Congressional review looms for California’s truck emissions rules

The Environmental Protection Agency under the Trump administration has taken a significant step toward potentially overturning California’s stricter truck emissions regulations. EPA Administrator Lee Zeldin announced that the agency has sent several vehicle emission-related waivers granted to California under the Biden administration to Congress for review.

This move targets California’s Advanced Clean Trucks (ACT) rule, Omnibus NOx rule and Advanced Clean Cars II rule. These regulations, which set more stringent emissions standards than federal rules, have been long-standing issues for the trucking industry.

“This is not the United States of California. California should never be given the keys to set national policy and regulate America’s supply chain,” said Chris Spear, President and CEO of the American Trucking Associations.

The EPA’s action raises complex legal questions. Traditionally, the Congressional Review Act (CRA) applies to federal regulations, not waivers. Glen Kedzie, a principal with E&E Strategies, noted, “So is a waiver a rule, or is it not a rule?” This distinction could be crucial in determining Congress’ authority to overturn these waivers.

Adding to the complexity, a November 2023 General Accounting Office opinion suggested that such waivers might be considered “adjudicatory orders” not subject to congressional review under the CRA.

California has set aside $25 million to fight various Trump administration initiatives, indicating a readiness for potential litigation. The state’s Air Resources Board criticized the EPA’s move, stating it “does not comply with the law.”

Truck parking apps have a driver shortage, researchers say

For fleets looking to help their drivers find parking, recent research by the Texas A&M Transportation Institute on behalf of the Federal Motor Carrier Safety Administration suggests it’s easier said than done. The study examined truck parking usage along the Interstate 80 and Interstate 94 corridors in Iowa and Wisconsin.

Despite the availability of app-based solutions, drivers are largely not utilizing these tools to locate available truck parking spaces. The study notes this behavior has led to a persistent problem of trucks parking in unauthorized locations, including entrances, exits and rest areas along the studied corridors.

The research uncovered a significant hurdle: driver adoption. “The two biggest challenges associated with app-based truck parking management platforms are driver participation (i.e., reaching drivers and convincing drivers to download the app) and compliance (i.e., convincing drivers to use the app every time when parking to check in and check out),” the study said.

This resistance to adoption is one of many dichotomies in trucking. On one hand, the input received from truck drivers at the pilot study rest areas during the implementation of the ParkUnload platform was “overwhelmingly positive.” Conversely, responses to social media outreach about such technologies were “overwhelmingly negative.”

In terms of solutions, officials in the states say more funding is needed. Both the Iowa and Wisconsin Departments of Transportation pointed to insufficient funding as a major obstacle in expanding truck parking to meet current and future demand.

