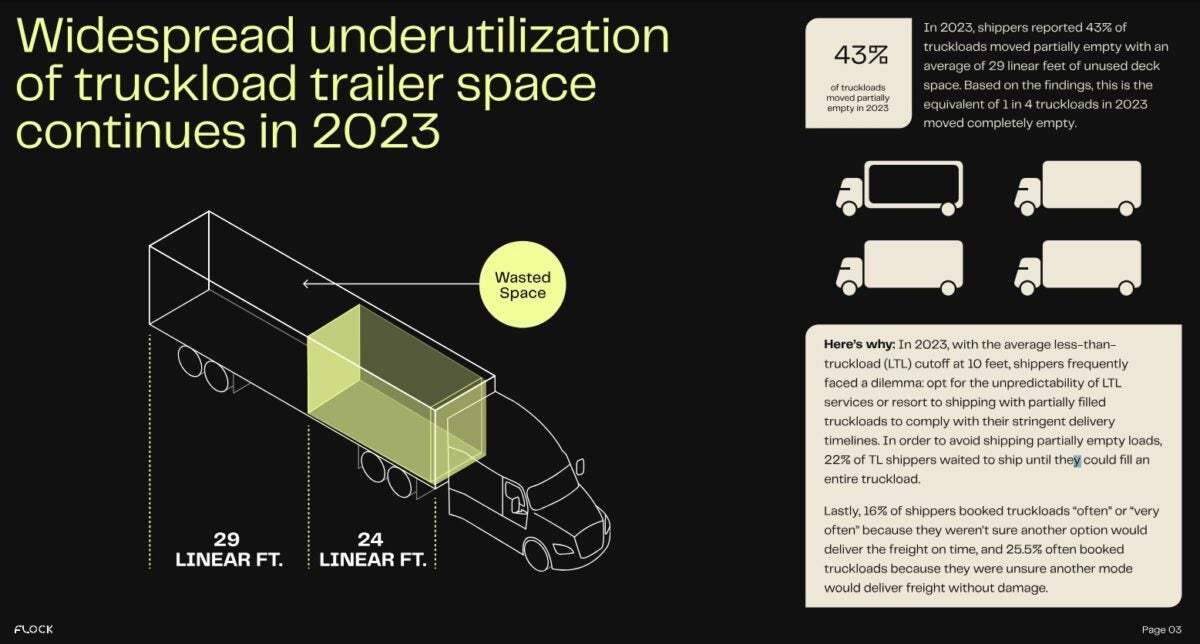

Study highlights nearly half of truckloads in 2023 moved partially empty

Flock Freight recently released its yearly study, which looks at how market conditions are affecting the industry in partnership with Drive Research. The report is based on survey data that included 1,000 transportation decision makers from various industries. The study found that underutilized trailer space remained an issue in trucking, and continues to persist, finding 43% of truckload moving partially empty in 2023 alone. Chris Picket, COO at Flock Freight said, ““Historically, the U.S. truckload market has been locked into a binary concept of ‘full’ or ‘empty’ when it comes to trailer capacity. We are challenging both Shippers and Carriers alike to rethink this,”

From personal experience, depending on who you ask, some carriers prefer lighter loads, as a fully laden 53’ dry van trailer at 45,000 lbs has a higher impact on truck wear and tear than a 20,000-lb-shipment. LTL has historically been the primary winner when it comes to partial shipments, but turbulence the past year following the demise of Yellow may explain some of the service disruptions and migrations, the Flock Freight report noted.

“In 2023, with the average less-than truckload (LTL) cutoff at 10 feet, shippers frequently faced a dilemma: opt for the unpredictability of LTL services or resort to shipping with partially filled truckloads to comply with their stringent delivery timelines. In order to avoid shipping partially empty loads, 22% of TL shippers waited to ship until they could fill an entire truckload,” said the report.

