Liquefied natural gas shipping has a freight market like any other, albeit with a lot more zeros on the end of its numbers. Day rates in LNG shipping are in the six figures. Profits on a single cargo can be in the nine figures.

“Welcome to the stratosphere of LNG prices,” commented Stifel analyst Ben Nolan on today’s market conditions.

The European hub price of natural gas, TTF, hit $84 per million British thermal units (MMBtu) on Monday. “This is close to $500 per barrel of oil equivalent,” noted Oystein Kalleklev, CEO of shipowner Flex LNG (NYSE: FLNG), during a conference call on Wednesday.

In LNG trading, it’s all about the arbitrage. The landed price for LNG in Europe was $60 per MMBtu on Monday. The natural-gas hub price in Asia, JKM, was at $61 per MMBtu. The U.S. price, Henry Hub, was at $10.

At current gas prices and shipping rates, Flex LNG estimated that a single shipload (172,000 cubic meters) of U.S. LNG could be transported to Asia and sold for an arbitrage profit of $204 million. A U.S. cargo sold in Europe could bring a profit of $201 million.

“Even though the Henry Hub is at a 14-year high, it is immensely profitable to move these cargoes to either Europe or Asia,” said Kalleklev.

Spot shipping rate roller coaster

The average spot rate for modern LNG carriers topped $250,000 per day in Q4 2021. Some individual deals were reported at over $300,000 per day.

European demand surged last winter even before Russia invaded Ukraine. Then the invasion in February prompted an all-out scramble for LNG to replace Russian pipeline supplies. LNG that previously went to Asia was pulled to Europe instead.

“Europe has been gobbling up LNG spot cargoes on an unprecedented level,” said Kalleklev. “So far this year, about two out of three U.S. LNG cargoes have ended up in Europe, compared to one in three last year.”

The switch to more U.S.-Europe voyages at the expense of U.S-Asia voyages reduced average sailing distance by 15% in Q1 2022 versus Q4 2021, “which released a lot of available ships in the market” and pushed spot rates back down from winter highs, he explained.

Rates then rebounded, with the most fuel-efficient models — with “MEGI” or “XDF” propulsion — back to $100,000 per day by May.

Then came the June 8 explosion at the Freeport LNG export facility in Texas. “That led to the loss of around 15 to 17 monthly cargoes, thus releasing a lot of ships, especially relets [time-chartered ships temporarily put into spot]. And with more ships available in the market, [MEGI] rates plummeted back to around $60,000-$70,000,” said Kalleklev.

Since then, the rate roller coaster has continued. MEGI spot rates are back up to around $120,000 per day. The Flexport LNG CEO said that rates could be “super strong” — in the $200,000s — during Q4 2022 when Asian buyers start booking more spot cargoes to handle peak seasonal demand.

“We are certainly in for an interesting winter,” he predicted.

Steady at highs for time-charter rates

The long-term charter market, which covers the overwhelming majority of LNG vessel employment, has been much less volatile than the spot market.

“The term market has remained strong for this whole period. It has been very firm, even in periods of spot-market weakness,” said Kalleklev.

He put one-year time-charter rates for MEGI LNG vessels at around $170,000 per day, three-year rates at around $140,000 and five-year rates at $110,000. Eighteen months ago, five-year rates were almost half that, in the mid-$60,000s per day.

“These are extremely high period rates for modern tonnage,” said Kalleklev.

The newbuilding market is offering support for the long-term charter market. The price of a newbuild MEGI LNG carrier was around $180 million last year. It has since jumped to $248 million.

“This has been driven by higher material prices — for nickel and steel — as well as higher labor prices and a much tighter balance at the yards because of the glut of orders, not just for LNG carriers but also for container ships.”

An LNG carrier ordered today won’t even be delivered until 2027, he said. “Actually, the delivery time for an LNG ship is now longer than [the construction time] for most LNG export plants.”

The newbuild situation supports the long-term charter market in several ways. First, given the high cost and exceptionally long delivery times for newbuilds, a company in need of shipping capacity may favor a long-term charter of an existing ship. Second, new export projects that opt for newly built vessels will do so by pre-agreeing to long-term charters from the shipowners that place the actual orders. A high newbuild price must be supported by a high charter rate.

