Not surprisingly, coronavirus is a major topic on the quarterly calls of public dry bulk shipping companies — executives maintain it’s having a negative effect on rates. And yet, index data provided to FreightWaves by S&P Global Platts shows that the rate decline clearly predates the coronavirus. Base spot rates have actually bounced up off the bottom during the outbreak.

So is the worst still to come, or are coronavirus dry bulk fears overblown? Have rates reached a point where they cannot go lower because owners will not accept lower rates?

During the quarterly call of Genco Shipping & Trading (NYSE: GNK) on Wednesday, CEO John Wobensmith said, “In addition to seasonal weakness, the outbreak of the novel coronavirus has further impacted industrial activity, commodity demand and freight rates.

“It’s still a little early to tell when Capesizes [bulkers with capacity of around 180,000 deadweight tons that carry iron ore and coal] start to move up in a significant way,” he continued.

“Our belief is that when the coronavirus is contained and things are stabilized, the Chinese government will do a large stimulus package, and Capes will certainly benefit.”

Platts global Capesize index

If there is a negative effect from coronavirus on rates, it isn’t showing up yet in the index data — a potentially ominous sign, given that data from CargoMetrics implies a sharp decline in China’s bulk import appetite.

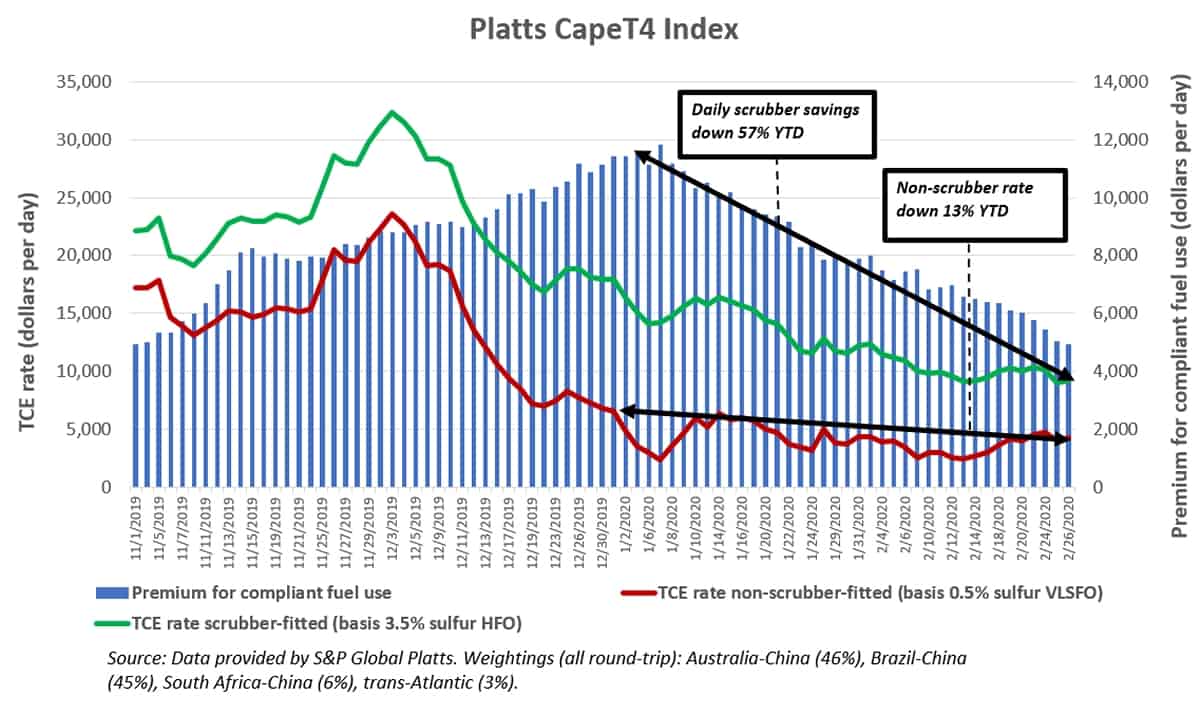

In addition to the 5TC Index produced by the Baltic Exchange, Capesize rates are tracked by S&P Global Platts through its CapeT4 Index. Platts provides dual indices in light of the IMO 2020 regulation, which requires all ships without exhaust-gas scrubbers to burn more expensive 0.5% sulfur fuel called very low sulfur fuel oil (VLSFO).