Another challenge LTL faces compared to full-truckload is cost, with current market conditions incentivizing full truckload over LTL for cost savings. The report adds, “Less than truckload (LTL) shippers might be drawn in by cost at the surface level, but hidden charges can soon add up. In 2023, the average enterprise shipper paid up to $6.3 million annually on LTL damage and loss claims alone.”

Trucking execs talk market conditions at Wolfe investor conference

On Wednesday, trucking executives from Werner Enterprises and Schneider National spoke at a Wolfe Research conference, providing additional commentary on freight market conditions. One positive sign was that truckload capacity has exited the market to such an extent that seasonal market events are having a notable impact on spot market rates.

FreightWaves’ Todd Maiden writes, “Leathers pointed to a notable decline in the number of trucks posted on load boards during the past two months and a more normal tightening in capacity during International Roadcheck, an annual 72-hour inspection blitz by law enforcement, held last week. He also said recent customer conversations have been positive and that all the discount retailers Werner serves under dedicated contracts have increased their truck counts this year.” Leathers adds that Werner is seeing less customer pressure to cut rates, adding, “This time around, we’re not seeing that same level of dislocation.We signal with pricing what we want to retain, and we’ve been able to do it.”

Both trucking execs hope for margin improvements, but when that will occur remains elusive. Werner targets 12% to 17% margins from their current TL OR of 95.3% or a margin of 4.7%. Schneider posted similar guidance with a TL margin target of 12% to 16% but posted an OR of 97.2% or 2.8% margin. Better margins also create opportunities for mergers and acquisitions. Mark Rourke, Schneider National’s president and CEO believes M&A should improve in the last half of the year, with the potential for large transactions than the $200 to $250 million in acquisitions the company executed in recent years.

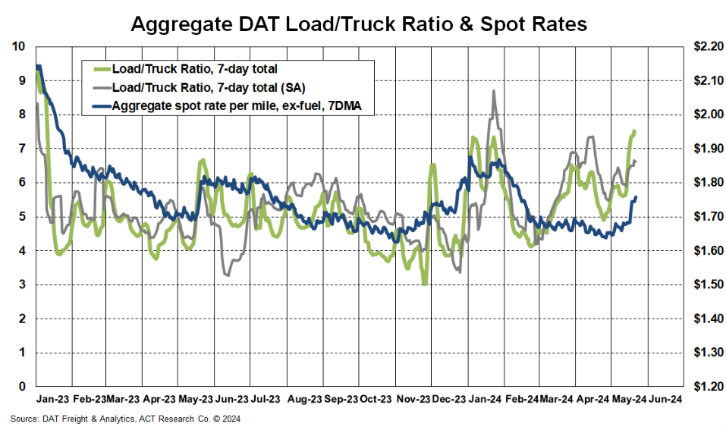

Market update: Road Check week bump suggests spot market near equilibrium

Recent data by ACT Research highlights how the recent CVSA Road Check impacted spot market rates. What was notable, was that there was a meaningful impact on spot rates as truckload capacity left the spot market to avoid the added inspection risk. FreightWaves founder and CEO Craig Fuller said on X, “For the first time in 18 months, a “market event” moved spot market rates. To us, this suggests that the freight market is closer to rebounding.”

The report notes that while the conditions are favorable for freight growth, the current winners are private fleets and railroads compared to for-hire carriers. Tim Denoyer, vice president and senior analyst at ACT Research wrote, “private fleets have added more than the industry’s net capacity growth in the past year as the for-hire sector has contracted. The productivity of this new capacity is now being tested. Most private fleet operations are one-way, and though some are adept at filling backhauls in the for-hire market, most are not.”

The growth of private fleets does not necessarily spell doom for the for-hire segment, since private fleets are directly tied into covering their shipper’s freight first. Denoyer adds, “to the extent private fleets are successful filling backhauls, it is further delaying the for-hire rate recovery, and this is likely a factor in lingering spot market softness. Backhauls are not mission critical for private fleets, and as a result, the lower productivity of this equipment as seasonal volumes pick up should support higher spot volumes.”

