The world does not have enough containers in the right places to handle cargo demand. It’s a conundrum that has persisted for so long that the mainstream press is finally covering it.

The New York Times reported Friday how the box shortfall is contributing to inflation: “Demand … has outstripped the availability of containers,” while the U.S. pandemic situation has eased to the point where retailers can pass along higher transport costs to consumers without being accused of price gouging — and “the cost of just about everything is rising.”

Many months after the container shortage first emerged, how bad does the problem remain?

Equipment leasing companies are in a good position to answer that. These companies order containers from the very small number of Chinese manufacturers that build them and lease the boxes to shipping lines, which also order from factories directly.

Two of the top public leasing companies — Triton International (NYSE: TRTN) and CAI International (NYSE: CAI) — commented on container availability as they reported Q1 2021 results on Thursday.

Generally speaking, the more profitable the market conditions for container lessors, the tighter box capacity is and the more cargo shippers must pay liners for transport. The bad news for U.S. importers and exporters: Equipment lessors see smooth sailing ahead, likely into 2022.

“There’s no indication from the shipping companies that they expect to see any easing of the tightness of supply that they’re dealing with,” said Tim Page, interim CEO of CAI International, on the call with analysts. “So … the horizon looks pretty good for us, at minimum through the end of this year, and likely well beyond that.”

Still only 2-3 weeks of supply

Three Chinese companies — CIMC, DFIC and CXIC — produce around 80% of the world’s containers. Production is up sharply, with estimates for 6%-8% growth in container capacity this year. But even so, boxes aren’t being built fast enough to ease the capacity crunch.

John O’Callaghan, global head of marketing and operations at Triton, said during his company’s call, “Despite the factories ramping up container production activity at the end of last year and beginning of this year, inventories of new containers remain very low. What’s sitting on the ground roughly represents only two to three weeks’ supply.”

The price of containers is an indication of ongoing scarcity. The price for a new container is now $3,500 per cost equivalent unit (CEU, a measure of the value of a container as a multiple of a 20-foot dry cargo unit) versus $1,800 per CEU in early 2020 and $2,500 per CEU in late 2020. The cost has remained roughly steady at $3,500 per CEU for the past three months.

Recent price gains have been more extreme in the used container market. Container xChange reported that the price of used containers in China has nearly doubled from $1,299 per CEU in November to $2,521 in March.

According to O’Callaghan, “The shortage of available sale containers leads to prices increasing week-on-week as the inventory has been depleted.”

Why new boxes are still falling short

This year’s rise in production comes after a period when orders were below market replacement requirements. According to Triton CEO Brian Sondey, “A lot of the container production that’s happened this year, to some extent, is making up for low production volumes in 2019 and the first part of 2020.” Added O’Callaghan, “We’re still playing catch-up.”

Another reason containers are not more plentiful, according to Page, is that the Chinese factories are not expanding production capacity. “There’s no indication from manufacturers that they’re going to increase container production,” he said.

Asked why a leasing player could not go for market share and push down prices, Page responded, “Absent a complete shift in behavior from the container manufacturers — and no one seems to think that’s likely — it would take them [manufacturers] to be willing to produce containers and go after market share, to produce containers well in excess of the demand, for there to even be the opportunity for somebody [in the leasing space] to have an excess of containers and push the market on price.”

In other words, Chinese factories are keeping production in check to keep their newbuild prices high. This negates the hope on the cargo-shipper side that the market might be flooded with excess new containers, thereby bringing freight rates down.

When could container crunch ease?

Relief from container scarcity is not just about production. Many containers have been held up in port congestion and by issues such as the Ever Given accident in the Suez Canal. When such logjams clear, more containers will become available.

According to Sondey, the slowdown of the “velocity of containers” by disruptions began with COVID lockdowns in early 2020, followed by “the flood of containers overwhelming the ability of the ports to move containers in and out” starting later in 2020, followed by “the icing on the cake: the blockage of the Suez Canal.”

Page reported an unusual situation now occurring at destination ports for Chinese cargo. Ships are in such a hurry to turn around that they’re “being forced to leave empty containers behind when they return to China,” he said.

“Several of our major customers report that virtually every ship leaving China and other export areas is fully loaded but because of the tight sailing schedules and the need to turn ships quickly, they are unable to wait for all the empty containers and they leave with 5%-8% fewer containers on the [backhaul] leg than they were on the [fronthaul] leg.”

Sondey said, “What we hear is that most customers [liners] don’t think these bottlenecks are going to evaporate quickly. But they also don’t think they’re necessarily permanent … [and] no doubt, as bottlenecks ease, that could free up container capacity.

“So, we’re all trying to figure out what this transition process will look like. I haven’t seen any of our customers express confidence that they can, within this current strong period, unbottleneck their operations. Our general view is it likely continues until trade slows. And who knows exactly when that’s going to be. But I think the betting is probably sometime at the end of this year or early next year when maybe the trade world starts to get back to normal.”

Equipment lessors top expectations

The stocks of the three leading public equipment lessors — Triton, Textainer (NYSE: TGH) and CAI — have risen strongly over the past year, although gains topped out in mid- to late-March and have pulled back recently.

On Thursday, Triton reported net income of $129.3 million for Q1 2021 compared to $67.2 million in Q1 2020. Adjusted earnings per share (EPS) of $1.91 topped the consensus estimate for $1.74.

After the results were released, Keefe, Bruyette & Woods (KBW) upped its full-year EPS estimate to $8 from $7.25 and B Riley Securities hiked its full-year EPS estimate to $8.26 from $7.04.

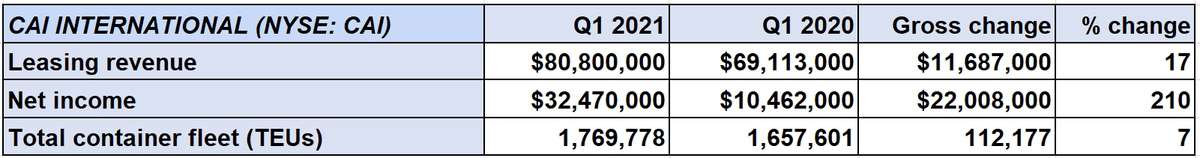

CAI reported net income of $32.47 million for Q1 2021 compared to $10.46 million in Q1 2020. Adjusted net earnings per share of $1.85 beat the consensus forecast for $1.76.

KBW increased its full-year EPS for CAI to $7.75 from $7.30 and B Riley increased its own to $8.02 from $7.21.

Click for more articles by Greg Miller

Related articles:

- Flexport: Trans-Pacific deteriorating, brace for shipping ‘tsunami’

- ‘March madness’ at LA port amid ‘once in a lifetime’ surge

- Demand boom on collision course with ocean transport ceiling

- ZIM: US importers buckle, sign contracts early, pay 50% more

- Deutsche Bank on import bonanza: ‘You ain’t seen nothing yet’

- Ocean carriers hold all the cards in contract talks with shippers

Niels Erich

Three words to consider, in terms of supply chain efficiency, export promotion and national security: Defense Production Act. Three more words: inland gray pools. Three more words: AgTC-USDA pilot. How to pay for it: infrastructure, infrastructure, infrastructure.