(UPDATE: New U.S. Coast Guard aerial video of container-ship traffic jam released: see link here)

In the movie “Falling Down,” the character played by Michael Douglas is stranded in a Los Angeles traffic jam. He abandons his car, starts walking with briefcase in hand and ultimately has a mental breakdown. Cargo shippers trying to get their containers through the ports of Los Angeles and Long Beach can relate.

The pileup of ships offshore in San Pedro Bay and congestion onshore at the terminals have reached epic proportions.

And the situation could become even more maddening in the weeks ahead.

32 container ships at anchor

American Shipper interviewed Kip Louttit, executive director of the Marine Exchange of Southern California, to get the latest on ships in San Pedro Bay.

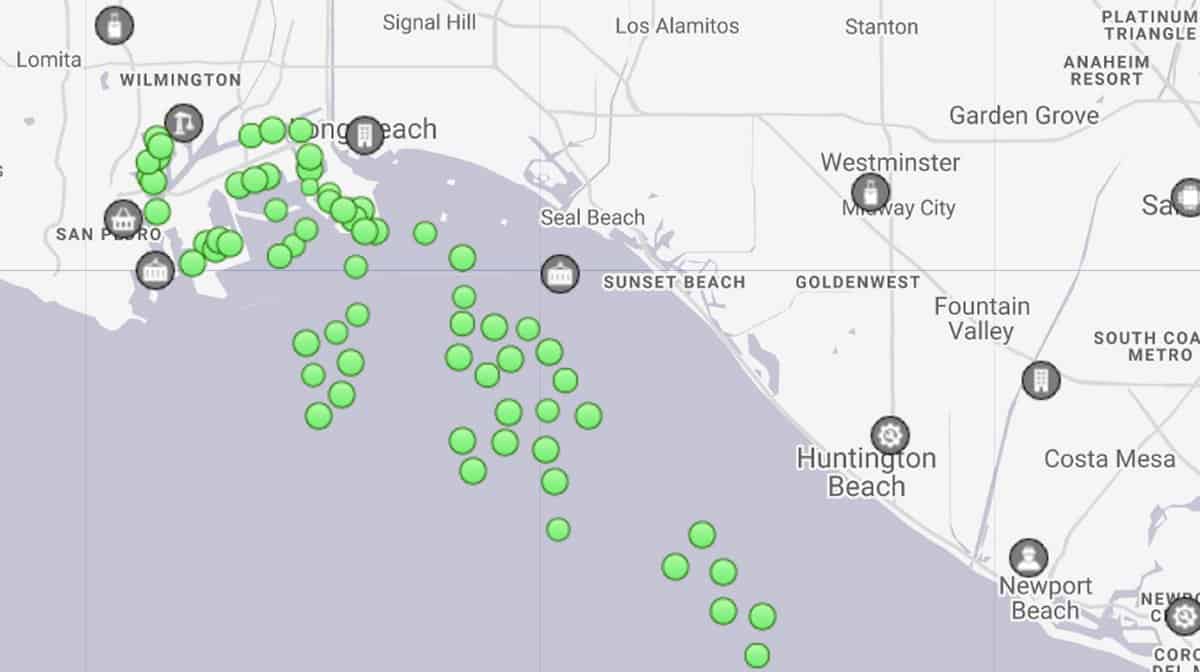

He reported that as of midday Wednesday, 91 ships were in port: 46 at berth and 45 at anchor. Of those, there were 56 container ships: 24 at berth and 32 at anchor. Between Wednesday and Saturday, 19 more container ships will arrive, with the same number due to depart.

There were a few more container ships at anchor on Friday —37 in total. Yet Louttit said “there has been no significant change between the first of January and today.”

Louttit confirmed that ships have effectively filled all of the usable anchorages off Los Angeles and Long Beach. Ships have also taken six of the 10 contingency anchorages off Huntington, the next town south.

If all the anchorages and contingency anchorages fill up, ships will be placed in so-called “drift boxes” in deeper water. These are actually circles not boxes. Unlike ships at anchorages in shallower water, ships in drift boxes would not anchor, they’d drift. “When you drift out of the circle, which has a radius of 2 miles, you start your engine and go back to the middle of the circle,” explained Louttit.

Historical perspective on traffic jam

Given the drift-box option, container ships are not about to hit any kind of maximum capacity offshore of California. Nor is there a higher safety risk. “There are a lot of ships, but they’re all very carefully watched and managed,” affirmed Louttit.

The significance of so many anchored ships is what they reveal about the extent of the logistics logjam on shore.

The most recent comparable anchorage level occurred during the labor dispute between the International Longshore and Warehouse Union (ILWU) and their employers in 2014-15.

“On March 14, 2015, there were 28 container ships at anchor. We’ve blown through that record,” said Louttit. The all-time record for ships at anchorage off California occurred in 2004 during a rail staffing shortage.

