The views expressed here are solely those of the author and do not necessarily represent the views of FreightWaves or its affiliates.

This week’s strategic question is “What are the bold new benefits shippers can expect now that the freight railways are super-efficient?”

It is May, and freight carriers – including the railroads – have issued their first quarter 2020 report cards. Simultaneously, it is a time of considerable economic uncertainty.

Previously in such crises, certain companies and leaders have stepped up with forward-looking new services and products targeted at seizing market share. They pursued strategic advantages, not just incremental advancement.

Therefore, I ask “what new offerings might customers expect to hear concerning how the railroads are going to parlay their recent internal efficiencies generated by precision scheduled railroading (PSR) into a truly expanded service role?” In other words, going for freight volume and not simply top-line revenues.

What did senior executive officers and their boards of directors reveal during the quarterly earnings releases and analyst calls about their revised business outlook for year 2020 and into 2021?

It should have been bold and positive. Right? It should have been detailed rather than vague. Why should we have expected this from our American railroad companies? As a railroad veteran, I believe that of all the modes of transport that the seven Class 1 railroads are the strongest financially.

I’d like to see what they can deliver as competitively priced services now that they are efficiently streamlined and so well capitalized.

Regardless of one’s accounting or financial background, the North American freight railways – all publicly traded companies – have the strongest earnings, positive cash flows, and the highest profit margins of the different freight movers.

While the trucking sector has the highest market share of shipper-paid freight billings (revenues), it is the railroads, with their superior operating efficiency metrics, that are the soundest freight corporations.

As an example, none of the seven Class 1 freight railroads needs federal government assistance during this deep recession and pandemic.

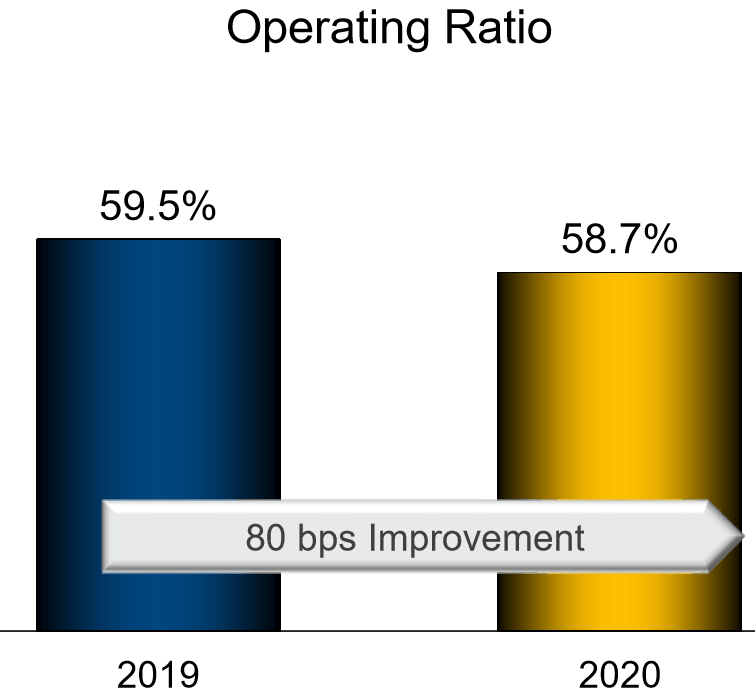

Need further evidence? Let’s examine a few of CSX’s first quarter graphics. Even during the turbulent first quarter, CSX managed to improve its calculated operating ratio (OR) to a record 58.7 percent. Compare that OR to the best of the major trucking companies.

On corridors where the CSX competes, its revenue profit margin is outstanding.

CSX’s free cash flow in the first quarter of 2019 was $866 million. In the first quarter of 2020 it was $812 million. These operating ratio and free cash flow numbers look great; but they are not customer benefits.

What would a customer like about these rail numbers? They would definitely see the financial strength of doing business with such railroads.

Both Kansas City Southern and Union Pacific had similar efficiency as well as accounting results. BNSF is also a strong carrier – although it is not practicing the PSR business model.

These railways look so strong financially, that surely they will step up to begin their long-expected moves to regain market volume from trucking.

That’s somewhat questionable. I see no aggressive new services or market share moves in their investor messages. The official railroad message is more like a restricted “guidance” outlook. That’s not particularly encouraging.

Recently, one informed contributor to Railway Age said it in this manner: “Guidance was pulled, and volumes will likely be light amid the COVID-19 pandemic and uncertain macroeconomic environment…”

CSX said in its first quarter report that it was “withdrawing guidance given economic uncertainty.” Yet at the same time CSX signaled persistent internal cost reduction savings from its PSR model.

