Schneider beat first-quarter expectations Thursday and raised its full-year outlook citing favorable contractual rate negotiations, which account for the bulk of its revenue.

The company posted adjusted earnings per share of 57 cents, which was 3 cents ahead of the consensus estimate and 26 cents higher year-over-year. It also raised its full-year EPS outlook to a range of $2.55 to $2.70 (from $2.35 to $2.55), compared to the consensus estimate of $2.53 at the time of the print.

“When we look at demand it’s quite healthy across the contract side,” Mark Rourke, CEO and president, commented on a call with analysts.

He said the company worked through nearly 40% of 2022 contract renewals in the first quarter and the outcomes were good. “We are seeing share gain and very healthy improvement in price with recognition towards the inflationary cost around the driver [and] around equipment,” Rourke said. “We think the market is still very responsive to that.”

Schneider’s (NYSE: SNDR) offering is different than a good deal of the broader truckload market in that it extensively utilizes trailer pools, which provide shippers with flexibility and efficiency gains.

The first-quarter EPS result excluded a $50.9 million gain on a property sale and a $5.2 million assessment related to an “adverse state tax audit” that it plans to appeal. The adjusted result also excluded a $59 million “adverse court ruling” involving litigation with the former owners of Watkins and Shepard Trucking, which Schneider acquired in 2016. The dispute centered on an earnout provision tied to that transaction.

Q1 highlights

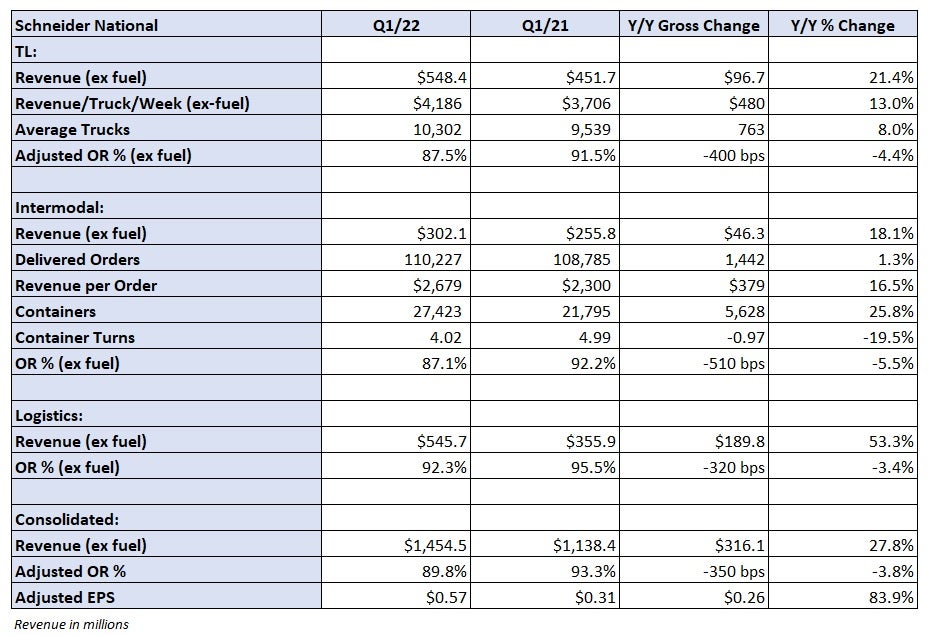

Average revenue per truck per week excluding fuel increased 13% year-over-year to $4,186. The percentage increase was almost 2-to-1 higher in the network segment (+19%) versus the dedicated unit (+10%). Improvements in the revenue metric and operating 8% more trucks in the quarter drove revenue 21% higher to $548 million.

The period included the acquisition of dedicated carrier Midwest Logistics Systems, which added 900 tractors and 1,000 drivers. The fleet generates roughly $200 million in annual revenue, operating at a high 80% operating ratio.

Backing out the gain from the property sale, the TL OR was 87.5%, 400 bps better year-over-year.

Schneider will continue to add “several hundred trucks” each quarter in its dedicated unit as the year progresses. Excluding the dedicated acquisition, more than 300 units were added from the fourth quarter to the first. In total, the unit count was nearly 1,600 higher year-over-year.

Gains on sale were “immaterial” in the period. The carrier expects to book only $45 million in gains on the sale of tractors and trailers in 2022 compared to $64 million last year. As delivery manufacturer schedules have been delayed, Schneider has opted to run some equipment longer to accomplish its growth initiatives. Both the lower gains on sales and expectation for modestly higher maintenance costs have been baked into guidance.

The company’s 2022 capital expenditures budget was raised by $50 million to $500 million to reflect higher purchase costs of equipment as well as incremental trailer buying.

Intermodal revenue increased 18% year-over-year to $302 million. The bulk of the increase was tied to higher yields. Containers in service were 26% higher in the quarter and the company expects to hold that growth rate for the rest of the year as Schneider executes on its goal to double the business by 2030.

The division recorded an 87.1% OR in the period, 510 bps better year-over-year. Higher rates drove the improvement, which was partially offset by higher capacity costs. Container turns were down 20% year-over-year to just north of four times per quarter.

Logistics revenue was up 53% year-over-year to $546 million due to higher revenue per load and a 24% increase in brokerage volume. The division posted a 92.3% OR, 320 bps better than the year-ago quarter.

Management was pressed by analysts throughout the call regarding the sustainability of contractual rate increases in the back half of the year given the gains recorded in the second half of 2021.

“We don’t feel that we are going to be in a net negative price area relative to the inflation,” Rourke said. “We’ve been nothing but encouraged based upon the first quarter of the year and how those things progressed.”

Click for more FreightWaves articles by Todd Maiden.

- Forward Air to hit 2023 EPS target a year early

- Old Dominion could see sub-70% OR in Q2

- GTI Transport Solutions acquires container transport provider Foxconn Logistics