“Normally, if you want a baseline, there’d be a dozen and rarely are they container ships,” he said.

Signal still flashing red

The Marine Exchange does not look past the coming four days’ arrivals. But there are other ways to see what’s headed this way across the Pacific.

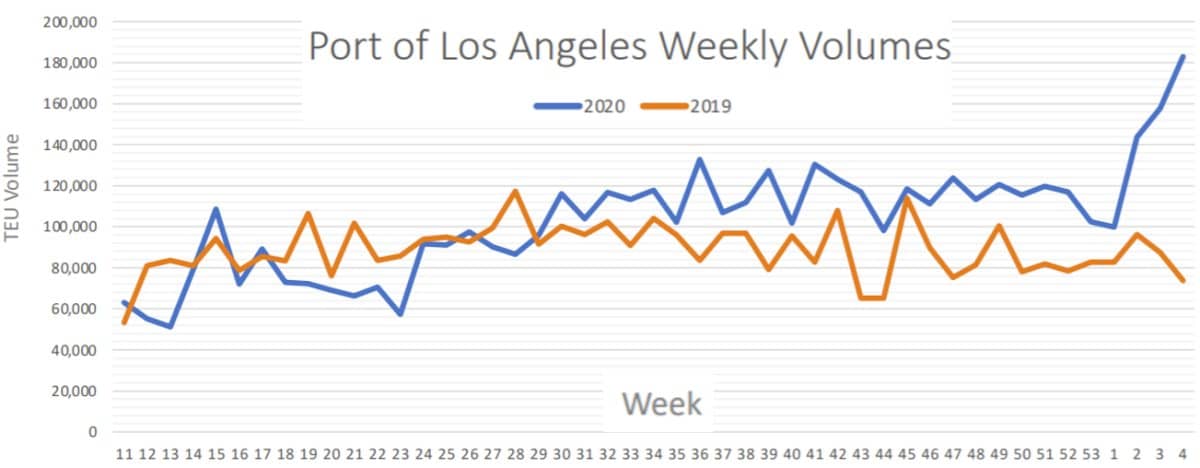

It takes two to three weeks for containers to cross the ocean from China to California. The Port of Los Angeles developed The Signal, a daily digital tool powered by Port Optimizer, to indicate what’s en route. The system uses manifest data from nine of the top 10 carriers calling in Los Angeles.

The Signal data updated on Wednesday showed no letup in sight. Imports are expected to rise from 143,776 twenty-foot equivalent units (TEUs) this week to 157,763 TEUs next week to 182,953 TEUs the week of Jan. 24-30.

Importantly, the data does not solely include TEUs arriving in a particular week. It also includes TEUs arriving in prior weeks that the port expects to handle in the stated week.

Consequently, the data provides an indirect indicator of how much cargo is getting delayed. For example, on Monday, Jan. 4, The Signal indicated the port would handle 165,000 TEUs that week. But by Friday, Jan. 8, the assessment for that same week had plunged to 99,785 TEUs — implying that over 65,000 TEUs were pushed to the following week (i.e., this week). This pattern also suggests that the forecast for 182,953 TEUs the week of Jan. 24-30 will ultimately be revised downward.

Congestion causes

In an alert to customers this week, carrier Hapag-Lloyd reported, “All terminals [at Los Angeles/Long Beach] continue to be congested due to the spike in import volumes and [this] is expected to last until February.

“Terminals are working with limited labor and split shifts,” it said, asserting that this is related to COVID. “This labor shortage affects all terminals’ TAT [turnaround time] for truckers, inter-terminal transfers and the number of daily appointments available for gate transactions and delays our vessel operations.”

As a result of “lack of terminal space” to service vessels, “there is a constant switching of terminals that must be kept in mind” given that containers are ending up “in the wrong terminal,” said Hapag-Lloyd.

Congestion woes are now spreading well beyond California ports, confirmed Hapag-Lloyd. The carrier reported “heavy congestion” in Canada and “berth congestion at Maher Terminal and APM Terminals [in the Port of New York and New Jersey] impacting all services with delays of several days being experienced upon arrival.”

Little relief ahead

Liner companies traditionally cancel numerous sailings during the Chinese New Year period to account for decreased Chinese exports. If they did so in 2021, it would allow U.S. terminals time to clear some of the inbound congestion. Unfortunately for terminals, liners are opting against canceling sailings during the Chinese holiday period next month.

Ports could also see congestion relief if U.S. consumer demand slowed. However, that does not appear to be happening.

Analysts believe the “blue sweep” scenario — with Democrats winning the presidency as well as both houses of Congress — will spur $1 trillion-$2 trillion in new stimulus during the first half of this year.

