Temperature-controlled warehouse operator Americold Realty Trust (NYSE: COLD) sees a healthy demand environment for cold storage continuing.

During its fourth-quarter 2019 earnings conference call, the Atlanta-based real estate investment trust’s (REIT) management team said it expects new facility development starts to be in the range of $75 million to $200 million during 2020. The company’s total project pipeline stands at $1.2 billion.

Further, management expects same-store warehouse revenue to increase 2-4% year-over-year in 2020 as there are “lots of occupancy opportunities” in their core markets, especially during peak produce seasons.

Management expects a continuation of the “strong” demand environment for temperature-controlled warehousing as consumption and population growth remain steady. Additionally, management said consumer preference continues to favor fresh and healthy food options that require cold storage.

Americold reported fourth-quarter 2019 core funds from operations (FFO) of 33 cents per share, 2 cents below analysts’ expectations.

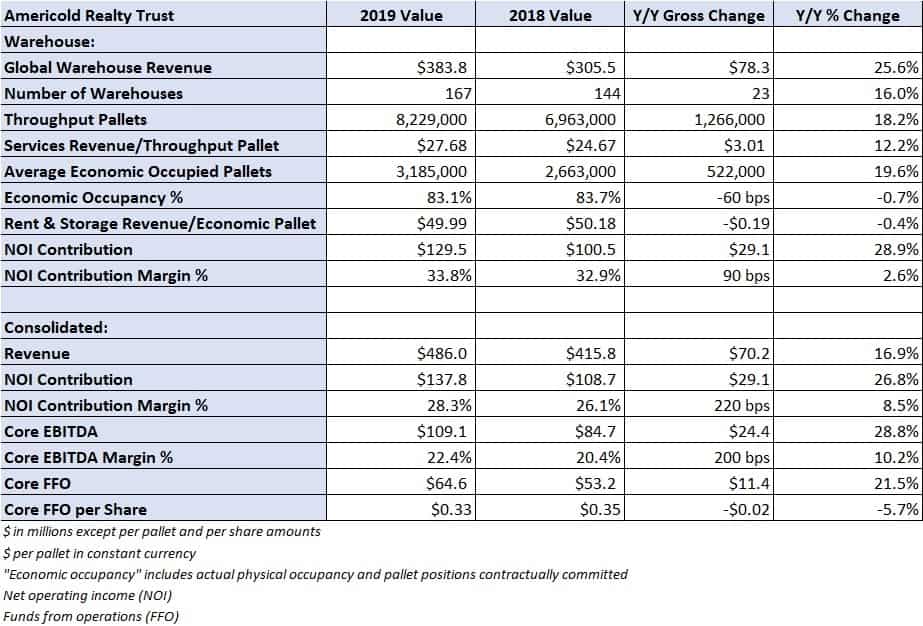

In the fourth quarter, Americold reported a 26% year-over-year increase in global warehouse revenue at $384 million. The average number of economic occupied pallets, or the total pallet space actually physically occupied or committed to its customers under contract, grew 20% to 3.2 million pallet positions. The occupancy rate of these pallets declined 60 basis points to 83.1% with revenue per pallet declining 19 cents to $49.99. Net operating income (NOI) contribution from the warehouse segment increased 29% to $130 million.

The bulk of the company’s growth came from prior acquisitions as warehouse revenue on a same-store comparison was slightly more than 3% year-over-year.

Americold made some large purchases in 2019. In May, the company acquired Cloverleaf Cold Storage in a $1.25 billion deal and announced an agreement to purchase Canadian-based cold storage facility operator Nova Cold Logistics in November for a little more than $250 million. That deal closed on Jan. 2.

In January, the company purchased an Upper Midwest temperature-controlled facility operator, Newport Cold Storage, for $56 million. In conjunction with Thursday’s financial report, Americold announced a 15% joint venture investment, $28 million, in SuperFrio Armazéns Gerais, a temperature-controlled storage operator in Brazil. SuperFrio operates 16 facilities with a combined total of 35 million cubic feet of refrigerated storage space.

Americold ended the year with $1.9 billion in total debt, $1.7 billion of which is real estate-related. The company’s primary debt leverage ratio — net debt to expected core earnings before interest, taxes, depreciation and amortization (EBITDA) including recent acquisitions — stood at 4.2x, slightly up from the end of the third quarter level of 4.1x.

