Could today’s unprecedented boom in containerized imports just keep going year-round? Right through Chinese New Year in February? Through the second quarter, then the fall peak — and all the way into 2022? Could the already overwhelmed global trade network stay stuck at its ceiling until next year?

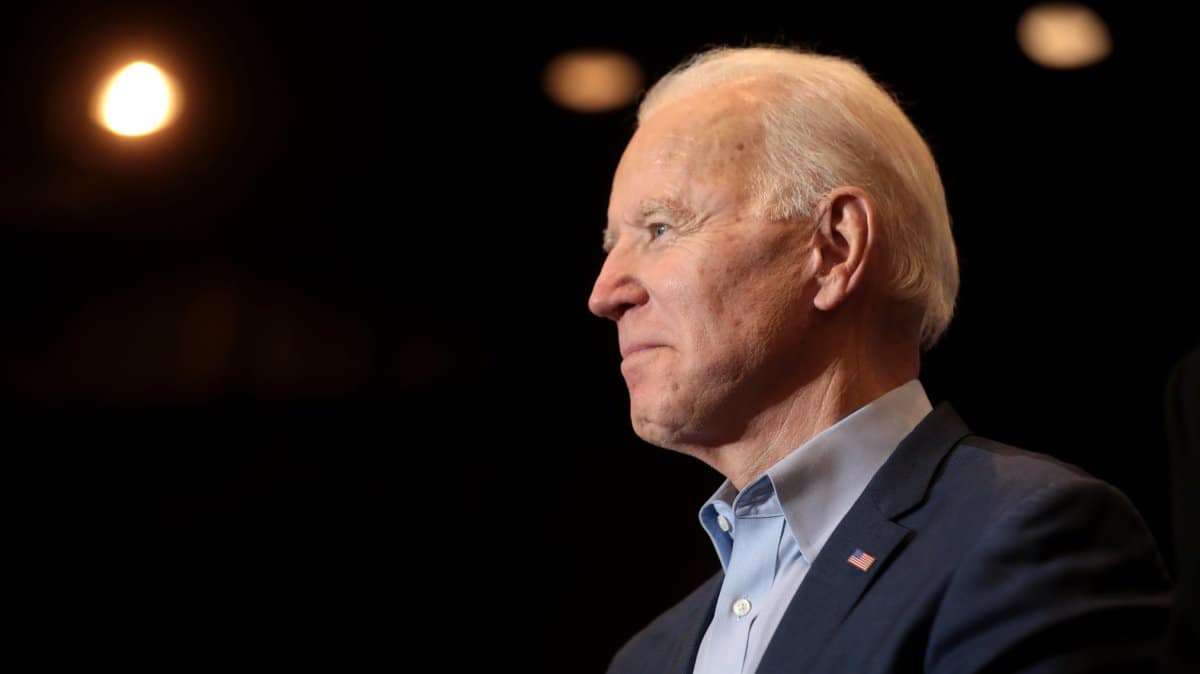

With COVID hospitalizations at record highs, almost 4,000 U.S. deaths per day and vaccine distribution slow out of the gate, a full-year boom scenario may sound implausible. But it just got more likely, courtesy of this week’s two Democratic Senate wins.

The “blue wave” political scenario is now a reality. And with it, the likelihood of much higher stimulus. That, in turn, would support much higher consumer spending — and imports — just as stimulus did in the second half of last year.

Jefferies: $1 trillion more in stimulus

According to Jefferies Chief Economist Aneta Markowska, “What seemed like an outside probability just a few weeks ago looks increasingly likely to become reality.”

With Democrats to control both the House and Senate, President-elect Joe Biden’s agenda “is back in play, which means even more fiscal expansion in the near term,” she said.

On top of the just-passed $900 billion lame-duck package, Jefferies now foresees another $900 billion to $1 trillion in stimulus.

“Although the funds will be distributed fairly quickly, we expect a big chunk to be saved and spent gradually,” said Markowska.