Flex LNG earnings

Flex LNG’s business has followed the same multiyear-charter-centric script as the market as a whole.

A year and a half ago, the company was almost entirely spot-exposed, either through index-linked charters or short-term employment. Now, its fleet is almost entirely on fixed-rate long-term charters.

Of its 13 vessels, 12 are on fixed-rate, multiyear employment. Only one, the Flex Artemis, has exposure to the spot market via a variable hire rate. Flex LNG is now largely in harvesting mode, paying out dividends, including a special dividend announced Wednesday.

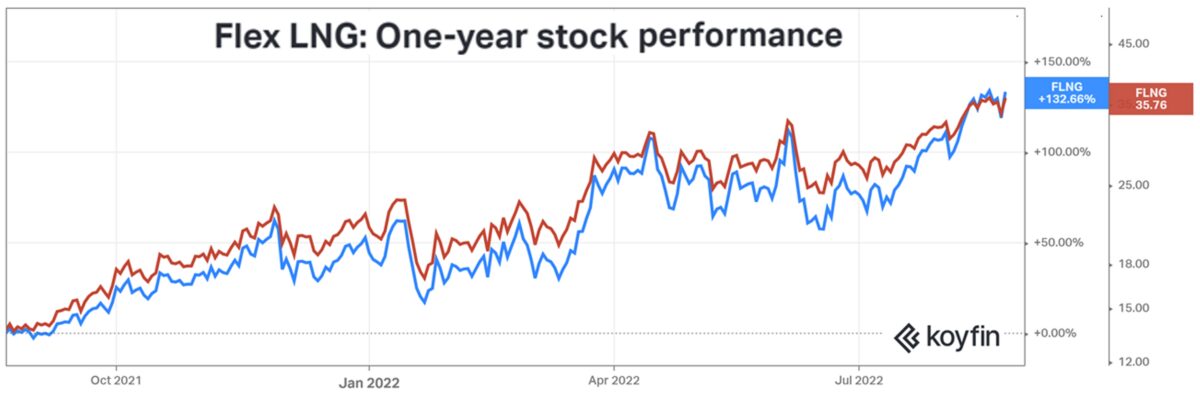

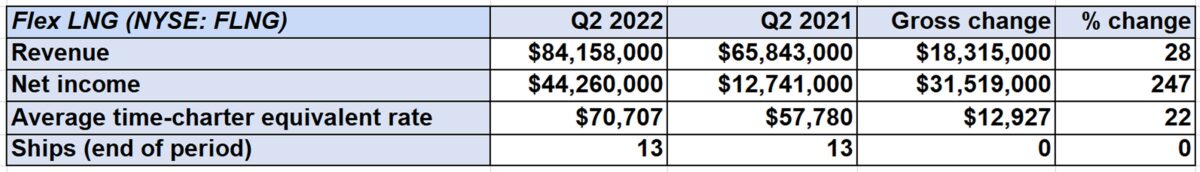

The company reported net income of $44.3 million for Q2 2022 compared to $12.7 million in Q1 2021. Shares rose 6% Wednesday and closed up 132% year on year.

Click for more articles by Greg Miller

Related articles:

- Biden-EU energy pact: LNG shipping game changer or wartime hype?

- Armada carrying US LNG heads to Europe, but it won’t be enough

- LNG shipping’s wild ride: Record, plunge, new record, new plunge

- Another one bites the dust: LNG shipping’s GasLog to delist

- New world record set for shipping rates: $350,000 per day

- LNG shipping rates just hit $125,000 per day

Hassan

We asking about Gas carriers ships fror Nigeria state – we looking for 5 years rent ship – we hope to find a good prices to make a contract for rent

you can contacting me at hassanica@gmail.com

thank you all

Michael Hogan

I think the spot price for natural gas is around $10.00, but the spot price for LNG is much higher.

Stephen Webster

10 yrs ago concern was raised that 🇨🇦 should have 2 more major refineries be built and 3 large LN G terminals

They also said that without a plan to have safe truck parking with electric plugs and hourly pay and overtime truck driver turnover would remain high

Frankie Ku

Canada says they will be shipping green hydrogen to Germany by 2025. Report shows costs 5 times as much using LH2 ships compared to LNG.