This is an excerpt from Thursday’s Point of Sale retail supply chain newsletter.

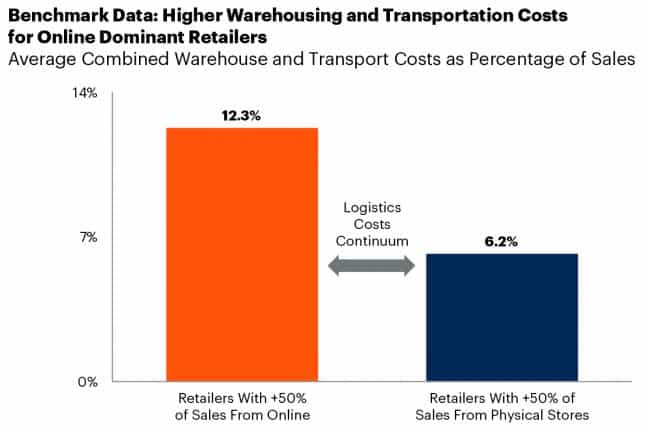

Retailers with more than 50% of revenue from the online channel have logistics costs as a percentage of sales that are almost double those of their store-focused counterparts, according to Gartner.

2020 was a year spent primarily expanding online fulfillment capabilities, but now retail supply chain leaders are now looking for opportunities to control, contain and, where possible, reduce their associated last-mile costs. How?

Focusing on packaging and product design. Packaging designed to stand out on a retail shelf is often oversized, with expensive “romance” design aesthetics, redundant features to prevent theft and not capable of surviving the journey to the customer. In many cases, these features can lead to suboptimal packaging for online distribution.

It’s easy to imagine who has led the way towards establishing packaging standards. It can only be a retailer with the scale and scope of Amazon.

Amazon has been focusing on packaging and product design optimized for online delivery since the launch of its ‘Frustration-Free Packaging’ Initiative in 2008. Amazon defines this as “packaging that is made of 100% recyclable materials, easy to open and designed to ship products in their original packaging, which eliminates the need for an additional shipping box.”

Since 2015, the initiative has reduced the weight of outbound packaging by 33% and eliminated more than 900,000 tons of packaging material, the equivalent of 1.6 billion shipping boxes.

Amazon is able to achieve these remarkable results via its Packaging Certification program, which has created standards for manufacturers.

“We consider packaging sustainability to be a win-win-win and we are working hard to share our standards and guidelines with brand owners and the packaging industry as a whole, so we can drive those positive outcomes faster, together,” said Brent Nelson, Principal Product Manager in the Customer Packaging Experience division at Amazon.

Recalibrating existing fulfillment and returns options. The shift of in-store traffic to online channels has forced retailers to rethink their online fulfillment offerings to ensure they can sufficiently meet consumer needs in a timely and cost-effective manner.

The most obvious manifestation of this process has been the rapid expansion of curbside pickup, BOPIS, and external lockers. Retailers with strong grocery offerings like Walmart, Target and Kroger had been investing in curbside operations well before the pandemic, but retailers outside of grocery have embraced touchless pick-up. BestBuy has effectively implemented a scheduled curbside service along with Dick’s Sporting Goods, Academy Sports + Outdoors, Ulta Beauty and countless others.

Lowe’s and Home Depot have impressed customers with the speed and convenience of picking up online orders from lockers stationed just outside stores. This system isn’t limited to just home improvement; Albertsons has implemented temperature-controlled lockers for produce in some locations.

Simultaneously, as retailers establish new curbside and other fulfillment offerings, some are looking to pass increased costs associated with online delivery to consumers and their suppliers. A Gartner analysis of 500 leading retailers found there has been a 12.5% decline in the number of retailers offering free shipping and a 30% reduction in those offering free shipping on returns between late 2019 and August 2020.

Final Thoughts. If retailers are trying to control and potentially reduce last-mile fulfillment costs, they ought to not only offer many options, but nudge consumers towards the optimal outcome. In other words, retailers should use both economic and environmental incentives to align customers with the preferred method of fulfilment.

Timberland, who I assume makes other products other than “Timbs”, but I wouldn’t know, has had success trialing an incentive-driven initiative, with 14% of its consumers choosing a slower delivery speed in return for the retailer planting a tree on their behalf.

I tweeted an idea about grocers gamifying pick up to boost fulfillment velocity and increase engagement with customers. I believe an offering like this can be leveraged to funnel orders to the most profitable fulfillment method.

Retailers have displayed their agility and might this past year with rapid e-commerce and omnichannel service offerings. Now, they must get creative in their desire for optimization and cost savings.

Want more retail supply chain news and insights? Try Point of Sale.