Investment bank Evercore ISI predicted, “Additional checks will reach consumers at a time when unemployment is lower [than during the 2020 stimulus round], mobility has significantly improved, the overall willingness to spend of the general public is up significantly, confidence levels are higher, housing is strong and the savings rate is still extremely high. That is a set-up for a consumer boom.” Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON CONTAINERS: ‘Blue wave’ could spur stimulus on top of stimulus: see story here. Liners highly unlikely to slash service for Chinese New Year: see story here. Container shipping 2021: hangover or party on? See story here.

Don

Buying products and goods from China for cheap will cost us in the long run. Believe me we will still pay a HIGH PRICE in the end! They are communists using SLAVE labor to do what it takes to rule the world. Don’t be a FOOL!

M. E. H.

I’m curious about the amount of pollution having all those ships sitting there is creating. Any information on that? They’re very close to shore.

Paul K

Greg, what is the potential impact, if any, to ocean imports based on recent foreign policy moves by the Trump administration (Mike Pompeo)?

Greg Miller, Senior Editor

Paul, I wouldn’t think much if any, because Pompeo’s moves can eventually be reversed. Assuming there’s no overseas military action in the next few days, it would seem to be all about the next administration.

KALYAN BERA

Knowledgeable article.

Andrew David goodson

The shear size and volume of vessels dosen’t help either.

Jason B

California ports are overwhelmed while the Washington ports are not, the Port of Seattle terminals are empty because the state is greedy.

Carl Perry

Look at the big brain on Jack

Jack Woodburn

Given what China has done to America and the world with COVID-19, my vote would be to send those vessels back where they came from. We could benefit without the continued wealth transfer to China while bringing manufacturing jobs back to the USA. Few, if any, people working or owning those vessels are Americans. The dock workers will still have plenty of other work to do.

Sandy Williams

Jack, I agree, good post.

CARLOS SALAZAR

Are you aware of what you are saying? There are tons of products required by companies in the US and Baja California’s maquila industry which depends on the supply of manufacturing raw materials coming to LA/LB ports and these are for the most part for US companies that will never go back to the US to open a plant because as everyone knows they look for the best value for their money! The US lost their manufacturing jobs many years ago either to Asia or Latin American countries were they can find cheap labor and tax exemptions making their products more profitable. Going back to the US if that would happen some day which I doubted, would mean a high rise in consumer prices for all end products. Now if you are thinking also of applying more taxes/duties to these companies the only ones who will suffer will be the end consumers which will pay all the increases as every manufacturing plant outside the US passes all those new taxes/duties to the end product! So the only ones affected are the US consumers! So please don’t give us childish ideas based on your temper tantrum about returning containers to Asia, you know who will pay?

Felipe

Everybody should do their best to avoid buying anything made in China. Any cent is a bullet in this war, we choose who will get it.

mrbigr504

Yeah right, miss me with that bulls–t! Send some of those ships around to Savannah and Charleston ports, we’ll handle up on’em! What China has done to the US? You stop all of these US businesses from outsourcing all of our jobs and manufacturing to China and India, maybe we can stand flat-footed on our own! But as it stands, due to the deals made looong ago (yes Republican presidents too) are economies are so freaking intertwined to the point if either fails, the other comes to a screeching halt! I didn’t vote for that idiot Trump but even a broke clock is right twice a day and so the trade deals he started are a move in the right direction. Just wish he left out all the bulls–t theatrics and showing of disrespect to our neighbors! As you can see, China did an end around and went to other countries like Africa and set up huge deals and they invested in Africa’s inferstructure to which they needed. Folks wanna keep blaming China for a lotta sh-t but fail to take responsibility for your own damn short comings! I hope the new administration doesn’t throw the baby out with the bathwater on these trade deals #44 started. Maybe fine tune it so consumers won’t get hit so hard when buying goods at the stores and shops. Get our manufacturing to mostly US made and boost our exports. We need to stop sending our recycled metals to China and then they flood the market with sub-par products at cheaper cost that knocks the US outta business! What kinda sh-t is that? Let’s get our sh-t together US because we may have came in on different ships but right about now we’re all in the same boat and there’s only so much duct tape and bubble gum to stop these leaks!

InGodITrust

Everyone needs to wake the hell up! China made deals with Africa and Australia and many other countries, and GUESS WHAT? China NOW has infiltrated them and own them, Just like they ALMOST owned the USA!

So save your theatrics and hatred of the best POTUS this country has ever seen and count your blessings! You will be glad Trump was POTUS and will still be POTUS as you see what is about to take place!! There is so much most dont know as it was kept hidden for a very very long time, and this POTUS is making it right! Yeah making it right even for ignorant people like you who has disrespects the ONLY President was able to accomplish this feat that we are about to witness! Bet you don’t know the REAL reason why DC has 25K National Guards and all fenced off!! Those that have voted for Paedo Joe Biden seriously need need a head check! China is one of the richest nations on this earth at this moment, but WE will be very very soon for what is to come!!