In light of new stimulus, Jefferies just upgraded its 2021 GDP growth outlook from 5.2% to 6.4%. It raised its 2022 outlook from 3.8% to 4.7%.

Evercore ISI: $2 trillion in stimulus

Evercore ISI Policy Economist Ernie Tedeschi predicted that the Democratic victories in the Georgia runoff “will have profound implications for fiscal policy.”

The investment bank sees two rounds of stimulus ahead. The first would be a $1 trillion-$1.5 trillion package in Q1 2020 adding an extra $1,400 per adult payout on top of the $600 checks in the lame-duck package; plus state and local government aid and more unemployment insurance extensions.

The second, which Evercore ISI foresees in Q2 2021, would be a longer-term infrastructure package totalling around $1 trillion.

In a separate research note, the Evercore ISI policy strategy team wrote, “With Biden’s presidential election certified by Congress and the Democrats surprisingly sweeping the Georgia Senate races … [additional stimulus] has the potential to significantly increase spending.

“Even without the stimulus, the significant increase in the savings rate at the same time retail sales had already returned to pre-COVID levels suggested a consumer boom was possible as the economy normalized,” said the policy team.

The new stimulus will add even more fuel to the fire.

The Evercore ISI policy team concluded: “Additional checks will reach consumers at a time when unemployment is lower [than during the 2020 stimulus round], mobility has significantly improved, the overall willingness to spend of the general public is up significantly, confidence levels are higher, housing is strong and the savings rate is still extremely high. That is a set-up for a consumer boom in the second half of 2021.”

Container network already maxed out

“All the ships that can sail are out at sea and all the containers that can hold cargo are in use,” said Vincent Clerc, head of ocean transport at Maersk, at a briefing on Wednesday, according to Bloomberg.

“We hadn’t foreseen just how COVID would change consumer patterns,” Clerc said, explaining the surprise container boom. “People use a much, much higher portion of their wages on goods [versus services],” Clerc added.