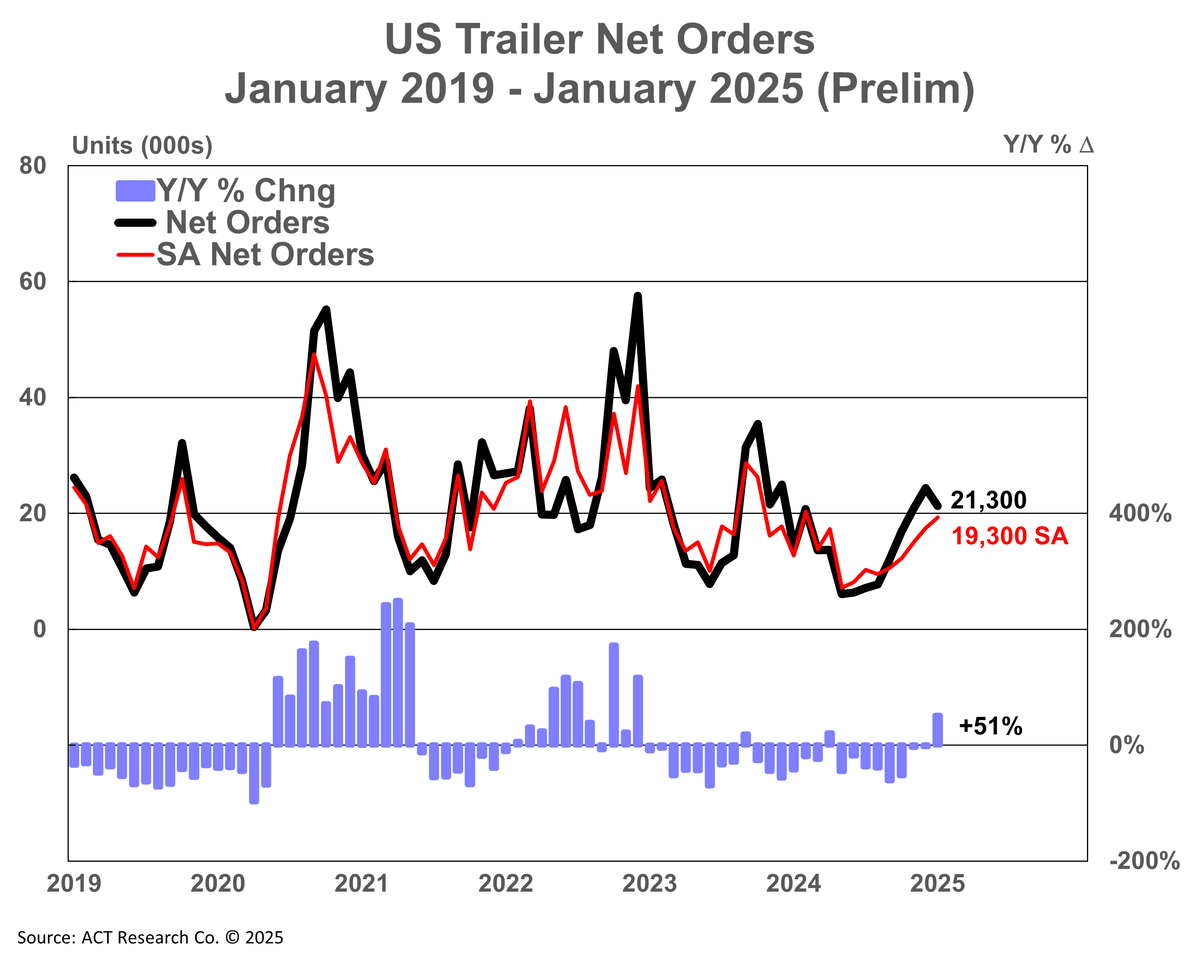

Market update: January preliminary trailer orders up 51% compared to 2024

January preliminary net trailer orders started 2025 with a bang, outpacing the previous year’s tally by 51%, according to recent data from ACT Research. Despite preliminary net trailer orders falling by 3,100 compared to December 2024, year-over-year comps surged by 21,300 units.

“Though past the traditional peak, we’re still in a period of ‘strong order’ intake. This month’s pattern of lower than December but still above average demand was expected. It’s also no surprise that the data are higher than the January 2024 intake, given the slowing demand that marked 2023 and led into the subdued market reported throughout most of 2024,” said Jennifer McNealy, director CV market research and publications at ACT Research.

However, McNealy cautioned that despite the strong start, expectations for the 2025 order cycle remain weak, adding, “Notwithstanding the improvement thus far in the 2025 order cycle, ACT’s expectations for weak trailer demand relative to recent performance remain, as continuing weak for-hire truck market fundamentals, low used equipment valuations, relatively full dealer inventories, and high interest rates impede stronger activity in the near term. An order uptick showcasing demand, or the lack thereof, depends not just on the first few months of the new order cycle, but on order volumes through Q1’25 and beyond.”

SONAR spotlight: Presidents Day brings further spot rate declines

Summary: The past week saw continued dry van spot market rate declines, breaking a temporary uptick observed in the second week of February. The SONAR National Truckload Index 7-Day Average fell 9 cents per mile all in or 3.8% from $2.37 on Feb. 10 to $2.28. The NTI is 19 cents lower compared to last month. Removing an estimated fuel surcharge from the NTI shows linehaul rates falling 8 cents per mile w/w from $1.80 to $1.72. The NTIL’s fuel surcharge is calculated by a fuel efficiency of 6.5 miles per gallon. The formula is NTID – (DTS.USA/6.5).

On the contract side, dry van outbound tender rejection rates remained mostly unchanged in the past week. VOTRI fell 9 basis points w/w from 5.27% on Feb. 10 to 5.18%. The dry van tender rejection rate performance continues to follow seasonal trends and is 52 bps higher than last year’s value of 4.66%. Part of the softness came from lower dry van outbound tender volumes, which fell in the past week and are underperforming yearly comps. VOTVI fell 499.06 points or 6.61% w/w, from 7,548.18 points to 7,049.12 points. Compared to last year, VOTRI is 832.67 points or 10.56% lower than 7,881.79 points on Feb. 18, 2024.

The Routing Guide: Links from around the web

Trucking braces for immigration crackdowns (FreightWaves)

FMCSA pushed TQL to drop broker transparency contract waivers (Overdrive)

Feds taking another look at truck-broker contract rules (FreightWaves)

The Playbook delivers small fleets, owner-operators a suite of resources to grow their business (FreightWaves)

Tenstreet acquires driver communications provider TextLocate (FreightWaves)

Trucking market remains stable, but recovery is slow amid tariff uncertainty (Commercial Carrier Journal)