DHL’s recent cancellation of transport partnerships with third-party airlines supporting its courier and freight forwarding networks is part of a new cost improvement campaign that helped the Express division achieve first-quarter operating profit despite lower shipment volume and rising trade volatility.

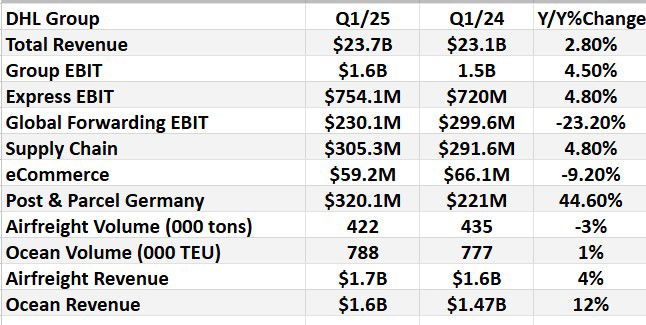

DHL Express’ operating profit increased 4.8% year over year to $754 million as efficiency measures ramped up, while better pricing and product mix boosted revenue 2%, according to DHL Group financial results released Wednesday.

Management said improved capacity utilization, seasonal network adjustments and higher yields countered the drop in volume. Demand for time-definite international parcels, the Express division’s core product, fell 7.1% to 975,000 items per day, while aviation supply costs for DHL’s own fleet and purchased transportation declined 7% year over year. Operating costs at Express air hubs decreased 1%.

In March, DHL (DHL.DE) unveiled a plan, called Fit for Growth, to eliminate more than $1.1 billion in annual structural costs by the end of next year. (FedEx and UPS have similar programs called Drive and Efficiency Reimagined.)

One way the integrated logistics provider will take out cost and drive efficiency in the air network is by streamlining the number of partner airlines that supplement the transportation provided by DHL’s own fleet, top executives said during the fourth-quarter earnings call in early March.

The recent end of several air cargo partnerships is more clearly understood in the context of DHL’s desire to eliminate excess capacity. DHL in February, for example, pulled out of its Polar Air Cargo joint venture with Atlas Air. The parties said at the time they mutually decided to close one of the best-known air cargo brands after 18 years.

Also in February, DHL dropped SmartLynx Airlines as a contract carrier in Europe. DHL was leasing four Airbus A321 converted narrowbody freighters from SmartLynx, which has since decided to focus on providing capacity for passenger airlines. Shortly afterward, FreightWaves reported that Slovakia’s AirExplore was discontinuing cargo business because of limited demand for its Boeing 737-800 converted freighters. The company didn’t disclose whether it had lost any customer accounts, but is known to have started operations for DHL in early 2024.

DHL Aviation is a group of airlines, either wholly owned or chartered by DHL Express. The company regularly flexes the fleet to handle shifts in volume. Aircraft space not filled by overnight packages is sold to shippers, either by guaranteed blocks for businesses with large, repetitive loads or on the spot market. The largest buyer of remaining capacity is DHL’s Global Forwarding business unit.

DHL continues to upgrade its intercontinental fleet. Boeing is expected to deliver the six 777 production freighters this year, the final tranche of a 28-unit order.

Air Hong Kong, an all-cargo subsidiary of Cathay Pacific that flies regional routes under contract within the DHL Express network in Asia, is expected to complete its fleet renewal and modernization this year, company officials said during the March earnings call. The project involves transferring several Airbus A300-600 freighters to DHL operators in Europe and replacing them with larger A330-300 converted freighters. Air Hong Kong received another A330 in March, according to aviation database Planespotters.com.

Fit for Growth aims to leverage technology across all divisions to improve productivity. Management said it is already showing results in sortation centers and for pickup and delivery.

Big picture

Overall, DHL delivered modest growth during a first quarter marked by destabilizing U.S. tariffs and economic weakness in Europe. Group revenue increased 2.8% to $23.7 billion year over year, and operating profit was $1.6 billion, up 4.5%.

The spread of tariffs hasn’t materially impacted finances so far, but forced the company to make significant operational changes. Management said it expects more demand and rate volatility going forward. Tariffs are double-edged for DHL: They can suppress consumer demand because of higher prices, but they also generate business from customers looking for ways to minimize their total landed import costs, including rerouting shipments and extra customs handling.

Top executives stressed that the company’s geographic diversification, experience navigating supply chain disruption and increased focus on high-margin services position it well to navigate current trade uncertainty.

DHL has relatively limited exposure to a downturn in trans-Pacific trade due to the tariff fight between the United States and China, CEO Tobias Meyer said during Wednesday’s briefing. Only 8% of DHL Express overnight shipments move from China and Hong Kong to the U.S., while only 4% of DHL Global Forwarding’s airfreight volume is on that trade lane.

DHL used to have a higher concentration of volume in the trans-Pacific, but the logistics provider last year was able to weed out low-margin, lighter-weight e-commerce traffic by raising prices and selling the space to freight forwarders with more dense cargo.

Meyer reiterated that DHL plans to concentrate expansion in countries with the fastest trade growth, such as Indonesia, India, Vietnam and the Philippines, which are also benefiting from geopolitical shifts as manufacturers explore production alternatives to China.

