WASHINGTON — Legislation created to address the cargo theft crisis across the U.S. is being undermined by the Trump administration’s focus on illegal immigration, according to Senate Democrats.

The Combating Organized Retail Crime Act of 2025, introduced in both the House and Senate in April, would set up a coordinated multiagency federal response to organized cargo and retail theft and make it easier to prosecute the crime groups responsible.

But Sen. Dick Durbin, D-Ill., who supports the bill, said that thousands of agents at the Department of Homeland Security have been told to shift their priority to deporting illegal aliens, based on President Trump’s executive orders.

“Let’s put the cards on the table,” Durbin said at a hearing on cargo theft held by the Senate Judiciary Committee on Tuesday.

“If anyone’s involved in illegally being in the U.S., undocumented or otherwise, that has engaged in criminal activity that endangers themselves and others, they should be removed, prosecuted, or never let in [to the country] in the first place.

“But to say we’re worried about whether someone who’s cutting grass on a golf course today is undocumented, and that we ought to put the resources of the federal government into putting him into a detention facility and deporting him, is that a priority over what we’re discussing today? Not in my book.”

The hearing was the third this year held to spotlight the rise in cargo theft as costs and safety risks rise in proportion.

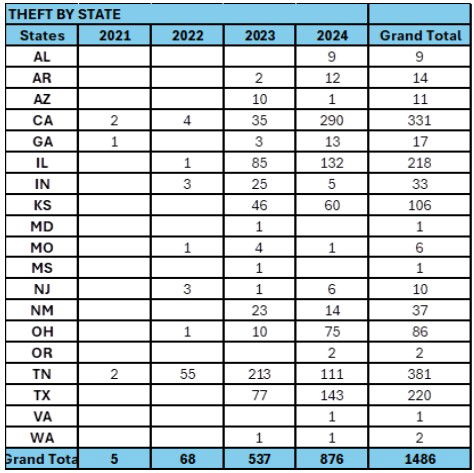

Donna Lemm, chief strategy officer of Collierville, Tennessee-based IMC Logistics, an intermodal logistics company specializing in moving ocean containers to and from major seaports and rail hubs, told lawmakers at the hearing that cargo theft at her company has exploded from five incidents in 2021 to 876 in 2024.

“We’re talking about hundreds of thousands of dollars stolen in incidents across the United States with no resolution,” said Lemm, testifying on behalf of the American Trucking Associations.

IMC Logistics operates approximately 1,900 power units and employs over 2,000 drivers, according to FMCSA data.

Lemm recounted an elaborate plot by fraudsters in 2023 to impersonate a real motor carrier that ended in five full cargo loads being stolen.

“The scheme involved outfitting a truck with fake placards and printing counterfeit IDs for the drivers. IMC Logistics’ chassis were equipped with GPS units, but the criminals were savvy enough to disable them within 20 minutes of leaving our lot. The total value of the lost cargo was substantial.”

Lemm described another incident in which two containers of appliances were stolen from a company facility in St. Louis, which was reported for insurance purposes but no arrests were made. Several months later the Bureau of Alcohol, Tobacco, Firearms and Explosives called.

“They had stumbled across our appliances in a warehouse that they raided. These refrigerators were being stuffed with cash to smuggle money across the southern border.

“This is not just an insurance matter. Cargo crimes, if connected, can help us link these operations orchestrated by transnational criminals. Brazen heists like these put our whole supply chain and workers in harm’s way.”

But connecting the dots on cargo crime at local, state, and federal levels will be difficult, Democrats asserted, without deploying sufficient assets.

“There are dozens of experienced people who focused on these kinds of crimes who are no longer [at DHS],” said Sen. Mazie Hirono, D-Hawaii, at the hearing.

“We can pass whatever laws we want, but unless there is that commitment to enforcement at the federal level we’re going to continue to run into resource problems.”