Where are the emerging public service or customer service improvement outlooks? A daring display of the railroads’ latent carload power from their streamlined rail networks would be a refreshing market view.

There is evidence of service improvement. CSX is gradually displaying the results of a much better scheduled delivery of carloads to the final beneficial receivers of freight. For a complicated rail carload yard network with multiple possible railroad-to-railroad interchanges, a delivery average close to 88 to 90% performance is considered very good. It is far better than many railroads’ 60 to 70% on-time as the trip plan promises.

CSX can build upon that success story. It can focus on this as an emerging game changer performance.

(Chart from CSX April 2020 investor report)

If CSX is now so much more efficient and continuing to improve, let’s see details of what’s to come in service from CSX (and the others).

With continued improvement in service, there logically could be a second rail freight Renaissance period unleashed.

This new period might shift the big North American railroads from a singular focus on financial goals to service and market coverage relevance.

That, my colleagues, is something different than taking larger price margins. If the railroads are as good as their reports suggest, then they are now in an excellent position to use their efficiency as a launching platform for service and pricing leadership. Moreover, they could do this as their trucking competition struggles. I believe that this railway attitude change is possible.

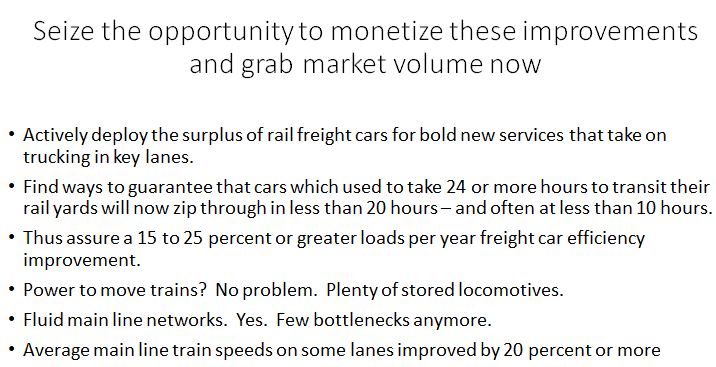

The following are core rail freight strengths upon which to become aggressive and to attack the market:

Actions the Class 1 railroads should take:

The railroads should create a better image in real business terms; they should tell customers what those higher average train speeds are worth. Think of improved network fluidity this way. A typical 2,200-mile-long intermodal train delivery run that used to take as long as ~90 hours now can be serviced in about 60 hours.

Sell more carload freight. Carloads offer a two to sometimes three times volume advantage at far lower rail rates per ton-mile for selected commodities.

Use market uncertainty to the railroads’ advantage.

None of the seven Class 1 railroads is going out of business. Financial strength can be a real lever in selling.

As I learned during my years with Ram Charan at Conrail, railroad executives can use periods of uncertainty like this to critically readjust their older business models and seize new business opportunities.

Which of the seven Class 1 railroads might do that first?

Why not use these quarterly reports to announce their second Renaissance? Are they ready?

While it might be comfortable to rely upon route leverage and pricing leverage as rail freight’s advantages, that is a dangerous road. That business model can become a crutch upon which rail freight witnesses a continuing market share withdrawal.

Rail traffic has been increasing year-over-year at a lower rate than trucking. That’s not good. It’s time to test the possible railroad market stars. And that means more than just intermodal.

Growth with better service and better shared benefits pricing could fill up the main lines again. But to execute, requires leadership from railroad executives.

Growth and relevance as the shippers’ choice of transport modes is not a prescription issued by the Surface Transportation Board or by journalists.

Rod Case of Oliver Wyman said this well during his mid-day slide show at Rail Equipment Finance 2020 back on March 2nd. The railroads, he said, have two basic choices to grow. They can try to match trucking, and in some lanes take share from trucking.

A second approach would involve taking less growth risk. But the price may be that the rail industry would see further route consolidations of traffic into fewer high-density rail routes. And there could be a consequence of a further abandonment of lines.

Given the potential upside, and the rail sector’s solid financial stability and streamlined assets, why would railroad leaders take the slower growth role?

The answer might be because “we have become too comfortable with PSR cash flows and assume that cost-cutting has no point of diminishing returns. We might see the easier path as just to keep cutting our internal costs.”

For signs of aggressive marketing, perhaps we need to look north. Are Canadian Pacific and Canadian National showing us the way to do it?

What do you think? Are you optimistic about high rail volume growth?