The dual indices assess the rates of nonscrubber ships burning VLSFO and scrubber ships burning 3.5% sulfur heavy fuel oil (HFO). Because HFO is cheaper, scrubber ships earn more on a net basis, depending on the VLSFO-HFO spread.

The Platts CapeT4 assessed Capesize rates on Wednesday at $4,292 per day for nonscrubber ships burning VLSFO. The index has been hovering around this level since the beginning of the year, well before China implemented virus containment measures; rates fell in December, not January. The index is down 13% from Jan. 2, but it’s up 72% from a nadir of $2,497 per day on Feb. 13. In other words, it has risen (albeit off extremely low levels) during the very time virus fears have heightened.

For scrubber ships, rates have declined 44% year to date. But that’s not because of coronavirus. It’s because the daily savings from burning HFO have decreased 57% over this period. The rate calculated on a time-charter-equivalent (TCE) basis is not lower because the base rate (in dollars per ton of cargo) is lower, but because the owners of scrubber ships are not saving as much on fuel as they did at the beginning of the year.

Platts Australia-China index

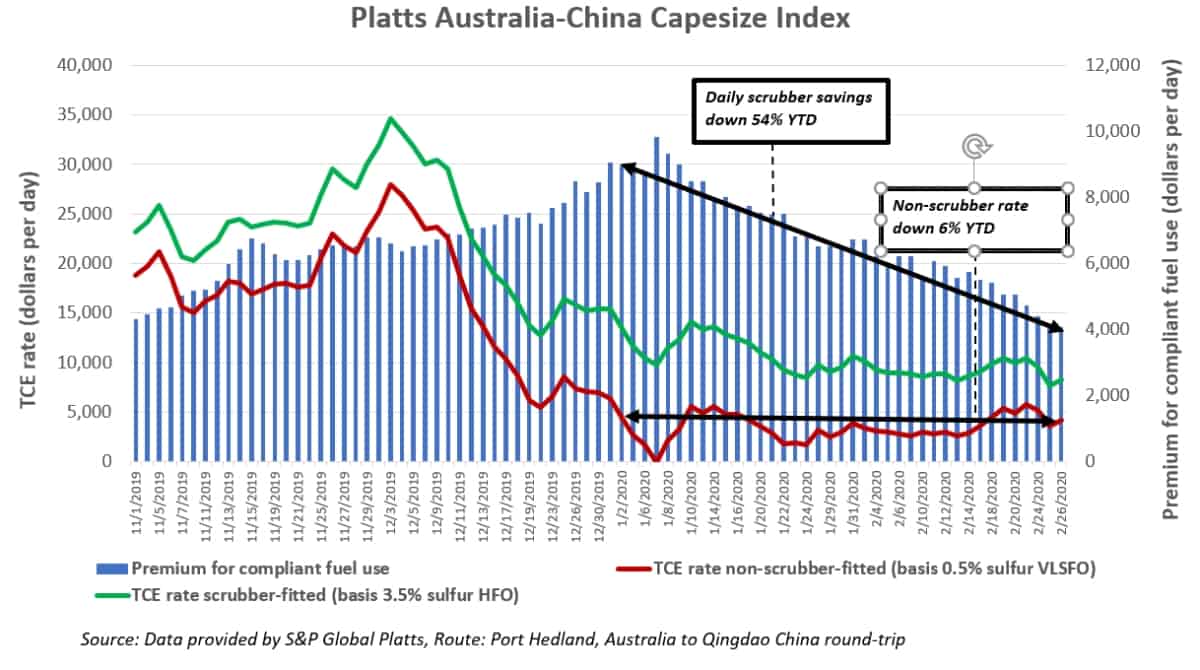

The Platts CapeT4 index is heavily driven by the Australia-China trade (which accounts for 46% of the index weighting) and the Brazil-China trade (45% weighting).

Excess ship capacity has pressured Australia-China rates as so many Capesizes reposition to the Pacific Basin for scrubber retrofits. The Platts Australia-China index has suffered the most extreme lows — it actually went negative for nonscrubber ships in early January.

As of Wednesday, rates were assessed at $4,176 per day for nonscrubber Capes burning VLSFO. This is relatively close to where the index started the year; down 6% from Jan. 2. According to Platts, the nonscrubber index for Australia-China has more than doubled since Jan. 22, i.e., during the outbreak containment period in China.

Rates for scrubber ships burning HFO have fallen 38% since the start of the year, once again, not due to coronavirus, but rather, due to a 54% drop in the daily savings from the fuel spread.