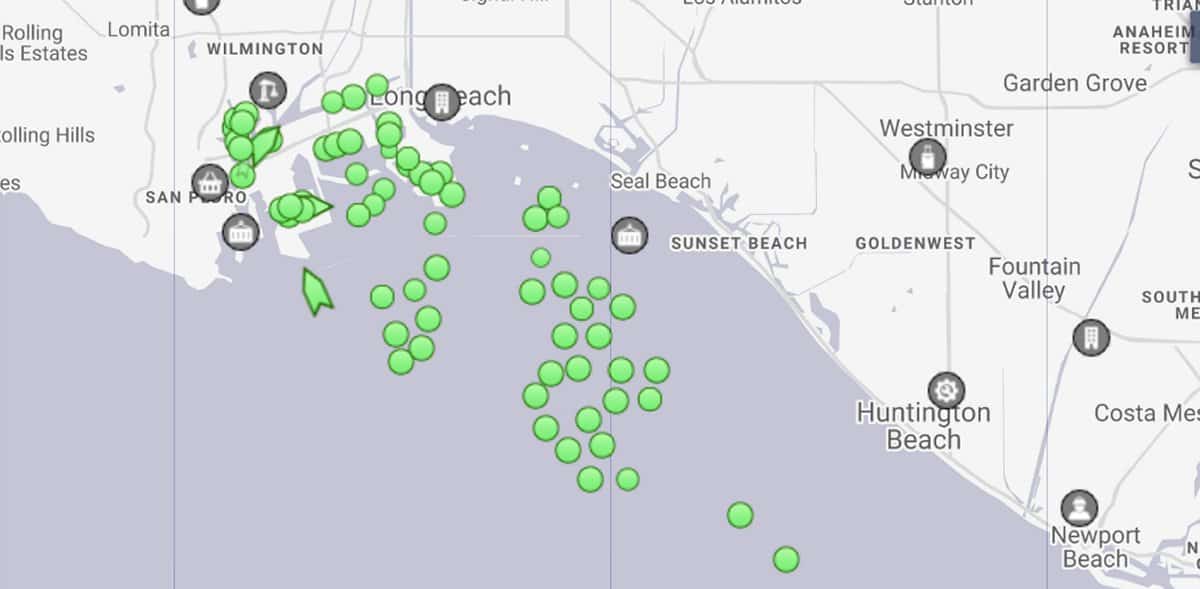

A map of ships in San Pedro Bay reveals the extent of the logjam caused by the import surge. Over 30 container ships were at anchorage Thursday, awaiting berths in the ports of Los Angeles and Long Beach.

Digital freight forwarder Flexport reported Thursday that the “January [Asia-U.S.] market remains extremely strong from both a rate level and booking perspective.”

Indirect stimulus for liners, lessors, stocks

If the blue wave spurs additional stimulus that keeps volumes elevated for much of this year, government spending would indirectly buoy profits of container lines, container-ship lessors, container-equipment lessors — and their shareholders.

Containers lines would earn high spot rates for longer than they would have without added stimulus. Lines would also be in a better position to negotiate higher contract rates. Meanwhile, ship and equipment lessors would see charter rates remain higher for longer or rise even further off current peaks.

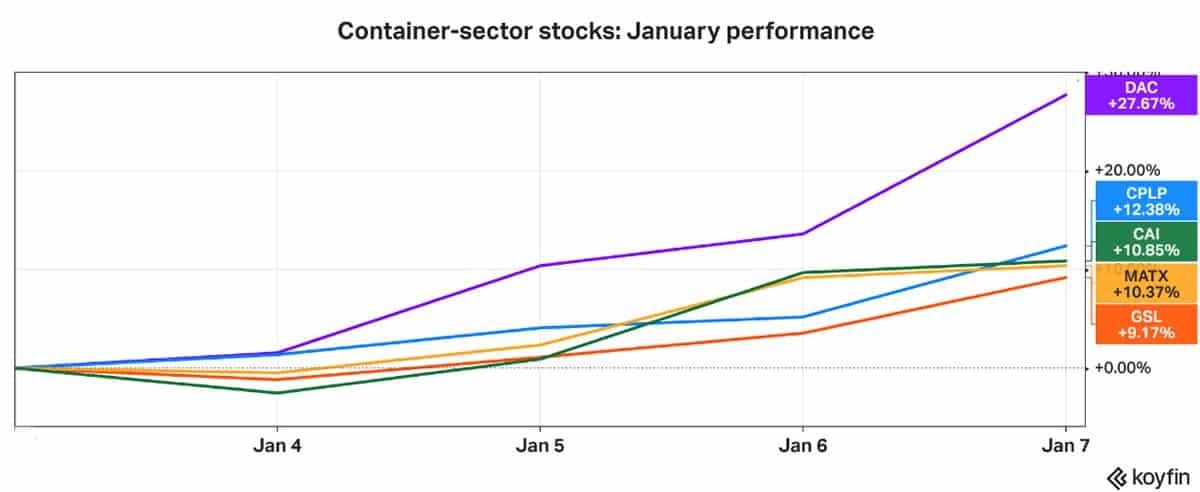

In the first four trading days of 2021, shares of container-ship lessors Danaos Corp. (NYSE: DAC) were up 28%, Capital Product Partners (NYSE: CPLP) 12% and Global Ship Lease (NYSE: GSL) 9%.

Shares of container liner operator Matson (NYSE: MATX) were up 10%. Those of box lessor CAI International (NYSE: CAI) rose 11%. Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON CONTAINERS: Liners highly unlikely to slash service for Chinese New Year: see story here. Container shipping 2021: hangover or party on? See story here. Liner capacity control and the future of container shipping: see story here. Container rates are on fire. How can you invest in that? See story here.