Schneider National (NYSE: SNDR) expects 2021 to be a year of investment throughout the enterprise. The company provided some goalposts for what those investments will look like on a conference call with analysts Wednesday.

The Green Bay, Wisconsin-based truckload carrier reported adjusted fourth-quarter earnings per share of 44 cents before the market open, 5 cents ahead of consensus. Strong results in TL and brokerage drove the improvement.

Full-year 2021 adjusted EPS guidance of $1.45 to $1.60, bracketing the current consensus estimate of $1.55, was also issued.

2021 a year of investment

Management said capital allocation plans for the year include mostly investments in the network, following a $2-per-share special dividend paid last year. Schneider ended 2020 with a cash balance of $396 million, a reduction of more than $150 million year-over-year. However, the reduction included the payment of the $355 million special dividend.

Total net capital expenditures for 2021 will be approximately $425 million, significantly higher than the $237 million spent in 2020. The decline was the result of liquidity preservation efforts implemented early on in the pandemic.

The bulk of the investment is slated for fleet replacement to lower the average age of its trucks, which has climbed to slightly more than 30 months. The goal is to get back to an average of 24 months. The company is also eyeing additional investments in the dedicated and intermodal segments along with an investment in trailers.

The average truck count declined almost 600 units year-over-year and was down almost 300 units from the third quarter. The company’s network division, or one-way segment, saw a 365-unit drop from the third quarter to 5,743 trucks. Management noted the loss of team drivers and owner-operators during the quarter as some of its contractors opted for higher rates in the spot market.

The company plans to get the network segment back to 6,000 trucks by peak season and add several hundred units to its dedicated segment. Recent pay increases and other driver investments are expected to help bridge the gap. Management believes that current price increases are coming in high enough to stabilize the driver environment and allow for margin expansion.

Schneider is expected to see only a modest build in its cash position during 2021 as capex ramps higher. Management said the current quarterly dividend, 13 cents per share, and possibly share repurchases are likely the only means of returning cash to shareholders this year.

Fourth-quarter results and expectations

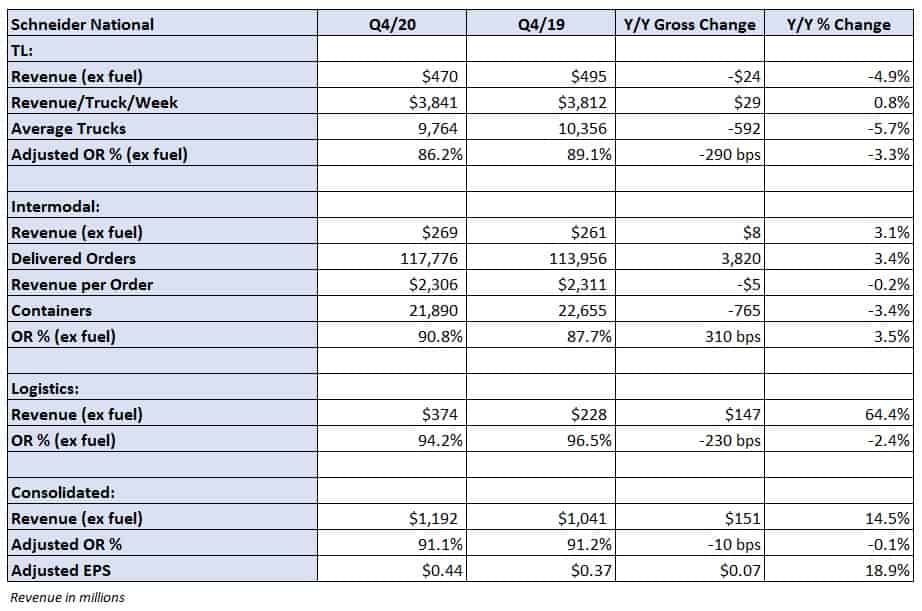

Consolidated revenue was 15% higher year-over-year, excluding fuel surcharges, at $1.19 billion.

The TL segment reported a 5% year-over-year decline in revenue, excluding fuel, due to the dip in average truck count, which was only partially offset by a 1% increase in revenue per truck. The adjusted operating ratio came in at 86.2%, 290 basis points better year-over-year excluding the year-ago impact of the shuttered first- to final-mile segment.

The quarter benefited from more project and spot freight opportunities and the carrier was successful taking yields higher. Management called out off-cycle bid activity and said more than 40% of its network business had been rerated. A $20 million reduction in insurance expense, the result of a sustained period of lower accident frequency and claims, was offset by an increase in incentive-based compensation.

Moving forward, margin expansion in the company’s asset-based modes is expected to occur as rates move higher and more than offset driver wage inflation.

Intermodal loads were up 3% year-over-year, lagging intermodal volumes on the Class I railroads, which were up approximately 11% during the quarter. Revenue per load was flat as the volume mix shifted to include lower lengths of haul on the East Coast. Lost revenue opportunities and higher costs were the result of continued congestion on the railroads.

Management said the intermodal division has the most upside to 2021 guidance. The year-over-year comparisons will likely prove easy as the backlog of containers at the ports and in the network eases as the year moves forward. Management noted “less than ideal” conditions will continue for a while longer but that a strong second half for intermodal is expected.

Logistics revenue increased 64% year-over-year on higher brokerage volumes and an undisclosed increase in revenue per order. The increase in demand for power-only brokerage services, which leverages Schneider’s large trailer pool, was also attributed with driving the growth. The segment increased its spot exposure, which led to OR improvement of 230 basis points to 94.2%.

Shares of SNDR were down 1% in midday trading Wednesday compared to the S&P 500, which was up 0.5% on the day.