expedited division – truckload and final mile – are expected to produce high-single-digit margins.

Intermodal is forecast to produce double-digit revenue growth and double-digit margins, a “double-double,” Schmitt said, and a level the segment achieved in March.

He said the company’s consolidated operations will produce close to a double-double during the second quarter, which is a jump from the 6.3% operating margin produced in the first quarter. The goal is to beat the recent high of $164 million in earnings before interest, taxes, depreciation and amortization set in 2018.

First-quarter results

The first-quarter result included 20 cents per share in expenses related to cybersecurity and shareholder engagement, following a cyberattack at the end of 2020 and a proxy battle with an activist investor. Severe winter weather was called out as a 6-cent-per-share hit to the quarter as well.

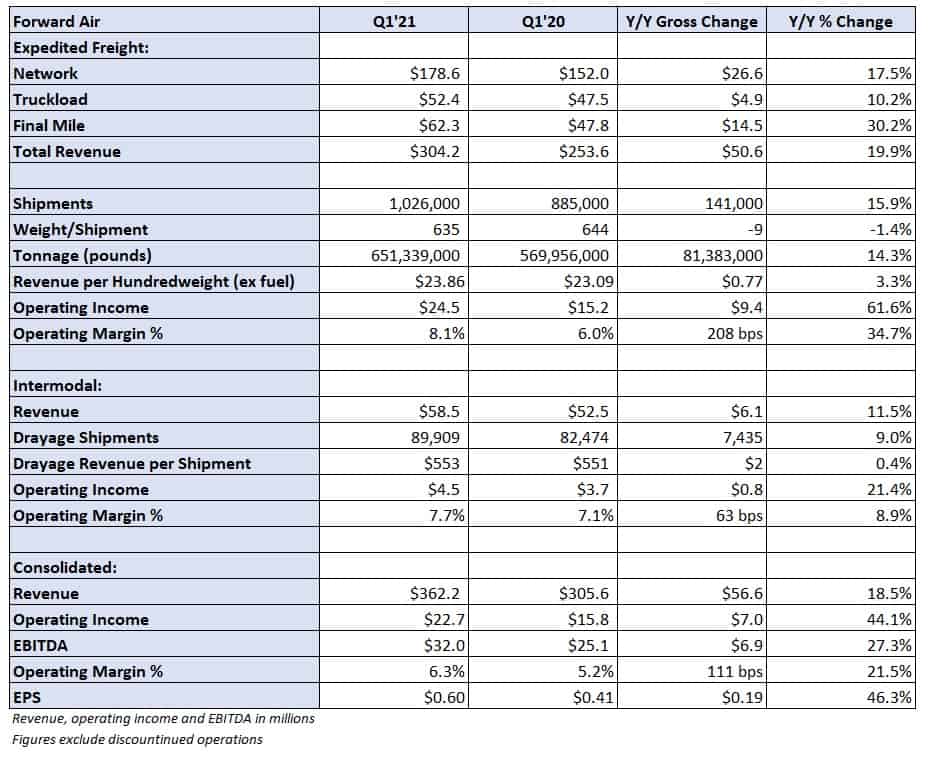

Expedited freight revenue increased 19.9% year-over-year to $304 million as tonnage jumped 14.3% and revenue per hundredweight excluding fuel surcharges was 3.3% higher. The division recorded 210 basis points of margin improvement posting an 8.1% operating margin.

Purchased transportation expense as a percentage of revenue increased 170 bps, but all other expense lines declined, including salaries, wages and benefits, which was down 160 bps.

Intermodal revenue was up 11.5% year-over-year to $59 million as drayage shipments increased 9% and revenue per shipment was flat. The division’s operating margin improved 60 bps to 7.7%.

和田 翔

突然のご連絡大変失礼いたします。 御社HPを拝見し、ご連絡させていただきました。 株式会社OneTechnology Japanの和田と申します。 弊社は≪ベトナムオフショア開発≫で貴社のAR・VR開発を提案いたします。 ベトナムオフショアと言っても完全日本語で対応可能です。 《弊社紹介ホームページ》 https://onetech.jp/ 2015年よりAR/VRソフトウェア開発、UNITY開発、MRホロレンズアプリ開発、IoTアプリ開発、3DCG制作に取り組んでおります。 昨今の情勢によりテレワーク化に伴いVR会議やVR研修などでよりリアルに近いコミュニケーション体験の需要も高まっております。 2017年より取り組んでおりますホロレンズMRアプリ開発では、遠隔支援、ARマニュアル表示、IoT連携などで業務支援として非常に高い評価もいただきました。 是非とも、弊社の直近の開発実績を紹介させていただくお時間をいただけないでしょうか。 ———————————————————————- ●ONETECH開発実績のご紹介 ■AR・VR・MR開発 建設・保守:点検業務をサポートするHoloLens2アプリ 飲食チェーン:VR従業員トレーニングアプリ 物流:デジタル模型(3DCG)をシェアHololensアプリ 製造業:VR_安全教育・訓練・危険体験アプリ ■スマホアプリ開発 教育:文化体験鑑賞ガイドアプリ 飲食チェーン:店舗向けポイントCRMアプリ 医療機器:クリニック向け_動画マニュアル作成・運用アプリ ■CG制作 ゲーム会社:ファイナルファンタジー7背景制作 自動車メーカー:自動車CG制作 販売:ARショッピング体験アプリ_3Dアバター制作 ■業務システム開発・マイグレーション 運送業:会員管理システム 製造業:生産管理システム 広告業:給与勤怠管理システム エンタメ:音楽系アーティスト公式_ファンクラブ管理システム開発 製造業:生産管理システム WIN 10対応 そのほかの実績はこちら https://onetech.jp/works/ —————————————————————————— ●ONETECHの特徴 ■2015年から60社、300案件以上の納品実績がございます。 ■取引開始から納品、保守運用まで完全日本語で対応します。 ■1週間ほどの簡単な案件から20人月以上の大規模案件にも対応可能です。 ■受託開発、ラボ開発、オンサイトなど柔軟に対応いたします —————————————————————————— ●オンラインセミナーのご案内 ■オフショアでAR・VRを開発 3月下旬開催予定 実績やプロダクトをデモンストレーション形式で紹介 ご興味いただきましたセミナーがありましたらお気軽にお問合せください。 問い合わせ先:wada@onetech.jp(和田) —————————————————————————————– ONETECHのホームページ https://onetech.jp今後のご案内を希望されない場合は、大変お手数ですが、こちらのリンクより配信停止のお手続きをお願いいたします。https://amt.onetech.jp/unsubs.html?id=787178847973