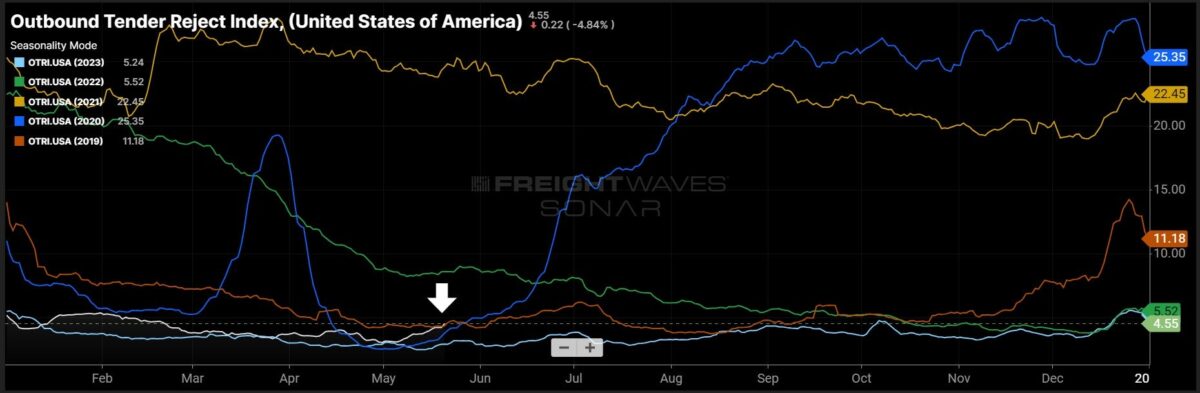

FreightWaves SONAR spotlight: Outbound tender rejection rates show flash of hope for carriers

Summary: Nationwide outbound tender rejection rates (OTRI) achieved a small milestone for 2024, reaching levels not seen at this time since 2019. OTRI rose 78 basis points in the past week from 3.77%, starting on May 13, to 4.55%. The gains were primarily driven by increases in both reefer and flatbed outbound tender rejection rates as produce season and the impacts of higher infrastructure spending fuel demand in these segments. Reefer outbound tender rejection rates rose 242 bps w/w from 5.02% on May 13 to 7.44%. During the same period, flatbed tender rejection rates increased 570 bps from 13.21% to 18.91%. The dry van segment saw slight gains in the past week, up 55 bps w/w from 3.63% to 4.18%.

In addition to higher outbound tender rejection rates, spot market rates saw increases in the past week. For dry van freight, the FreightWaves National Truckload Index 7-Day Average (NTI) rose 4 cents per mile all-in from $2.25 on May 13 to $2.29. Reefer all-in spot rates were up 8 cents per mile w/w from $2.51 to $2.59, while flatbed remained mostly flat, down 1 cent per mile all-in from $2.93 to $2.92 per mile.

Increases in spot and tender rejection rate volatility are both promising signs for carriers, but what remains to be seen is if this rally is temporary or if enough truckload capacity has exited the market to create a meaningful impact on the truckload supply and demand balance. Excess truckload capacity remains the primary impediment to a sustained spot market rally, which would signal the beginning of the end of the prolonged down market period in the truckload business cycle.

The Routing Guide: Links from around the web

Covenant seeks exemption from driving restriction for 2,000 new drivers (FreightWaves)

Carrier, OEM investors reject ESG proposals (Trucking Dive)

House lawmakers introduce bill to combat freight fraud (FreightWaves)

CDL truck driving school shutters operations, files for bankruptcy (FreightWaves)

Historic trucking rate disparity could cripple service in late ’24 (FreightWaves)

Swift Transportation driver’s license rule discriminates against foreign-born applicants, lawsuit alleges (Trucking Dive)