The company ended 2019 with $1.4 billion in liquidity to pursue future acquisitions and facility projects.

For 2020, management’s guidance calls for adjusted FFO of $1.22-$1.30, compared to the current consensus estimate of $1.33 and the $1.17-per-share result it reported for full-year 2019.

Americold Realty Trust’s real estate portfolio includes 178 temperature-controlled facilities, including 11 facilities in its third-party managed segment, with more than 1 billion refrigerated cubic feet of storage in the United States, Australia, New Zealand, Canada and Argentina.

ankara seo uzmanı

Hello; you have opened a very successful topic. That’s very good that the people getting awareness via your page.

I have been following your page for a long time and I find it really useful. I am very happy to read the text of valuable people like you. I wish you continued success. Yours truly.

Noble1 suggests SMART truck drivers should UNITE & collectively cut out the middlemen from picking truck driver pockets ! UNITE , CONQUER , & YOU'LL PROSPER ! IMHO

Americold Reality Trust(COLD) Stock takes a DIVE on an open gap down today !

Market cap lost 10% during the course of the day retesting the 50 weekly moving average . Currently approx. -6.75% on the day and approx. -8.5% for the week .

Ethan Josh

Great Work!

Noble1 suggests SMART truck drivers should UNITE & collectively cut out the middlemen from picking truck driver pockets ! UNITE , CONQUER , & YOU'LL PROSPER ! IMHO

Of course it’s strong(solid) ! They are a consumer staple ! They are in a business that caters to an essential necessity ! FOOD ! Particularly in “food preservation” through temperature controlled cold storage . They also own their own fleet .

However , that doesn’t imply that their stock price won’t fluctuate . This can be seen in late October 2019 on a weekly chart . The uptrend from its IPO date peaked and snapped by 20% down to find support at its 50 weekly moving average and bounced back from there to a precise ratio and has pulled back from there recently .

Americold also owns and operates a marble quarry in Carthage Underground .

Their Canadian competitor is as well !

Quote :

“VersaCold is jointly owned by Toronto-based private equity firm KingSett Capital and Quebec-based investor Ivanhoé Cambridge.

Ivanhoé Cambridge is a subsidiary of the Caisse de dépôt et placement du Québec, one of Canada’s biggest institutional fund managers”

In 2010, Americold acquired Versacold to become the largest temperature-controlled warehousing and distribution services provider in the world .

End quote .

Americold actually acquired VersaCold’s international operations and one Canadian subsidiary due to VersaCold wanting to focus on their Canadian operations . VersaCold is still owned by the two firms quoted above .

Quote :

“In 2010, we sold our offshore operations and returned to our Canadian roots, using our global knowledge and experience to help our North American clients navigate and improve their increasingly complex supply chains. ”

Quote:

“VersaCold cements food-distribution dominance with CPX acquisition

Canada’s largest cold storage and transport company has bulked up with an acquisition that will boost its revenue by 40 per cent and make it a bigger player in fresh food distribution.

Vancouver-based VersaCold Logistics Services signed a deal to buy Coastal Pacific Xpress, a trucking company based in the Vancouver suburb of Surrey. Both firms are privately owned.

VersaCold would not reveal the purchase price, chief executive officer Douglas Harrison said the deal will increase his firm’s annual revenue by $150-million to about $500-million, cementing its position as the biggest player in a fragmented cold storage and logistics business worth about $12-billion in Canada.

VersaCold has primarily focused on warehousing and transport of frozen foods, Mr. Harrison said, while CPX has more expertise in moving time-sensitive fresh foods, an increasingly important business as consumer tastes evolve toward a greater interest in high-end, non-frozen products.

CPX also has significant cross-border business in the United States, which will complement VersaCold’s mainly east-west trucking operations, which extend from British Columbia to Newfoundland.

VersaCold was once mainly in refrigerated warehousing, but is intent on continuing its transformation to a broader operation that includes transport and third-party logistics services and back-room supply-chain management, Mr. Harrison said. It even does some food processing and packaging for clients.

End quotes .

The beauty of these businesses catering to essential needs is that THEY ALL DEPEND ON TRUCK DRIVERS !

But truck drivers are to busy arguing about ELD’s & parking space rather than FOCUSING ON UNITING , strategically structuring themselves, and taking control of this industry !

IMHO !