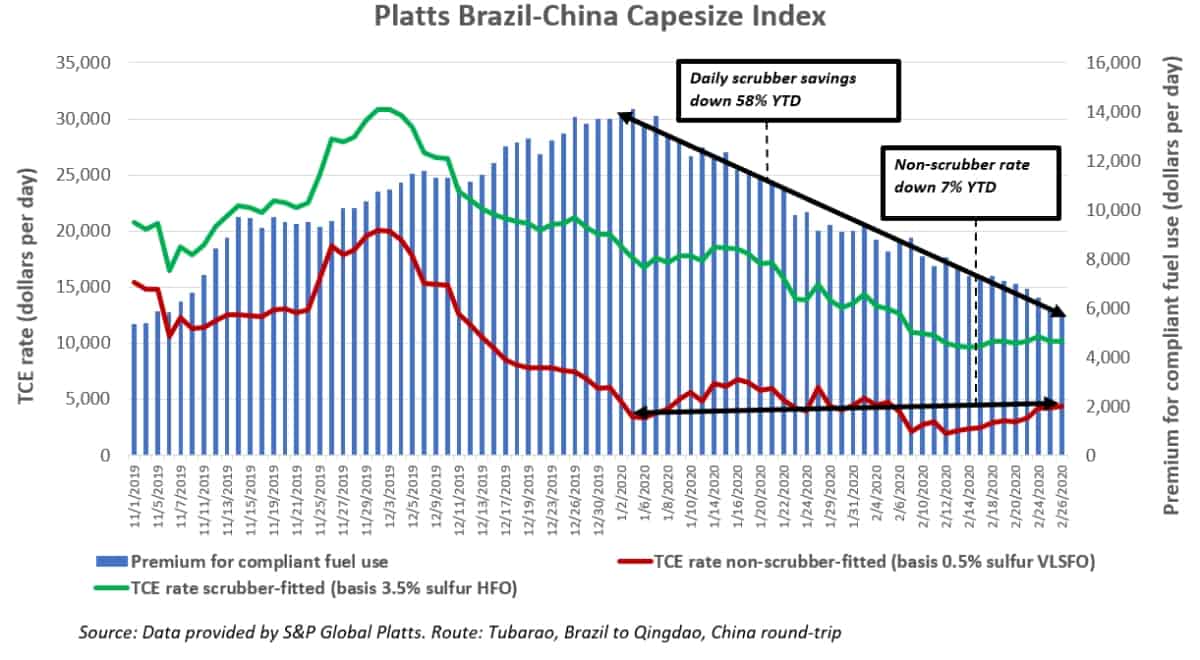

Platts Brazil-China index

The Brazil-China export route has been heavily impaired by severe flooding and ongoing production issues of miner Vale (NYSE: VALE) due to constraints following the tragic tailings-dam accident a year ago.

Brazil-China Cape rates were outperforming Australia-China rates earlier in the quarter, but they’re now roughly in line. As of Wednesday, nonscrubber Capes sailing from Brazil to China were earning $4,392 per day, according to Platts.

Nonscrubber earnings have been relatively flat year to date, down 7% from Jan. 2, but they are now double the quarter low of $1,971 per day on Feb. 12.

TCE rates assessed for scrubber Capes are down 45% year to date, driven by a 58% decline in savings from burning HFO as opposed to more expensive VLSFO.

Genco quarterly results

Genco is a perfect example of a company benefiting from the HFO-VLSFO spread. It now has scrubbers installed on all 17 of its Capesizes.

The New York-headquartered company reported net income of $882,000 for the fourth quarter of 2019 versus net income of $18.3 million in the fourth quarter of 2018. Adjusted earnings per share for the most recent period of 7 cents came in below the consensus forecast for 9 cents.

For the first quarter of 2020, Genco has 78% of its available days for its Capesizes booked at $17,080 per day, well above index levels.

Wobensmith attributed the outperformance to three factors. “First, we clearly weren’t predicting coronavirus but we were predicting a seasonally slow first quarter, so we did forward bookings. Second, we bought quite a bit of fuel [HFO] at the end of December, when prices were lower. And third, the spread was beneficial [the spread between HFO and VLSFO earlier in the first quarter].”

He conceded that the spread has now come down. “The spread today is $155-$160 [per ton], so that has certainly weakened. But again, this is a seasonally slow period and there’s also a slowdown from the coronavirus. Once all that’s in our rearview mirror, I expect more demand for VLSFO and for the spreads to push back towards $200. And if the price of oil moves up, the spread will move up as well,” Wobensmith said. More FreightWaves/American Shipper articles by Greg Miller