“On the one hand, our global presence makes us significantly less dependent on the U.S. market than many of our competitors. On the other hand, trade continues even with tariffs. It just becomes more expensive and complex,” Chief Financial Officer Melanie Kreis said. “We cannot spare our customers the tariffs, but we can take the complexity off their hands. In short, we are closely monitoring the situation and feel well prepared for various scenarios.”

At DHL’s annual general meeting on Friday, Meyer said, “the majority of world trade takes place without the U.S. Around three quarters of global trade now involves neither U.S. imports nor U.S. exports. If the US closes itself off more, other countries will benefit. Other trade lanes will then become more important. Trade lanes where DHL generally has a significantly greater market share than for trade to and from the United States.”

DHL’s road map for sustainable growth – Strategy 2030 – also helps insulate against demand ebbs by concentrating investment in markets with high-growth potential such as life science and health care logistics, new energy (wind and solar power, electric vehicles, batteries, battery storage systems and devices for grid expansion) and e-commerce, according to leadership.

In early April, DHL announced it will invest $2.2 billion over five years to upgrade capabilities in the pharmaceutical and medical sectors as it looks to double health care logistics revenue to $10.8 billion by decade’s end. It also agreed to acquire Nashville, Tennessee-based CryoPDP, a specialty courier that provides logistics services for clinical trials, biopharma, and cell and gene therapies, for $195 million.

The German logistics giant in January acquired Inmar Supply Chain Solutions, a large reverse logistics provider for e-commerce retailers in North America.

“We want to buy capability, not scale, and then leverage that capability across our network,” Meyer said. Drug and medical device manufacturers, who have smaller, high-value shipments, benefit from using an integrated express delivery company that offers better control than a traditional freight forwarder who cobbles together different transportation and distribution vendors to execute a delivery, he said in the March presentation.

Challenges for freight unit

Industrial weakness in Europe, particularly in Germany’s automotive sector, caused a significant drop in trucking business, which weighed on results for DHL’s Global Forwarding and Freight division. Management also acknowledged that the rollout of a new transportation management system in the German market was more costly and bumpier than expected. Excluding the system integration, the unit likely would have broken even on profits.

Airfreight volumes for Global Forwarding declined by 3%, with most of the impact on trade lanes from Europe and Asia. Airfreight revenues rose 4% while gross profit fell by 1.8%. Ocean freight volumes increased by 1.4% year on year, with growth especially on trade lanes from Asia. Volume growth was impacted by the systematic withdrawal from the transport of high-volume, low-yield business. This impact is likely to continue throughout 2025.

The Supply Chain division continued its growth trajectory in the first quarter, aided by the signing of new customers and productivity increases from automation.

DHL eCommerce, which provides international and domestic shipping services for merchants with lightweight parcels, saw top-line growth of 6% even as consumers became more cautious. Results were hurt by depreciation costs for ongoing network investments as the company pursues greater market share in the sector.

In addition to Inmar, it is investing in sorting facilities in India and other countries, as well as last-mile delivery in Turkey. Earlier this year it gained a stake in Ajex Logistics Services, a parcel carrier in Saudi Arabia.

Meanwhile, Post & Parcel Germany significantly increased earnings thanks to a spike in revenue associated with the first postage increase in three years and the recent federal election, which required delivery of mail ballots. Second-quarter results could be worse as costs will rise again due to a planned wage increase for postal workers.

Europe’s largest postal company continues to face structural hurdles in the form of sharply rising costs and a significant decline in letter volumes. Kreis said the postage increases are insufficient to cover all the inflation in recent years. Without higher postage rates, DHL can’t maintain the necessary profitability to make future investments, she added.

The Fit for Growth plan calls for the elimination of 8,000 postal positions this year.

Tariffs

Customers are responding to the 145% U.S. tariffs on China, a 10% tariff on all nations, sector-specific tariffs and the specter of more tariffs in June, in a variety of ways, said Meyer.

Some businesses are pausing orders and investments until the shifting regulatory landscape settles down or pre-bought inventory to beat tariff deadlines. Others are shifting some procurement elsewhere in Asia to avoid the 145% U.S. tariff on Chinese goods. And e-commerce retailers are likely to switch from shipping individual packages to consolidated containers through traditional business-to-business distribution channels with the elimination Friday of the de minimis rule, which means consumers no longer enjoy duty-free purchases on low-value goods from China and Hong Kong.

“There is still the belief with many of our customers in the U.S. that this environment is going to evolve and move back to lower tariff levels as those negotiations, much talked about, unfold,” Meyer said in explaining the wait-and-see approach.

Trade talks between China and the United States could begin soon, according to news reports on Friday.

Management noted that U.S. tariff exemptions for electronics are generally positive for its express and air freight businesses. As for the loss of de-minimis exemptions, DHL said it sees opportunities in consolidated shipments of such parcels, or what it calls breakbulk express.

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

DHL drops embargo on medium-value goods after US walks back customs rule

DHL eCommerce expands operations to Saudi Arabia

Atlas Air, DHL terminate Polar Air Cargo joint venture

DHL Express’ Miami air hub meets the moment for peak season

Air cargo faces $22B revenue hit when China tariff exemption ends